GST Filing Preference

Masters India autotax software is highly efficient. It reduces the time of GST filing by half.

The Central Board of Indirect Taxes and Customs (CBIC) launched the ground-breaking Quarterly Return Filing and Monthly Payment of Taxes Scheme (QRMP) to lessen the cost of compliance for small taxpayers. With a turnover of up to Rs. 5 crores, this revolutionary initiative aims to relieve companies and simplify the tax procedure. This thorough manual explores the nuances of QRMP, providing information on its importance, advantages, and how companies may use this streamlined tax system.

Understanding QRMP: Simplifying Taxation for Small Businesses

Overview of the QRMP Scheme

The CBIC's introduction of the QRMP program is a calculated step to facilitate small taxpayers' compliance journey. This initiative offers enterprises with a yearly revenue of up to Rs. 5 crores an alternate filing frequency. In contrast to the customary monthly filing schedule, qualified taxpayers may choose to file quarterly returns while still making monthly tax payments under the QRMP.

The registered dealer is required to pay taxes each month under the QRMP program. By the 25th of the following month, the taxpayer must use Form GST PMT-06 to pay the taxes owed for each of the first two months of a quarter. During the first two months of a quarter, there are two ways to pay taxes:

- Fixed Sum Method: Based on the dealer's past information, the GST Portal will provide a pre-filled challan (35% or 100%) on Form GST PMT-06.

- Self-Assessment Method: The taxpayer is required to pay the actual tax liability on their real sales, deducting the Input Tax Credit.

Procedures Explained

Note: When using the fixed sum technique, the 35% Challan can be created by choosing Reason for Challan > Monthly Payment for Quarterly Return> 35% Challan. This will then compute the 35% Challan based on the circumstances listed below:

- 35% of the tax amount paid from the Electronic Cash Ledger in the GSTR 3B return for the previous quarter, if it was provided on a quarterly basis; or

- If the tax was provided on a monthly basis, 100% of the amount paid as tax from the Electronic Cash Ledger in their GSTR-3B return for the final month of the previous quarter.

Eligibility Criteria for QRMP

Dealers, whether individuals, businesses, or entities, are eligible for the QRMP Scheme, allowing them to pay taxes on a monthly basis and file returns quarterly. This scheme is applicable to registered dealers with a turnover of up to Rs 5 Crores in the preceding financial year, required to file monthly GSTR-3B. Additionally, dealers obtaining a new GSTIN or opting out of the Composition scheme can also benefit from the QRMP scheme.

How Masters India Filing Preference Tool Works: A Step-by-Step Guide

-

Step 1: Assess Your Turnover

Determine whether your business falls within the eligibility criteria by assessing the aggregate annual turnover. If your turnover is up to Rs.5 crores, you qualify for QRMP.

-

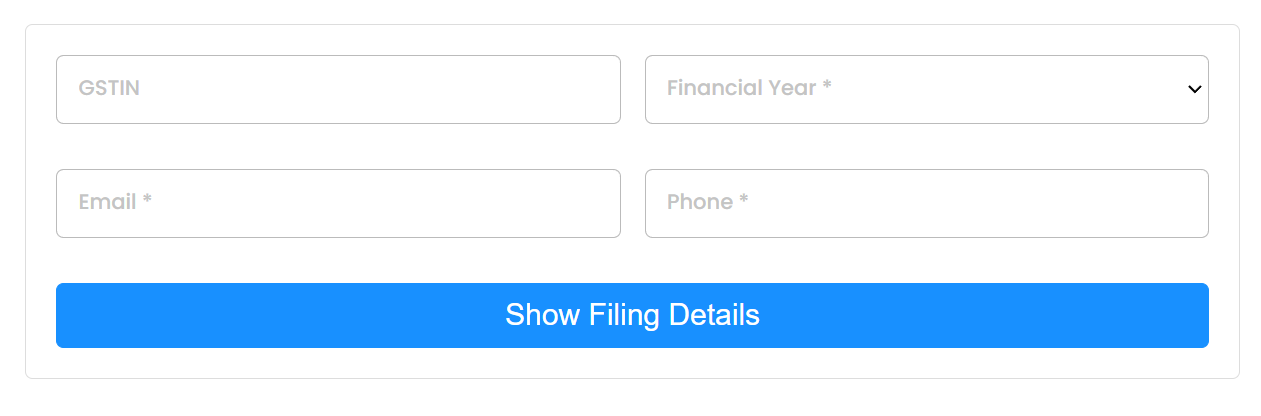

Step 2: Enter your business details on Masters India Tool

Once eligible, enter your business details along with the financial year and other required details. Masters India will fetch the filing details of the given GSTIN and financial year.

-

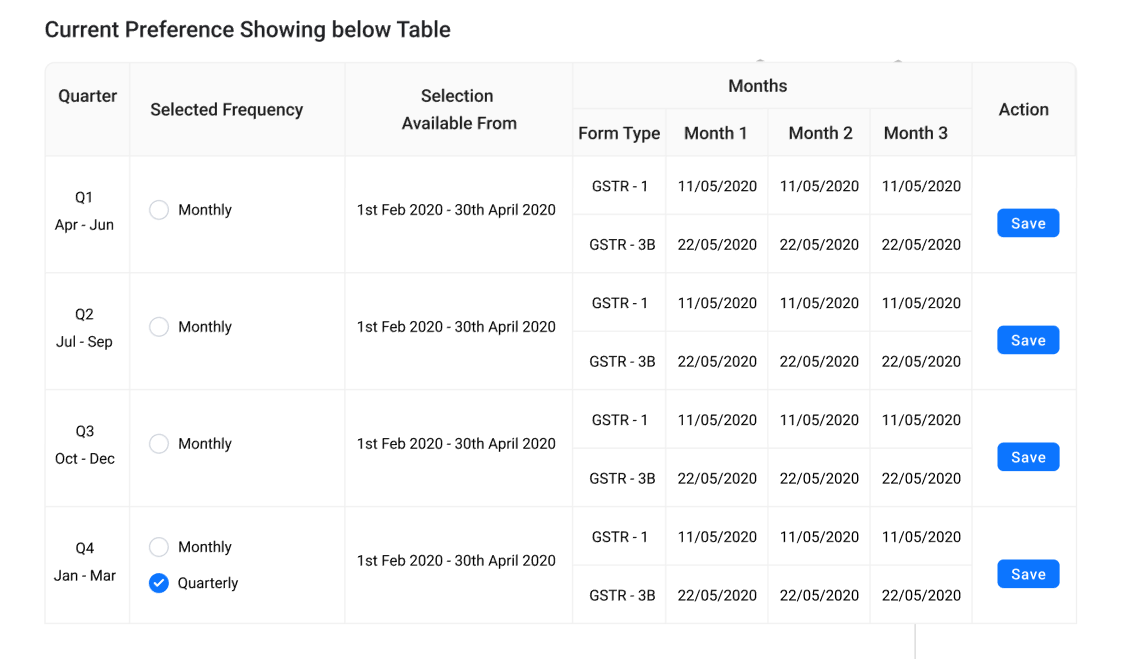

Step 3: Check your filing status

While the return filing frequency may change, the monthly payment of taxes remains constant. Businesses opting for QRMP can check their filing status, for every quarter as per their selected choices. They can also check the tentative dates of filing as per your frequency selected and months.

-

Step 4: Update your filing preference by selecting preference and clicking on save.

Key Features and Benefits of QRMP

1. Reduced Compliance Burden

For small firms, QRMP is revolutionary since it drastically lowers the monthly filing compliance load. Businesses may more effectively use their resources by providing the option of quarterly returns, allowing them to concentrate on their core competencies instead of juggling several tax files.

2. Flexibility in Return Filing

The QRMP Scheme is available for selection throughout the year, for any quarter. Registered individuals can choose to opt in during the period from the first day of the second month of the preceding quarter to the last day of the first month of the current quarter.

Note & Example: Note: In order to get benefits from the QRMP Scheme, the registered individual has to have filed their most recent tax return at the time of scheme opt-in.

Example:

If Mr Singh wishes to utilize the QRMP scheme for the October to December 2022 Quarter, he can make this choice from August 1, 2022, to October 31, 2022. If Mr Singh opts in on September 15, he should have already filed GSTR 3B for August 2022 by September 10.

Taxpayers don't need to choose again every quarter. Unless the taxpayer modifies their decision, once opting in, the choice is enforced for the next quarter.

3. Simplified Tax Payment

The monthly tax payment under QRMP stays the same, giving businesses a structure that is reliable and regular. This guarantees monetary stability and facilitates efficient cash flow management for enterprises. The Taxpayers are not required to deposit any amount in the first 2 months if

- There is no tax liability.

- Balance in Electronic cash ledger/credit ledger is sufficient.

4. Application of Interest:

- Fixed Sum Method: If the taxpayer pays the tax burden for the first two months of the quarter by the deadline, there is no interest charged. Interest will be charged at the current rates from the due date to the actual payment date in the event that payment is delayed.

- Self-Assessment Tax Method: Interest is levied on unpaid or postponed taxes (net of Input Tax Credit) that are due beyond the designated deadline.

GST Search by Name, GST no Verification, Indian Online GST Calculator, HSN Code Finder, GST Filing Status

- ★★

- ★★

- ★★

- ★★

- ★★

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement