Masters on E-Way Bill Portal

While generating E-way Bills there are few items which are required every time like HSN, Product Details, Transporters Details etc. Entering these details every time to generate an E-way Bill is cumbersome. The ewaybill systems login portal facilitates the user to create and manage their own business related masters. Masters JSON simplifies the data entry while generating the E-way Bill making the procedure of the bill watch system quick and error-less. Here we will discuss various types of the Masters JSON in the e way bill systems and how to manage them efficiently.

Types of Master

There are four different types of Masters under the E-way Bill.

- Product Master

- Client Master

- Supplier’s Master

- Transporter’s Master

Product Master

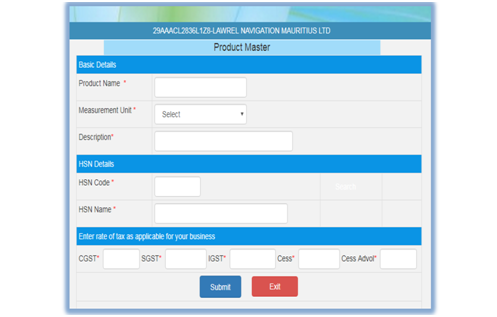

To create a product master one must select the option of “Master” from left panel and select the sub-option “Product”. Following screen will appear.

The following details need to be entered

- Product Name:- Name of the Product to be mentioned.

- Unit of Measurement:-Unit in which the product is sold needs to be mentioned like nos, kgs, liters.

- Brief Description:- A brief description regarding the product to be mentioned.

- HSN:- User needs to Enter HSN Code. If the user doesn’t has HSN code user can select HSN Code from Search options and HSN Name accordingly.

- Rate of Tax:-Rate of tax as applicable to the product needs to be mentioned – CGST, SGST, IGST, Cess Advol.

After filling the above data press submit button. Upon the submission of the request the system validates the entered values and saves. If there is an error, the message will be displayed on the screen. User can create master for all its products and save them. The user can create multiple master of the same product if the unit of measurement or rate of tax is multiple.

Client/Customer Master

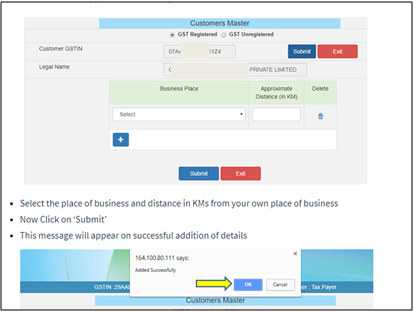

A user must select sub-option “clients” under the “Master” menu.

The user has to provide customer details, if the customer is registered or un-registered.

1. If the Customer is Registered with GST

If the customer is registered, GSTIN has to be entered. Once GSTIN is entered, the eway bill systems shows the customer details in the combo box. If GSTIN holder has additional place of business, then the combo will show both, the main and additional place of business. User has to select the place of Business and distance in KMs from his own place of Business. The user has to press submit option. On submission, the ewaybillsystem will save the details of the particular customer in the masters.

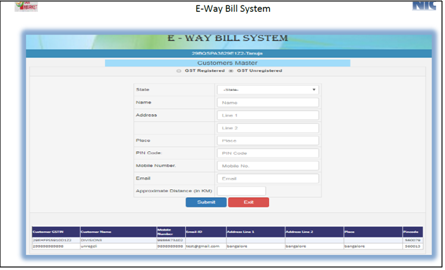

2. If the Customer in Not Registered with GST

If the customer is not registered, the “Unregistered” that option has to be selected. The following screen will be displayed.

Supplier’s Master

The procedure for adding the supplier’s master is same as that of adding the customer’s master and in the same way for the registered and the unregistered supplier the appropriate details has to be filled.

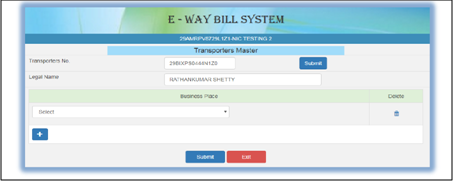

Transporter’s Master

The user needs to select the option of “Transporters” under the heading of “My Masters”. The user needs to enter the transporter number and select the submit button. Legal Name will be auto-filled.has to enter the details of the registered transporter. This is used to enable registered person to allow the transporter to update the vehicle number and other details related to the transporter in the product bill watch system whenever required.

The user need to enter state, name, client address, place, pin code, mobile number and email id and approx distance from his own business place. Once the details are submitted, the system validates the entered values and appropriate message is shown if there is any error.

Thus the clients details are captured in the masters and will be available for use as and when required.

Create the Masters in Bulk

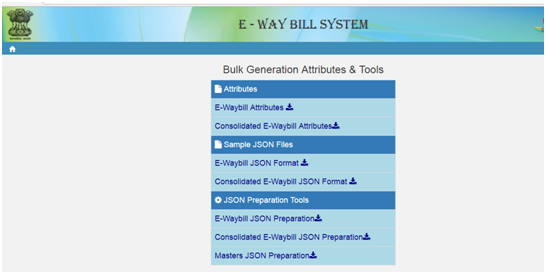

Go to the Home Page of www.ewaybill.nic.in (Not www.e way bill system or www.ewaybillsystem) and Click on “How to Use”. Select the option of “Tools”. Under the Options Select Bulk Generation Tools.

User should Click on “Master JSON Preparation” to download the same.

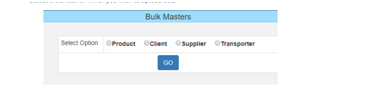

The user needs to fill the details in the downloaded file and validate it. The user needs to select “Prepare JSON” on each Excel. Under the E-Way Bill, select the Bulk Master.

Select the type of the Master for which Bulk Master has to be uploaded. Now Upload the JSON File created. The list will be available on successful upload of JSON File.

Frequently Asked Questions

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement