GST Challan Cancellation Steps

GST registered taxpayers have to pay taxes regularly. The GST portal has multiple options through which taxpayers can pay the due tax. Over The Counter (OTC), payments can be made only if the GST payable is less than INR 10,000. This amount can be paid by cash, cheque, or Demand Draft (DD).

Furthermore, OTC payments can be made only at authorized banks. This is beneficial for smaller taxpayers who do not have access to internet banking facilities. But do you know about how to delete challan in GST?

If not then in this article you'll come to know about how to delete GST challan from challan history.

How To Generate GST Challan For OTC Payments?

The steps to generate GST Payment Challan – GST PMT-06 are available here.

Note: When ‘Over the Counter’ payment mode is selected, the taxpayer will have to take a printout of the Challan and make the payment at an authorised bank. In next few steps we'll explain you how to delete created challan in GST portal and the challan cancellation process is as shown below.

How to cancel GST challan?

Below are the steps which explain how to delete e challan in GST:

- Step 1: Log in to the GST Portal.

- Step 2: Under ‘Services’, select ‘Payments’ and then ‘Challan History’.

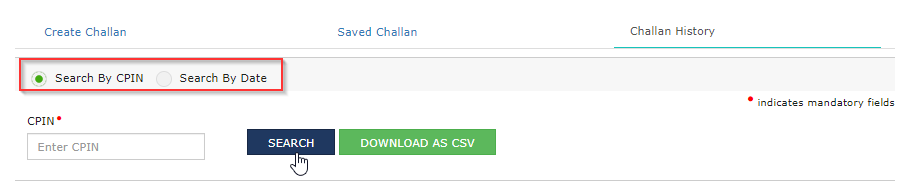

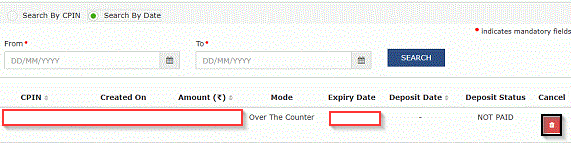

- Step 3: Search the Challan which has to be cancelled. Challans can be searched by entering the date range or CPIN.

- Step 4: Once the desired Challan is found, click on the ‘Cancel’ button. To cancel the Challan, the taxpayer needs to ensure that no payment has been made against the Challan.

- Step 5: Click on ‘Proceed’ to complete the cancellation process.

Once the Challan is successfully cancelled, the status of the Challan will automatically change to ‘Cancelled’, and no payment can be initiated for it. These are the simple steps that help on how to cancel e challan.

Points To Remember

- For OTC payments, the date of realisation is treated as the payment deposit date.

- OTC Challan payments can be made at any branch of the authorised bank.

Now, you understand how to cancel challan and perform challan cancellation process in the easy way.

Need of GST Notes | GST Invoice Number Length | Power of Officer Under GST | GST On Dry Fruits | GST On Society Maintenance

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement