E-Invoice

As a part of the new initiatives under the GST regime, the concept of E invoicing under GST was introduced in 2019, to be implemented from 2020. The intention was to bring in a standardized pattern for disclosing invoice level details by E invoicing format and E invoice schema. The misconception that E-invoicing e invoice sample format will replace the traditional modes of issuing an invoice is clarified here.

In simplest terms, e-invoicing is the submission of pre-issued invoices on a government portal called the IRP so that it can be authenticated and validated. This will eventually help in reducing multiple efforts for the preparation and filing of GST returns.

What is e-invoicing?

E-Invoicing is a standard configuration rolled out and managed by the National Informatics Centre (NIC) for specified taxable entities under GST. This will help in the interoperability of invoice level data in real-time.

On the practical level, if e-invoicing is applicable for you or your company, you need to remember that you can keep producing invoices through your existing accounting framework or Enterprise Resource Planning Software (ERPs). All you need to ensure is, the system/software is configured to meet the standards set by the government.

The e-invoicing framework will just decide the invoice scheme. This will ensure that invoices generated by different GST Software are analyzed uniformly.

How to Check Status of ‘E-Invoice Enablement’ for a Taxpayer?

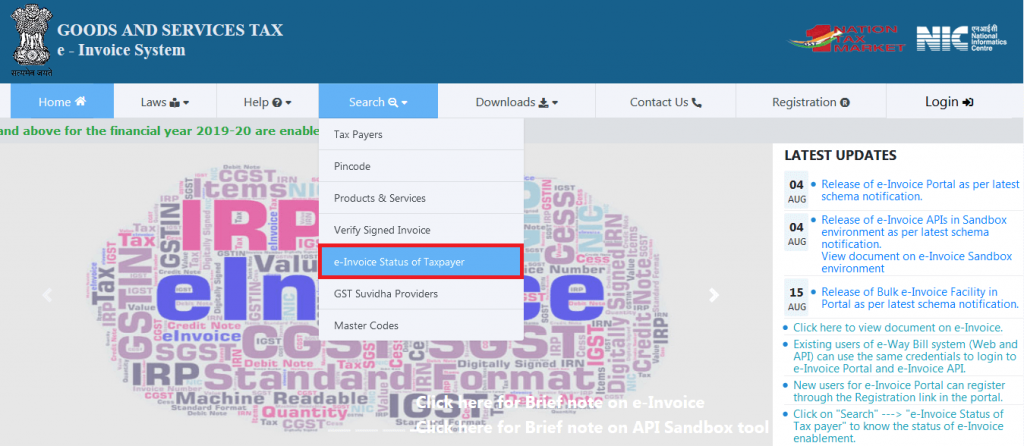

You can know your eligibility for the generation of IRN through the E-Invoicing portal. All you have to do is, under the ‘Search’ tab select, ‘e-invoice status of Taxpayer’.

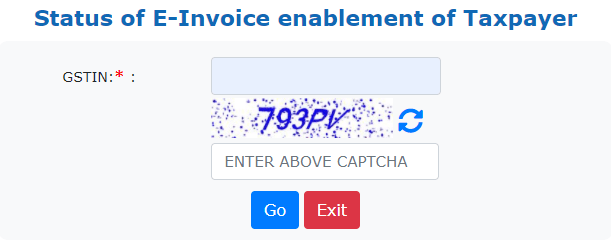

This will redirect you to a new page, where you have to enter the GSTIN for which you need the details.

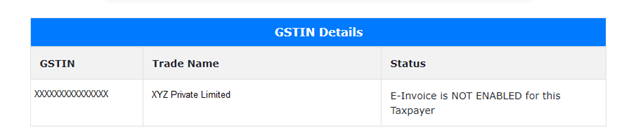

Once the GSTIN is entered, the system will indicate whether this GSTIN is enabled/notified for the IRN generation.

Example:

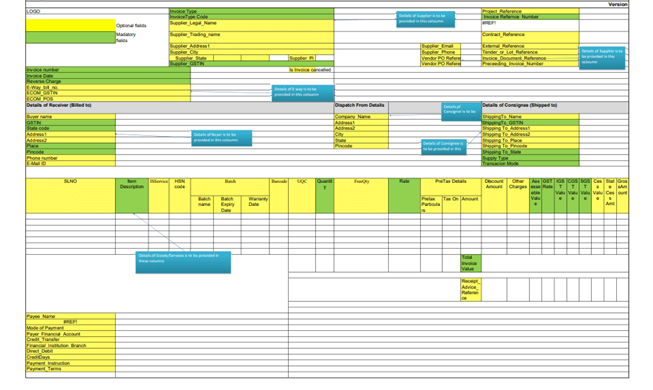

What are the contents of the e-Invoice schema?

Broadly, the E-Invoice contains two fields:

- Mandatory fields and

- Optional fields.

Here, the mandatory fields are those columns that imperatively form an essential part of the invoices under the e-invoice standard.

On the other hand, the optional fields are columns that are not mandatory to generate a valid e invoice bill format. The option to fill these fields is the discretion of the taxpayer/business entity.

As per the latest GST E invoice format, notified on 30th July 2020, there are

- 12 Sections - In these 5 are mandatory.

The mandatory sections are:

-

- Basic details

- Supplier information

- Recipient information

- Invoice Item details

- Document total

- 6 annexures - In this 2 are mandatory.

The mandatory annexures are:

-

- Item details

- Document total details

How to read the E-Invoice Schema?

The individual line items to be included in the sections and annexures mentioned above are available here in the notified schema.

For ease of navigation, the e invoice excel format schema contains the following columns:

| Defined Columns | Meaning |

|---|---|

|

Technical name of the field |

Section names, line items, annexure names, and sub-entries are mentioned here |

|

Cardinality |

This column indicates whether the item is mandatory or optional. It also clarifies whether the item can be repeated or not with the help of codes. The codes are: 0..1 - Optional, but when reported can’t be repeated 1..1 - Mandatory and can’t be repeated 1..n - Mandatory and can be repeated more than once 0..n - Optional, but when reported, can be repeated more than once. |

|

Brief description of the field |

This simplifies the intent of the technical name mentioned before |

|

Whether mandatory/optional |

This column explicitly communicates if filling the particular item is mandatory or optional |

|

Technical field specification |

The maximum length of the field, date format, and decimal places are elaborated here |

|

Sample values of the field |

This column simplifies the previous column for the user with an example |

|

Explanatory notes |

A detailed explanation about the intent of the line item is given here. |

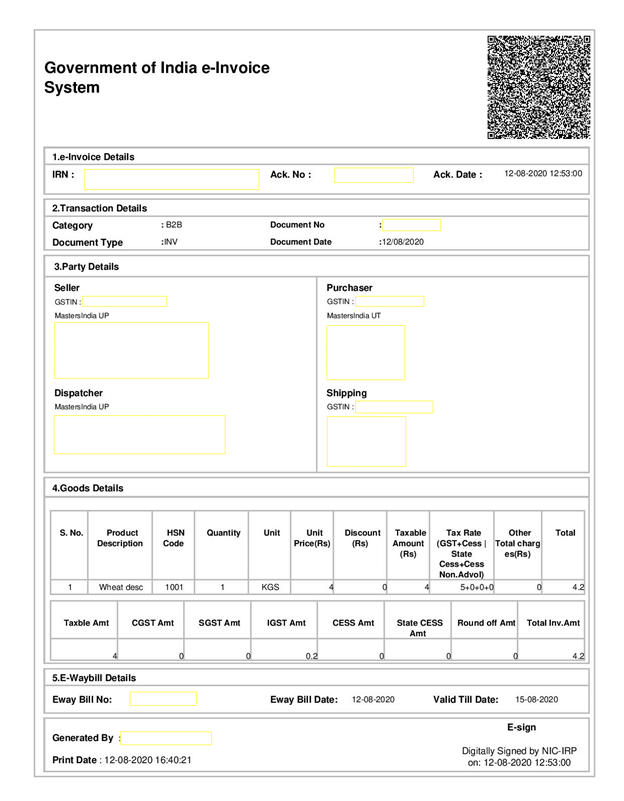

Authentication and Validation

Once the mandatory details are uploaded on the IRN portal, your e-Invoicing solution will authenticate the invoice and validate it by generating a unique IRN. Any duplication will be eliminated at this stage. The IRP will digitally sign the invoice and generate the QR code. Also, the IRN will eventually transmit the authenticated details of the invoice to the GSTN and E-Way bill portal, facilitating better transparency and control on ITC claims and other administrations.

Note: The IRN, acknowledgment number, date, and QR code has to be mentioned in the invoice issued to the buyer by the taxpayer.

E Invoice template

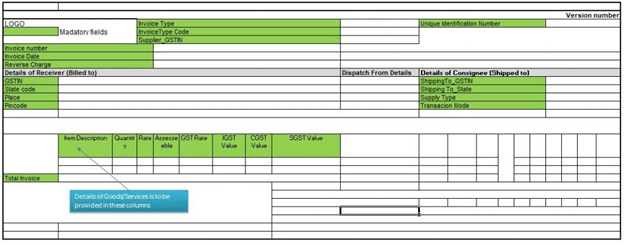

The authorities have released two templates; One with the mandatory fields alone and the other with mandatory and optional fields.

Only mandatory field’s template:

Mandatory and optional field’s template:

Output sample

Free GST Invoice Generator | Check Invoice Number Online India | E Bill Software | Dry Fruits GST Rate | Maintenance Charges GST

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement