Government Self Service Portal

GSTN (Goods and Services Tax Network) has established itself seeing constant upgrades with time, presently propelling its self service portal GST. Since GST has been recently introduced, various confusions surround it. With Crores of taxpayers getting to GST portal and the obvious issues they may have, GSTN has overhauled their previous Helpdesk into another SELF HELP, where taxpayers do not need GST helpdesk number or mail their inquiries to helpdesk@gst.gov.in anymore. Rather, they can write their issues and can inquire the same on a single web-page, where other taxpayers or tax experts can help those by reading and resolving their queries. Along these lines, it gives one straightforward answer for huge numbers of your GST-related issues. You should simply, go to the Grievance Redressal Portal and raise a ticket. Express the problem and inquire and check the status of your raised tickets now and then. This self-help portal was introduced on 22nd January 2018 and went live on 25th January 2018.

Services offered on the Self Help GST portal

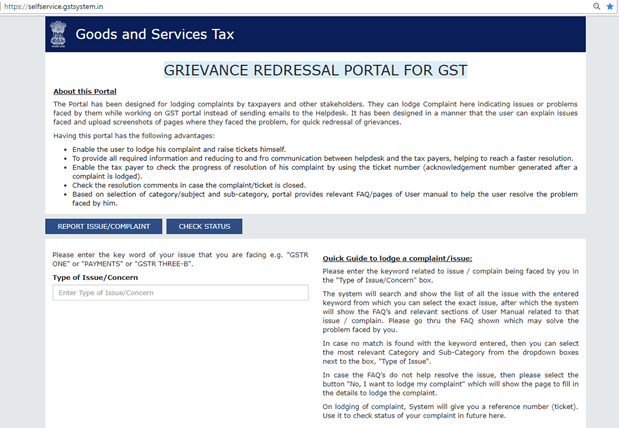

Here are the services offered on the self help GST portal:

- Report issue and Complaint

- Check Status of ticket raised

Here is the screen-shot showing the glimpse of self-help portal:

Handbook to raise your GST query or report issue

Step 1: Open the GST Self-Help Portal

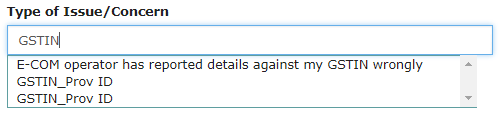

Step 2: Enter the issue or concern in the ‘Type of Issue/Concern’ box.

Step 3: Once you enter an issue a drop-down list will appear to choose the appropriate issue mentioned in the drop-down bar. For Instance, if you enter keyword GSTIN different drop-down will appear

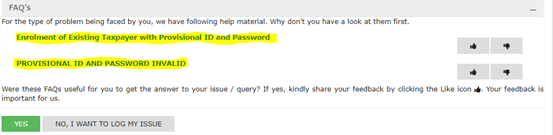

Step 4: Once you enter your query or concern you may get a link to the FAQ section. In case if that FAQ solves your issue or concern you may click on the “Yes” button that your issue was resolved. In case if your issue or concern is not resolved with the given FAQ’s you may proceed and click on the button saying “No I want to log my issue”

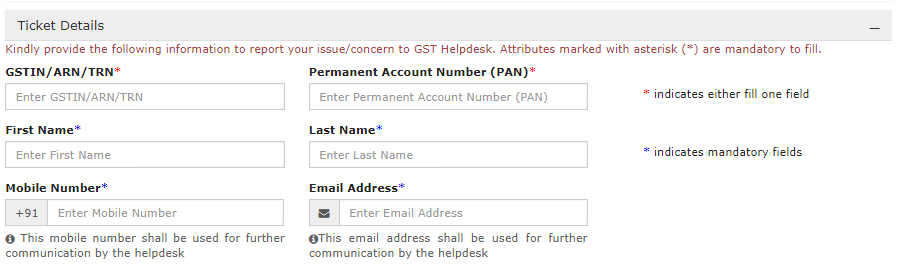

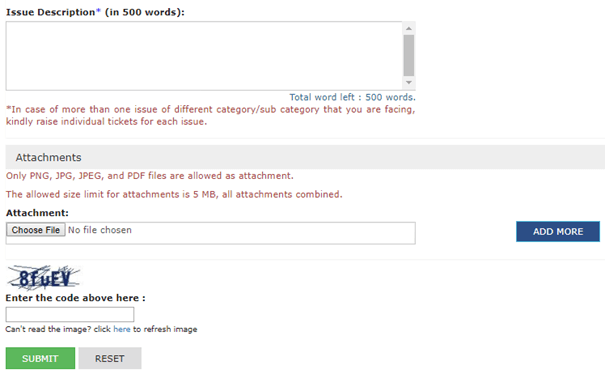

Step 5: Once you click on the log my issue button you need to enter the following details to generate a ticket.

Step 6: Post entering all the details enter the CAPTCHA Code and hit the Submit button.

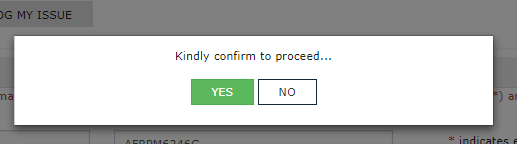

Step 7: After clicking on the Submit button a dialogue box will appear saying “Kindly confirm to proceed.” Hit yes in case if you want to proceed further.

Step 8: Once you click on the Yes button, a confirmation screen will appear showing your 15 digit Ticket Reference Number. Either write the ticket number or save the Ticket Reference Number as PDF for future reference. However, a mail containing the TRN will also be sent on the registered mail-ID of the taxpayer.

Handbook to Check Status of ticket raised

Any taxpayer can check the status of their ticket raised anytime

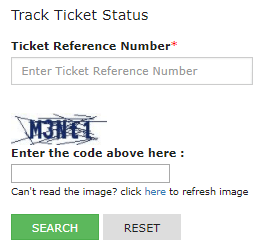

Step 1: Open the self-help portal. Step 2: Click on the CHECK STATUS button given on the homepage

Step 3: Once you click on that you will be redirected to a new page wherein you need to enter the Ticket Reference Number (TRN) and enter the CAPTCHA code.

Step 4: Post entering the details click on the search button and after clicking on that the status of ticket raised will be sent on the registered mail-ID.

Advantages of the Self Help GST Portal

Following are simply the advantages of the self-help portal:

- The self-help portal has a compelling and proficient UI

- A one-stop web page to post every one of your issues and get it settled through an immediate channel

- Track the status of the ticket raised. At the point when the ticket is settled, you can check the result.

- General FAQs provides solutions to many basic errors.

Online Invoice Generator GST | GST Invoice Check Online | E Invoice Software India | Online GST Software | E Way Bill Developer Portal

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement