GST Registration Process

Whether you are a regular taxpayer or a composition scheme dealer, the steps for process of GST registration for individual or GST registration step by step is the same for both. Following is a detailed registration process of GST at the GST portal.

Part A:

- GST REG-01 is to be filled and submitted by using the PAN, mobile number and e-mail ID. Post the PAN verification on the GST portal, the mobile number and the e-mail ID will be verified using a one-time password [OTP], sent on the registered mobile number.

- Once verified, an application reference number [ARN] will be generated and sent on the registered e-mail ID and mobile number.

Part B:

- Part B of GST REG-01, will need you to put the application reference number + mandatory supporting documents [PAN, photographs, constitution of the taxpayer, proof of principal/additional place of business, soft copy of the passbook/statement and authorization form].

- Should there be any additional document/information required, a form GST REG-03 will be auto-generated outlining the requirements. A response to this form can be submitted by using the form GST REG-04 with 7 working days of receiving the form GST REG-03.

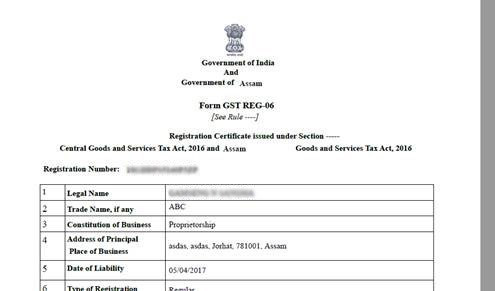

- If the information provided via form GST REG-01 / GST REG-04 is complete and authentic, a certificate of registration will be issued via form GST REG-06 with 3 working days of the receipt of the GST REG-01 / GST REG-04. If the information provided is not satisfactory, the registration application will be rejected by issuing form GST REG-05. Note, in case the Aadhar authentication is not done or not opted for, the application will take 21 days to get approved.

When is GST Registration Mandatory or Required?

Any business which falls under the purview of the following pointers is liable to be registered under GST and should have a GSTIN:

- An intra-state business with an annual turnover of INR 20 lakhs and above [barring special category states of North East, Uttarakhand, Himachal Pradesh and Jammu and Kashmir, where the upper threshold is 10 lakhs]. Note: The limit is INR 40 lakhs if the taxpayer is exclusively engaged in the supply of goods and is in compliance with the prescribed conditions.

- All inter-state business irrespective of the annual turnover.

- All e-commerce businesses, irrespective of the turnover.

- To claim Input Tax Credit, a business should be having GSTIN, irrespective of its annual turnover.

- For multiple businesses in different states, separate registrations are required.

- Casual Taxable Person Making taxable supply.

- Persons who are required to pay tax under Reverse Charge.

- Non-Resident Taxable persons making taxable supply.

- Persons who are required to deduct tax under Section 51, whether or not separately registered under this act.

- Input Service Distributor, whether or not separately registered under this act.

- Person require to pay tax under sub-section (5) of Section 9.

Multiple GST Registrations for Different States

The procedure for GST registration is PAN based and state specific. A supplier has to register in each of such state/union territory, from where he effects supply. In GST, the supplier is allotted a 15-digit GST identification number called GSTIN and a certificate of registration incorporating this GSTIN. The first 2 digits of the GSTIN is the state code, next 10 digits are the PAN of the legal entity, the next two digits are for entity code and the last digit is the checksum number. Registration under GST is not tax specific, which means that there is a single registration for all the taxes i.e. CGST, SGST/UTGST, IGST and cess.

A given PAN based legal entity would have one GSTIN per state, that means a business entity having its branches in multiple states will have to take separate state-wise registrations for the branches in different states. However, an intra-state entity with different branches can have single registration wherein it can declare one place as a principal place of business and other branches as additional places of business. However, a business entity having separate business verticals [as defined in Section 2 (18) of the CGST Act, 2017] in a state may obtain separate registration for each of its business verticals too.

GST Registration Turnover Criteria

The GST will apply to those businesses with an annual aggregate turnover of INR 20 lakhs and above.

- The GST states that the aggregate turnover is the cumulative value of all taxable supplies, exempt supplies, exports of goods or services or both, inter-state supplies but excluding the value of inward supplies on which tax is payable by a person on reverse charge basis the same PAN to be computed on an all-India basis. However, it excludes central tax, state tax, union territory tax, integrated tax and cess from it.

There are 11 special category states [where relaxations are given based on their economic and political scenarios], where this aggregate turnover is just halved and is only INR 10 lakhs. Such states are:

- Arunachal Pradesh | Assam | Jammu & Kashmir | Manipur | Meghalaya | Mizoram | Nagaland | Sikkim | Tripura | Himachal Pradesh | Uttarakhand

GST Registration for Service Tax Dealers

The existing taxpayers, paying taxes which are to be subsumed under GST [Service Tax / Central Excise / State VAT] and whose PAN have been validated from CBDT [Central Board of Direct Taxes] database will not be required to apply afresh. They will be issued provisional GSTIN by the GST portal, which will be valid for six months. Such taxpayers will be required to provide relevant data as per the GST enrollment form online on the GST Portal. On completion of data filing, the status of the taxpayer will change to migrated. On the appointed day, the status of the taxpayer will change to active and he will be able to comply with the requirements of the GST regime for payment of taxes, filing of returns etc., on the GST portal.

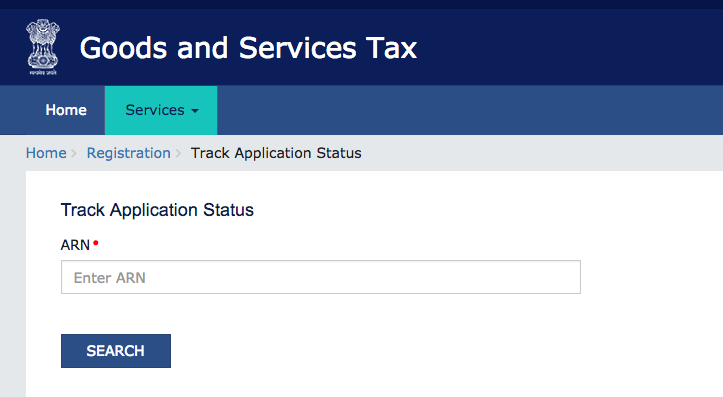

Track the GST Registration Status Without Logging In

You just need to have your ARN [Application Reference Number] handy, if you wish to check on your GST registration. ARN is an alpha-numeric number, which is generated when GST REG-01 is properly submitted. The process to track the status of your GST registration is as under:

Go to https://www.gst.gov.in/

- Step 1: Go to the Services tab

- Step 2: Scroll to Registration

- Step 3: Click on Track Application Status

- Step 4: The below window opens, where you can put in the ARN and then click on Search

- Step 5: You can now see your registration status and simultaneously the status will also be sent your registered mobile number and e-mail ID.

Should you face issues in tracking your application, please touch base with the GST helpdesk at helpdesk@gst.gov.in | +91 124 4688999

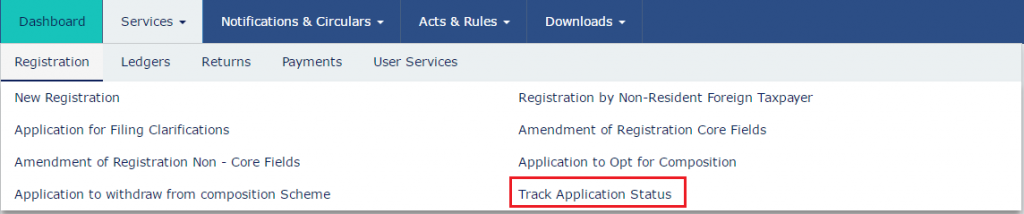

Track the GST Registration Status After Logging In

You just need to have your ARN handy for checking your GST registration application status:

- Step 1: Log in to https://www.gst.gov.in/ with your credentials

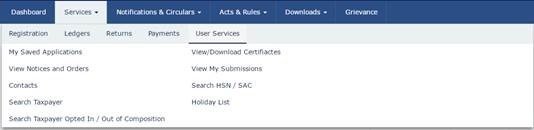

- Step 2: Hover the mouse to the Services tab > Registration > Track Application Status

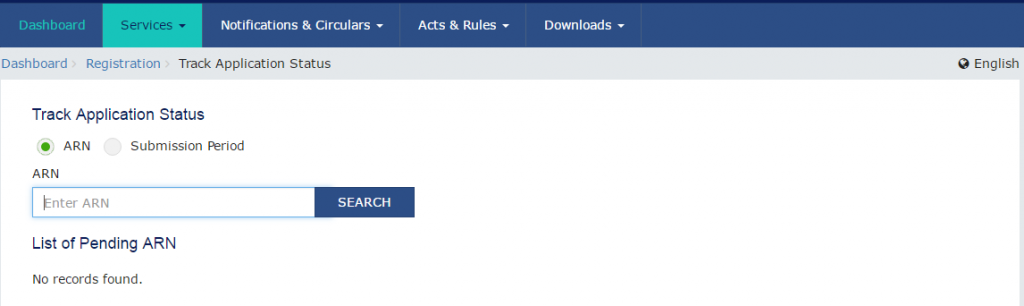

- Step 3: Two options would be displayed to search:

- Through ARN: Select ARN and fill in the ARN in the ARN field and click on Search. Your GST application registration status gets displayed.

- Through Submission Period: Select the Submission period of the application using the calendar and click on Search. Your GST application registration status gets displayed.

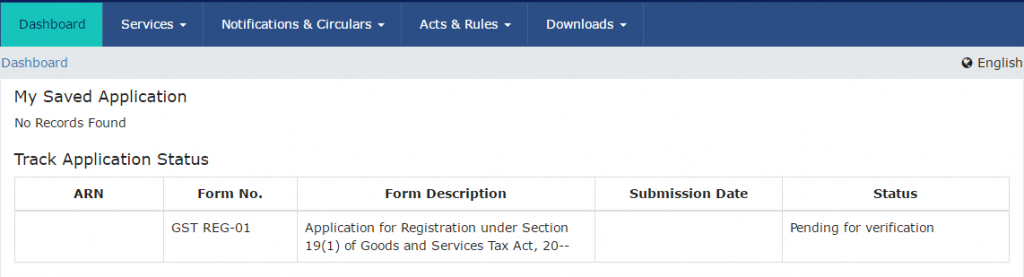

Different Registration Statuses and their Interpretations

There are different types of registration statuses, which may pop up, during the different stages of a GST registration procedure step by step or GST registration process pdf

Provisional | Validation against error | Pending for verification | Migrated | Cancelled.

Provisional:

When the Provisional ID is issued and the application for enrollment of existing taxpayer is still to be filed with the digital signatures, a provisional status pops up, asking you to register.

Validation Against Error:

If the PAN given does not match with the CBDT database, a validation error would up pop asking you to resubmit the correct PAN.

Pending for Verification:

It denotes that the registration application submission has been successful and the same is under process by the tax authorities. Once verified, the status will get updated.

Migrated:

It denotes that the registration application has been accepted by the system and no further changes can now be made.

Cancelled:

When the existing registration is cancelled leading to the cancellation of the provisional ID, a cancelled status shows up.

Downloading the GST Registration Certificate

- Step 1: Log in to https://www.gst.gov.in/ with your credentials

- Step 2: Navigate to Services > User Services > View / Download Certificates

- Step 3: The View / Download certificates page gets displayed. Click on the Download button to download the GST certificate and save it on your system.

- Step 4: You can now open the file, which you’ve just downloaded to view your GST Registration certificate.

Should you still have some queries about registration or need any sort of GST consultation overall, the proactive and technically deft team at Masters India is here to help. Please feel free to connect with us at info@masterindia.co | 9773706840

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement