What are Financial Statements?

Financial Statements or financial report shows a formal record of all the financial activities carried out by an entity during a financial tenure and its financial position. These are written reports that determine the performance, financial strength and liquidity of an entity. The financial statements of a company in india manifest the impact of day to day financial transactions impact on an entity. Here, we will know what are financial statements, Indian financial statements, types of financial statements pdf, and more.

Types of Financial Statements

The main components of an entity's financial statements are

Profit and Loss Statement

The income and expenditure statement or the profit and loss statement (P&L) represents revenues generated by an entity and the expenses incurred by it to generate those revenues. Profit or loss is the end result of this statement which can be quantified by finding out the difference between generated revenues and expenses incurred.

Profit or Loss = Revenue/Income - Expense/Expenditure

These figures help an entity to take necessary actions depending upon the result and also influence expense management, product pricing including entities marketing strategies.

Balance Sheet

The balance sheet is a statement that represents an entity's financial picture such as what an entity owes and what it owns at a specific point of time. The main heads in the balance sheet are assets, equities and liabilities.

The balance sheets follow the below-mentioned accounting equation to balance out an asset, equities and liabilities

Assets = Liabilities + Equity

This helps an entity to know what the financial position is at a specific time period.

Cash Flow Statement

The cash flow statement or a statement of cash flows is a financial statement represents how changes in the balance sheet, profit and losses impact inflow and outflow of cash and cash equivalents. The cash flow statement has 3 main headings

- Operating activities: Includes all the activities related to the working of an entity

- Investing activities: Shows all those activities that are related to the investment of an entity

- Financing activities: List those activities that are concerned with the entity's finances.

Notes to Accounts

The basic motive of this financial statement is to show the elaborated information of all Profit and loss, balance sheet and cash flow statement. For instance, an entity's balance sheet contains the head intangible asset having the value 2,00,000 INR. Now, the entity of the owner will come to know about what item comes under the head of the intangible asset such as goodwill, patent or copyright and what are their respective values.

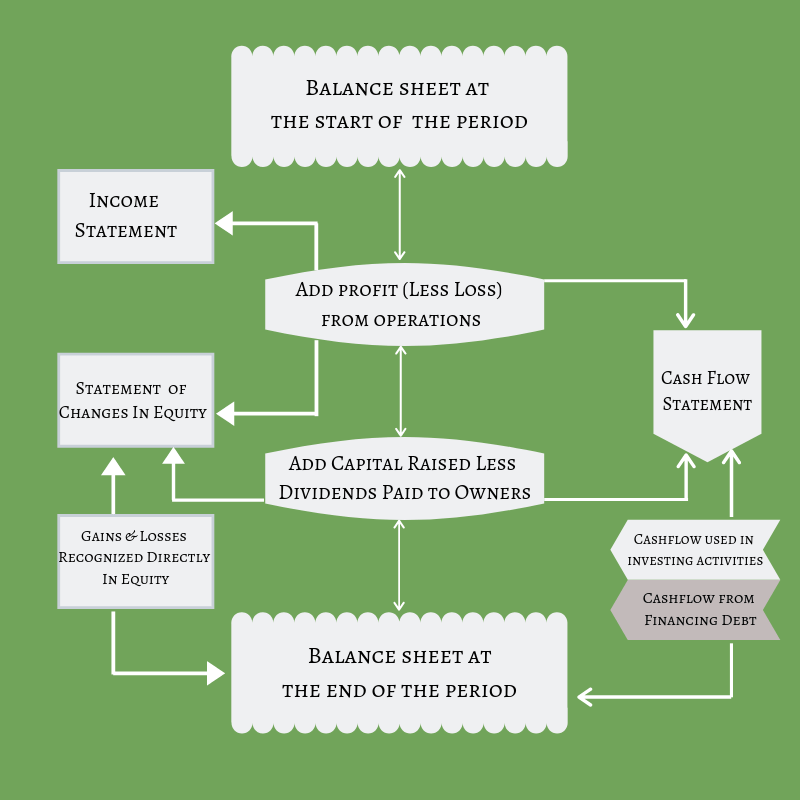

The Link between Financial Statements

The following financial statements diagram consolidates how different financial statements are linked to each other

Importance of Financial Statements

Financial statements are like snippets that help a user of an entity to know their true and fair financial position during a specific period of time.

Owners, Managers, and Employees

Financial statement helps them to take important financial decisions that will ensure an entity's continued operations.

Investors/Potential Investors

These financial statements help the potential investor to know whether to invest in an entity or not. In a case if he wants to then how much amount shall be invested can easily analyzed using these financial statements.

Financial Institutions

Based on these financial statements, financial institutions decide whether to grant loans to an entity that may be needed by them to meet working capital needs or for expansion.

Financial statements of an organization play a very important role. Right off the bat, they show the true and fair view of the organization. They likewise help in taking significant financial data. From investors and shareholders to tax authorities, creditors and the government, numerous individuals use them. Here is a list of financial statement uses:

Uses of Financial Statements

1. Bridging the Gap in Management

Basically, the use of a financial statement is to show the financial performance of an organization. It shows the assets, liabilities, profit and loss of an organization during a period of time. They show how fruitful the decision of an organization has been. Since investors approach these financial statements of any indian company , they can determine the performance of the company easily. This further helps in bridging the gap between planning and results.

2. Availing Credit from Lenders

Each business needs to acquire assets for working. For this reason, they need to depend on loans like banks and financial institution. And in loan approval, financial statements play a very crucial role. Since they demonstrate an organization's liabilities, profits and losses, investors can utilize them to settle on decisions that are informed.

3. Use for Government

Government rely on these financial statements to frame governmental policies for corporates. As these statements show how the companies are working. The administration can utilize this data to assess the tax and to form strategies or policies.

4. Use for Investors

Investors likewise broadly utilize financial statements to access the funds of an organization. That encourages them to know how the organization's dissolvability will be. In this way, the better financial position of an organization will attract greater investments.

5. Use for Stock Exchanges

SEBI and the stock exchanges like BSE and NSE also utilize financial statements of Indian companies for various reasons. SEBI can survey an organization's internal matter utilizing them to guarantee the protection of investors. And to frame their quotes even stock advisors needs these financial statements. They are likewise an extraordinary wellspring of data for stockbrokers and financial specialists.

6. Information on Investments

The investors of an organization depend on these financial statements to see how their investments are performing. In a case, if the organization is profitable there are chances that it may invest more money. On the other hand, investors can even withdraw the amount invested once they see losses or stagnant profits.

In spite of these uses of financial statements, there are a few limitations to them also.

Limitations of Financial Statements

1. Not a reflection of the present Financial Position

The balance sheet reflects the position of an organization on the date it was prepared as it is prepared at the end of every financial year. Howsoever, it is difficult to ascertain the position of the company during any period of time as the purchasing power keeps on fluctuating.

2. Probability of Bias

There are probabilities that the financial statement does not provide the correct position of the company. This might happen as the accountant uses various accounting method, policies and convention as well as personal judgements.

3. The Absence of Important Information

Accountants may avoid a ton of indispensable data while preparing financial statements. For instance, the nature of understandings signed by the organization is significant information; however, it is never referenced in yearly statements.

4. Lack of Qualitative Information

Despite the fact that organizations depict their numbers and funds in yearly statements, a great deal of subjective information is skipped. Subsequently, the details of the company, efficiency, and so forth are commonly absent from these statements.

5. Lack of Details

Financial statements may express the assets total value; however, they don't uncover the assets nature. So also, a ton of details like these do not discover notice.

Disclaimer:

“The information contained herein is not intended to be a source of advice with respect to the material presented, and the information and/or documents contained in this article do not constitute any personal advice.”

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement