DSC (Digital Signature Certificate) – How to get DSC, DSC Classes and Advantages

Digital Signature Certificate

Filing Returns on GST portal requires registration through a few certificates. When it comes to businesses, the compliances tighten. One such compliance is the DSC which is required to file documents online on the GST portal. DSC is mandatory to electronically sign Enrolment Application by domestic and foreign companies, and domestic and foreign Limited Liability Partnerships (LLPs and FLLPs respectively). Other taxpayers may use DSC as an optional tool.

What is Digital Signature Certificate (DSC)?

Digital Signature Certificate (DSC) is a digital counterpart for someone’s signature. It is used as an online identity verification tool for an entity. They are basically electronic certificates confirming one’s identity. Using DSC, one can access all information and services related to the entity, and sign documents electronically. This certificate is used worldwide, and in India, it can only be issued by authorized agencies. Only PAN based DSC of classes II and III are accepted by the GST portal.

Classes of DSC

The applicant type and the reason for which the DSC is acquired characterizes its class. At the time of creating DSC one must apply for a class of DSC that they require. There are three classes of DSCs issued by the authorities:

Class 1 DSC

These are issued to an individual person or private subscriber. Further Class 1 DSC are utilized to affirm that the person’s name and email id exist in the database of the issuing authority.

Class 2 DSC

These are issued to the CEO or Directors of the organizations that have signatory authorities. Further, Class 2 DSC the companies to e-file forms with different governmental organizations such as ROC.

Class 3 DSC

Class 3 DSCs are utilized at the time of participating in e-auctions across India. In addition to this Class 3 DSC are necessary for the person who wish to take part in the online tenders.

Issuing Authorities for Digital Signature Certificate (DSC)

For issuing DSCs (Digital Signature Certificates) the controller of certifying authority has given authorization to the following authorities:

- e-MUDHRA

- Code Solutions

- NIC (National Informatics Center)

- Safes-crypt

- IDRBT (Institute for Development and Research in Banking Technology)

How to Obtain DSC?

In order to obtain a DSC, one must fill the required forms and attach the relevant documents and submit them to any CA in the country, along with the fee. Certifying Authorities (CAs) are granted special permission by the government to issue class II and III type of DSCs under the Indian IT-Act 2000. Thus, all one needs to do is follow the procedure and get the certificate. You can easily find a CA through the following link: http://www.cca.gov.in/cca/?q=licensed_ca.html. Once you get the certificate, you will have to register yourself on the GST Portal.

Advantages of a Digital Signature Certificate (DSC)

Digital Signature Certificates are useful in verifying the personal information of an individual, when leading business on the web.

Less Expensive and Time-saving

DSCs are less expensive and time-saving as the person does not have to sign the printed documents individually. Whereas in case of DSC you can e-sign the documents and the DSC holder need not to be physically present to do so.

Data Security

Documents that are marked digitally can't be modified or altered in the wake of signing, which makes the information sheltered and secure.

The administration offices regularly request these certificates to cross-validate and confirm the business exchange.

Increases Documents Authenticity

Documents that are digitally signed offers certainty to the beneficiary to be authenticated. Further, they can be worry-free regarding the DSC signed documents as the beneficiary can take an action on such document.

DSC Registration Process on GST Portal

Before you register yourself to the GST portal, make sure you have the following things handy: software to install DSC on the portal, your DSC USB token, and the DSC software (client installer) on your computer which can be downloaded from its registration page on the GST portal. Also, ensure that you are registered on GST portal before registering your DSC. Once you are through with that, you can follow these steps to register you DSC on the GST website:

1. Open the GST Portal: Go to the website https://www.gst.gov.in/

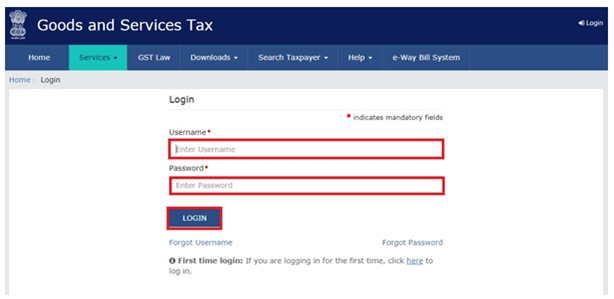

2. Login to your account: Click on ‘Login’ and enter your username and password to login.

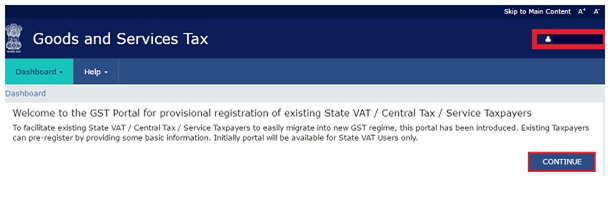

3. Dashboard: You will be redirected to your account. Click ‘Continue’.

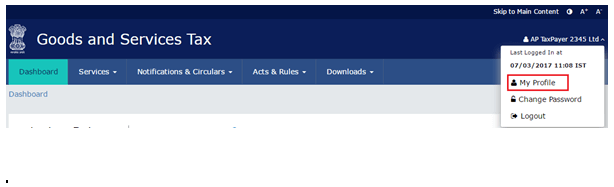

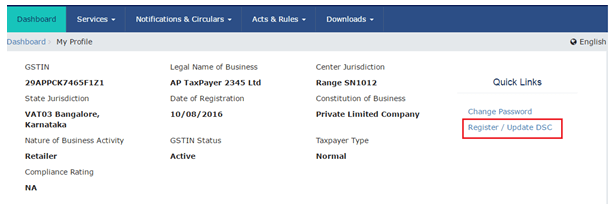

4. Profile selection: Click on your profile name at the top on the right corner and select ‘My Profile’ from the dropdown. You will be taken to your profile page.

5. Registration/Update: Click on ‘Register’ in the option ‘Register/Update DSC’ under ‘Quick Links’. Once selected, attach your DSC USB Token to your computer.

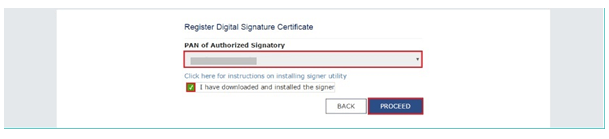

6. Selection of Authorized Signatory: On the ‘Register Digital Signature Certificate’ Page, select your authorized signatory in the ‘PAN of Authorized Signatory’ list and ‘Proceed’.

7. Certificate Selection and Signature: Click on ‘Select Certificate’ and then on ‘Sign’. As soon as you click on it, your DSC will be registered.

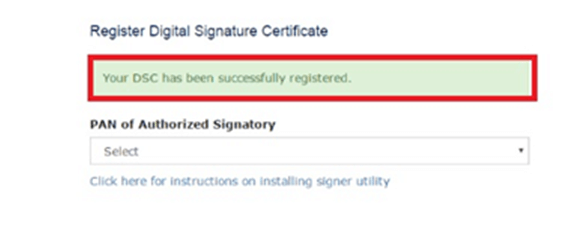

8. Confirmation: You will then be taken to a page which will confirm that ‘Your DSC has been successfully registered’ on the GST portal.

Once your DSC is registered on the portal, you can easily use it to sign documents digitally and prove your identity electronically. With these simple steps, you can easily avail your Digital Signature Certificate.

Adhering to Statutory Compliances

Any individual or entities whose record need to be audited can file their Income Tax Returns using DSC. Moreover, the MCA has made DSCs (Digital Signature Certificate) compulsory to record all reports, forms and application for entities.

Further, using DSC (Digital Signature Certificate) one can easily get register for GST by authenticating the GST Registration form with it. The utilization of a digital signature is important notwithstanding for furnishing all applications, GSTR Form and amendments.

Key Points

- Once the Digital Signature Certificate (DSC) expire it shall be renewed, as they are given for one or two years.

- An individual can have more than one DSCs (Digital Signature Certificates). Such as personal DSC for personal purposes and official DSC to meet official tasks.

- Documents that are signed using DSC are legal and can be used as an evidence in the court.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement