Form 26AS - All You Need to Know About the New Format

New Form 26AS is the Faceless hand-holding of the Taxpayers

Form 26AS is a ‘Tax Passbook’. This form works like the ‘Annual Tax Credit Statement’ which discloses the details of the tax credit available for the taxpayer (on a Permanent Account Number - PAN basis) as per the database of the Income-tax Department. With effect from June 1, 2020, a new format has been notified for Form 26AS. This new format will enhance the flow of information between taxpayers & tax authorities and also assist the taxpayers in filing their income tax return (ITR) by calculating the correct tax liability. This will, in turn, refrain from those who intentionally conceal information/financial transactions in their tax returns.

Now let's get to know about 26as download, how to reconcile 26as with tally, what is form 26as, form 26as format and much more in this article:

Parts of New Form 26AS

The new form 26as login consists of 9 major parts which include form 26as download as well.

Part A: Details of Tax Deducted at Source

The amount of TDS deducted on any kind of income - salary, interest, pension, prize winnings etc. is visible in this part against the Tax Deduction Account Number (TAN) of the deductor. This information is updated quarterly.

Part A1: Details of Tax Deducted at Source for Form 15G/15H

If the taxpayer has submitted Form 15G or Form 15H, this section in the form will present the details of 26as view and income where no TDS has been deducted.

Part A2: Details of Tax Deducted at Source on Sale of Immovable Property under section 194(IA)/TDS on Rent of Property u/s 194IB / TDS on payment to resident contractors and professionals u/s 194M (For Seller/Landlord of Property/Payee of resident contractors and professional

As per section 194IA of the Income Tax Act, when a specified immovable property (other than agricultural land) is purchased for a value more than INR 50,00,000, the buyer is required to deduct tax at source @1% of the amount paid/credited to the seller. For the seller, this TDS amount will be reflected in this section and will be available as a tax credit.

Part B: Details of Tax Collected at Source

This section has data when the taxpayer, as a seller, collects tax at source (TCS) from the buyer. TCS is applicable on the sale of specified goods. Example: Alcohol, scrap, etc.

Part C: Details of Tax Paid (Other than TDS or TCS)

This part of the form contains the details of advance tax and self-assessed tax paid. The challan details of these payments are explicitly visible here.

Part D: Details of Paid Refund

This part of the form contains particulars about any tax refund received during the relevant assessment year. Details of the: mode of payment, amount paid, interest paid, and date of payment is available here.

Part E: - Details of SFT Transaction

As an initiative to bring transparency, from now on, Form 26AS will carry additional details on taxpayers’ financial transactions as specified in the Statement of Financial Transactions (SFTs) in various categories. Information like cash deposit/withdrawal from saving bank accounts, sale/purchase of immovable property, time deposits, credit card payments, purchase of shares, debentures, foreign currency, mutual funds, buyback of shares, cash payment for goods and services, etc. under Section 285BA of Income-tax Act, 1961 from ‘specified persons;’ like banks, mutual funds, institutions issuing bonds and registrars or sub-registrars etc., by individuals having high-value financial transactions will be shown in this section.

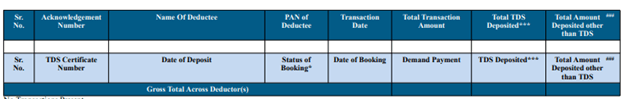

Part F: Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA/ TDS on Rent of Property u/s 194IB /TDS on payment to resident contractors and professionals u/s 194M (For Buyer/Tenant of Property /Payer of resident contractors and professionals)

Part B of this form discloses the tax details regarding immovable properties from the seller's perspective. However, this section gives details from the buyers’ viewpoint.

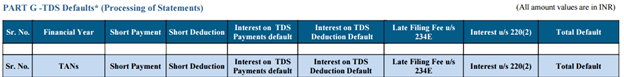

Part G: TDS Defaults*(Processing of Defaults)

This part contains all the defaults relating to the processing of statements. Note: This part does not contain demands raised by assessing officers.

On the first look at it, we can say that the new Form 26AS will be an all-inclusive document that will reduce the efforts of the taxpayers at the time of filing returns and while addressing income tax proceedings.

Need of GST Notes | GST Invoice Number Length | Power of Officer Under GST | GST On Dry Fruits | GST On Society Maintenance

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...