How to Generate E Way Bill?

The government has initiated the trial of the EWay Bill System from 15th January 2018 for the Generation of E-way bills for both Inter and Intra-state movement of goods. The system is expected to be rolled out soon, making it mandatory for Organizations & Transporters to Generate new waybills according to the GST law and in compliance with Rule 138 of the CGST Rules. Every registered person or a taxpayer who transfers his Goods or causes to the movement of goods value exceeding fifty thousand rupees in relation to supply; or reasons other than supply; or inward supply from unregistered person eway bill generation is necessary. The unregistered person shall generate eway bill online on the e-way bill portal.

A dedicated eway bill portal (EWB) has been created to e way bill generate and issue the e-way bills under e-way bill system. The direct link to the portal is http://ewaybill1.nic.in/ewbpl1/ NIC has also released E-Way Bill APIs to licensed GST Suvidha Providers for helping large Organizations/Transporters in automating the entire process by integrating their solution within a taxpayers ERP or existing waybill system for generating e-way bill online in real-time.

How to Make E Way Bill Step by Step:

- To generate e way bill online, Visit the E-Way Bill website: ewaybill.nic.in

- Enter your username and password followed by a captcha. You will be successfully logged in to the E-way bill. system.

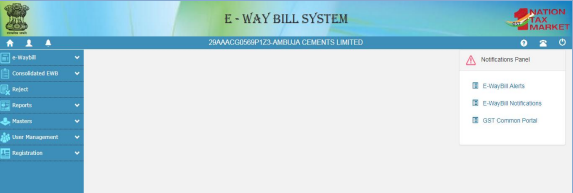

- The following screen will appear on successful logging in

- On the left panel of the screen, the system will show the options which will be used for generating cancelling rejecting etc on the E-way bill system.

- E-way bill – Under this option, the user can generate, operate, cancel and print e-way bill.

- Consolidated e-way bill – Under this option user can consolidate the e-way bills, updated them and cancel them.

- Reject – Under this option the user can reject the e-way bill generated by others if it does not pertain to the user.

- Reports – Under this option user can generate various kinds of reports.

- Masters – Under this option user can create masters of customers, suppliers, products and transporters

- User Management – Under this option, user can create, modify and freeze the sub-users.

- Registration – under this option, the user can register for SMS, Android app and API facilities.

- On the right panel of the screen, there are notification options like alerts and notifications.

Generating New E-Way Bill?

So, how to generate e way bill, just follow the steps below and it should be on hand with the user for generating the e-way bill:

- Invoice / Bill / Challan / Document details.

- GST number of the party to whom goods are to be supplied.

- Product and Quantity wise details of the product to be supplied.

- Transporter Name and ID or Vehicle no through which the transportation will be done.

How to Create E Way Bill?

Following Steps to be Followed for Generating the E-Way Bill:

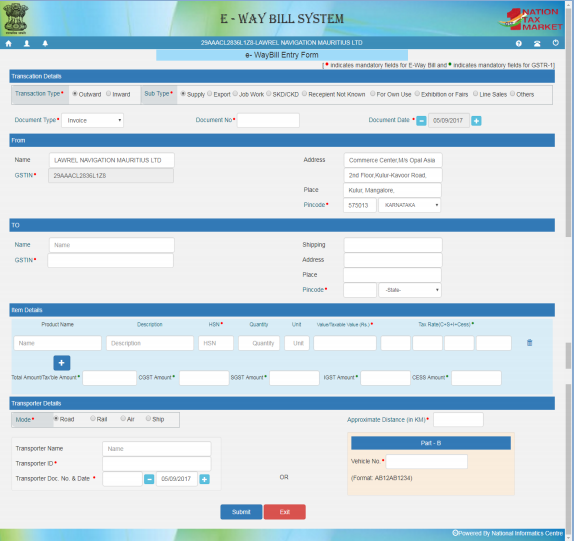

- The user needs to select the “Generate e-way bill” option under the e-way bill option. Then the following screen will be displayed.

- Now first of all user needs the select the option “Inward / Outward”. Inward means the used will be receiving the goods and Outward means user will be supplying the goods.

E-Way Bill Generation by Consignor for Outward Supply of Goods:

- After selecting the outward supply now the user has to select the appropriate sub type option i.e. the material is for own use, job work, export etc.

- Then after user needs to enter the document type appearing from the drop-down list viz. Invoice, bill or challan. The user will fill in the document number and date. Please note that the system will not allow to enter the future date.

- For the outward supply, the user details in the “From” section i.e. name address etc will be auto-populated. If the user has an additional place of business, he will be allowed to select the additional place of business. However in auto-populated addresses also the user is allowed to edit the address.

- Now in the “TO” section user can enter the consignee details with 2 options:

a. if the user has created the customer master in the Master client option then the user has to only type 2-3 characters of consignee name the system will display the consignee with such name and the user has to select the consignee. All other details like consignee GSTIN address etc. will be auto-populated. These fields are also editable if the user wants to edit.

b. If the master is not created then the user can enter the GSTIN number of the consignee then all details like consignee name, address etc will be auto-populated and these details are also editable.

c. User is also allowed to manually fill up all the details like consignee name, GSTIN, address etc.

d. If the consignee is an unregistered person then the user has to enter the “URP” in the GSTIN column.

e. Now the user needs to enter the “item details”. If the user has created masters of product form Master – product then after typing 2-3 characters of product the product with such name will be auto-populated and user needs to select the same. All other fields like description, HSN, unit, and Tax rate are auto-filled from the master. The user has to enter the quantity and taxable value of the product mentioned in the document.

f. More / multiple products also can be added with the option.

g. Based on the inputs the system will auto-calculate the CGST, SGST, IGST and CESS. The user is also allowed to edit the same.

E-Way Bill Generation by Consignee for Inward / Receipt of Goods:

- After selecting the inward supply now the user has to select the appropriate sub type option i.e. the material is for own use, job work, export etc.

- For the inward receipt if the user has created the customer master in the Master client option then the user has to only type 2-3 characters of the consignee name the system will display the consignee with such name and the user has to select the consignee. All other details like consignee GSTIN, address etc. will be auto-populated. These fields are also editable if the user wants to edit.

- If the master is not created then the user can enter the GSTIN number of the consignee then all details like consignee name, address etc will be auto-populated and these details are also editable.

- User is also allowed to manually fill up all the details like consignee name, GSTIN, address etc.

- If the consignee is an unregistered person then the user has to enter the “URP” in the GSTIN column.

- Now in the “TO” section user details i.e. name, address etc will be auto-populated. If the user has an additional place of business, he will be allowed to select the additional place of business. However in auto-populated addresses also user is allowed to edit the address.

- Now the user needs to enter the “item details”. If the user has created a master of product form Master – product then after typing 2-3 characters of the product the product with such name will be auto-populated and the user needs to select the same. All other fields like description, HSN, unit, and Tax rate are auto-filled from the master. The user has to enter the quantity and taxable value of the product mentioned in the document.

- More / multiple products also can be added with the option

a. Based on the inputs the system will auto calculate the CGST, SGST, IGST and CESS. The user is also allowed to edit the same.

b. The user has to now select the mode of transportation viz. Road, rail, air or ship. User also needs to enter the approximate distance between the supplier and the recipient.

c. If the goods are sent by user directly then he can enter the vehicle number without entering the transporter details.

d. If the transportation is carried out by any transporter then the user needs to enter the details of the transporter like transporter ID, document number and date given by the transporter. User can create the Transporter master through which he can select the transporter next time and other details of the transporter will be auto populated.

e. With the third-party transportation is done with Transporter ID the generated E-way bill will be sent to the transporter login account and the transporter can enter the vehicle number while moving the goods.

f. Hence, for creating the E-way bill either “Transporter ID” or “Vehicle number” is required.

E-Way Bill Generation by Transporter:

- If the transporter is generating the e-way bill on behalf of the consignor/consignee, he can enter both the consignor and consignee details for generating the E-way bill. The system will not block him transporter in any column.

- After entering the respected details by the consignor, consignee and transporter the request is to be submitted. The system will validate the entered details and pop up the error message if there is any error, otherwise, the E-way bill in EWB-01 form will be generated with a unique 12-digit number.

- The E-way bill will not be valid without vehicle entry in the E-way bill. Once the vehicle is entered the system will show the validity of the E-way bill. Hence, the user needs to move the good in the given date and time otherwise movement of the goods can be considered illegal.

- Following is the sample image of E-way bill.

The following point should be taken care of during the generation of E-way bill

- Mandatory fields are indicated by a red highlighted circle

- Mandatory fields GSTR 1 are indicated by the green highlighted circle. Entering this filed will automatically prepare the GSTR 1 form next month.

- Ensure availability of Transport ID or vehicle number before starting date entry.

- Ensure that client, supplier, and transporter master are entered for quick and accurate generation of e-way bill.

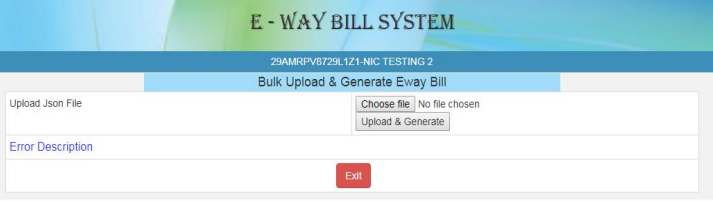

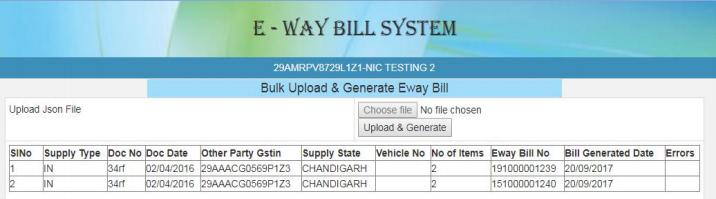

How to Generate Bulk E-Way Bills

- Users can generate the bulk e-way bill from the system. When the user needs to generate multiple e-way bill in one shot bulk e-way bill is used.

- For generating bulk e-way bill user needs to have an EWB bulk converter or an excel file which helps the user to convert multiple e-way bills excel files into a single JSON file.

- For generating bulk e-way bill user needs to select “Generate bulk” under the option e-way bills. The following screen will appear.

- The user then has to select the choose file and select the JSON to be uploaded. Then the user needs to upload the same JSON file in the e-way bill portal and can use the file for generating the bulk e-way bill.

- If there are no errors then the system will process the JSON file and will generate the E-way bills.

Frequently Asked Questions

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement