E Invoicing Bulk Uploading

Electronic invoice (e-invoice) was introduced in the 35th GST Council meeting, applicable to taxpayers in a phased manner. As per the latest notification, e-invoicing has been made mandatory w.e.f. 1st October 2020, for taxpayers whose aggregate turnover (based on PAN) in a financial year, exceeds INR. 500 crores, subject to certain exempted entities like SEZ Units, Insurance Companies, Banks (including NBFCs), Goods Transport Agency (transporting goods by road in goods carriage), Passenger Transport Services, and Multiplex Cinema Admissions. In this article, we will help you understand:

What is e-Invoicing?

‘E-invoicing’ or E Invoice Tool is a process wherein the taxpayer uploads their invoice details on the Government Invoice Registration Portal (IRP) and obtains an Invoice Reference Number (IRN) generated by the IRP system. That means, the taxpayer will first prepare and generate the invoice using their existing ERP or billing system and then upload these invoice details to IRP and get a unique reference number, known as IRN along with a QR code. The Government has clarified that the e-invoicing process does not mean preparation or generation of taxpayer’s invoice on the Government portal. This will only validate the already generated invoice.

What is Bulk Invoicing?

Although the industry welcomed e-invoicing, a concern was noted, especially by large businesses. The volume of invoices raised by large businesses can make e-invoicing a tedious process. As a result, the bulk invoicing feature was introduced on the portal. This feature can assist the taxpayers in generating IRN for multiple invoices at once.

What are the Steps for Bulk Invoicing (Offline Tool)?

Bulk invoicing or e invoice bulk generation tool can be done either by using e invoice offline tool download or through API. In this article, we will discuss in detail the steps for bulk invoicing using the einvoice offline tool.

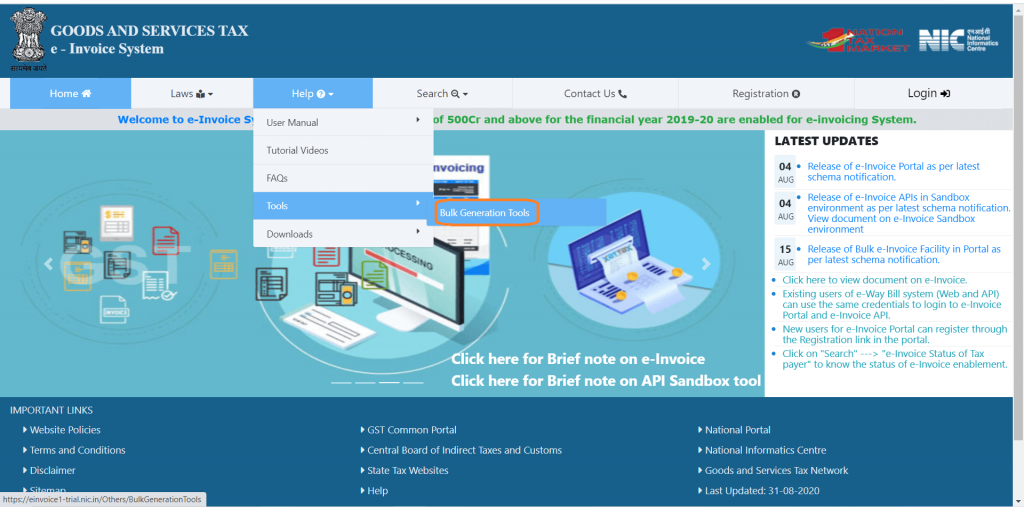

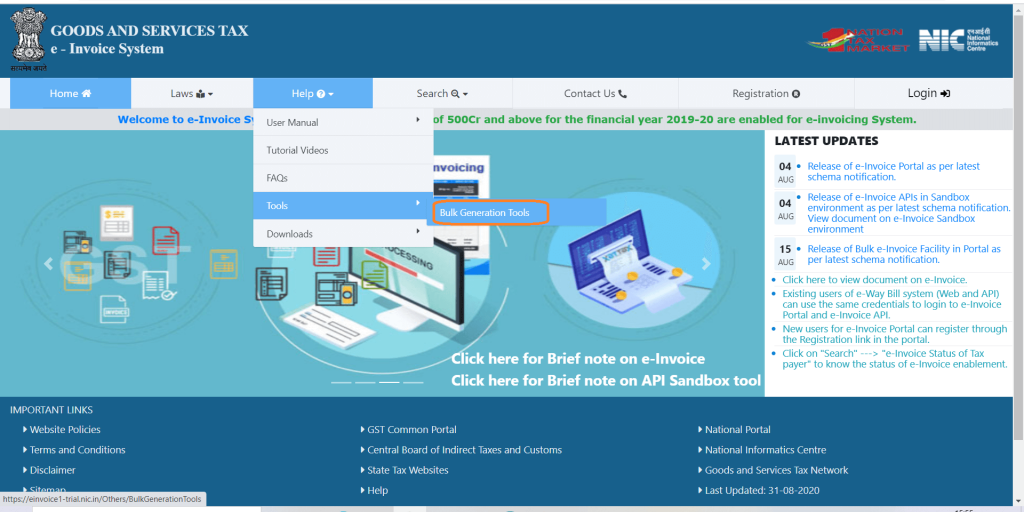

- Step 1: Download the applicable ‘Bulk IRN Generation’ e invoice offline tool from the e-invoice portal. Help -> Tools -> Bulk Generation Tools

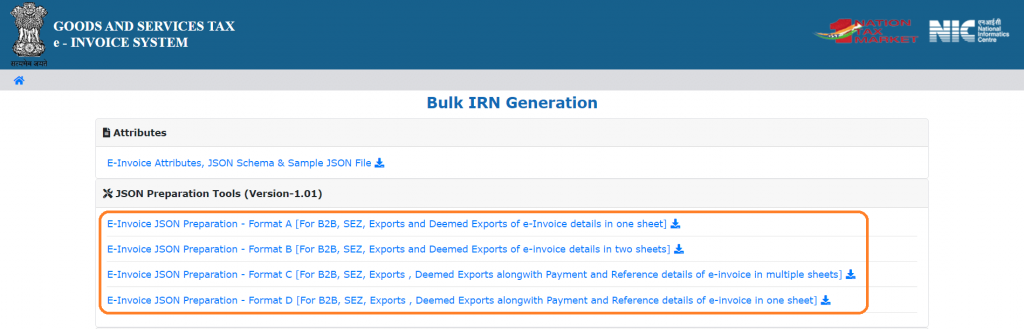

There are four formats of utility available:

| Particulars | Type of Utility | No. of Worksheets | Details included in the worksheet | Transactions |

| Format A | Basic | One | Invoice details | B2B / B2G |

| Format B | Basic | Two | 1. Invoice details 2. Product details | B2B / B2G |

| Format C | Detailed | Three | 1. Invoice details 2. Product details 3. Payment details (including invoice reference details) | B2B / B2G / Exports |

| Format D | Detailed | One | One combined worksheet with all the details of Format C | B2B / B2G / Exports |

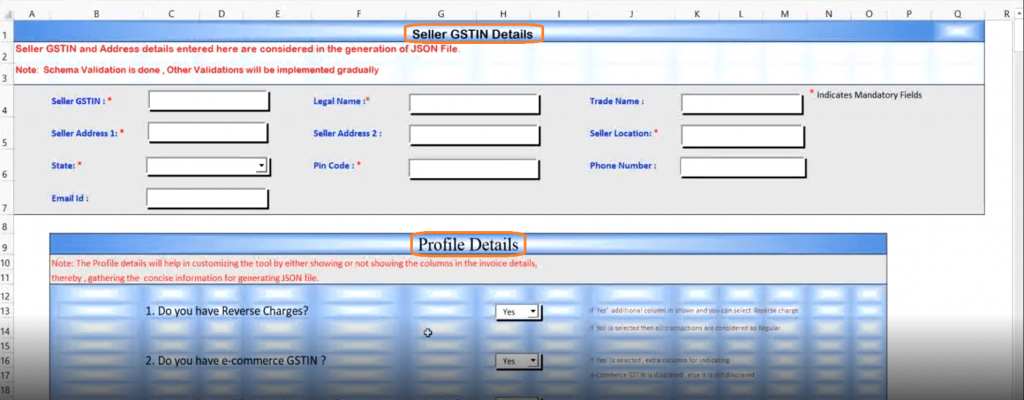

- Step 2: After offline e invoice utility download, enter all the details as required in the ‘Profile’ Tab under ‘Seller GSTIN Details’ and ‘Profile details’.

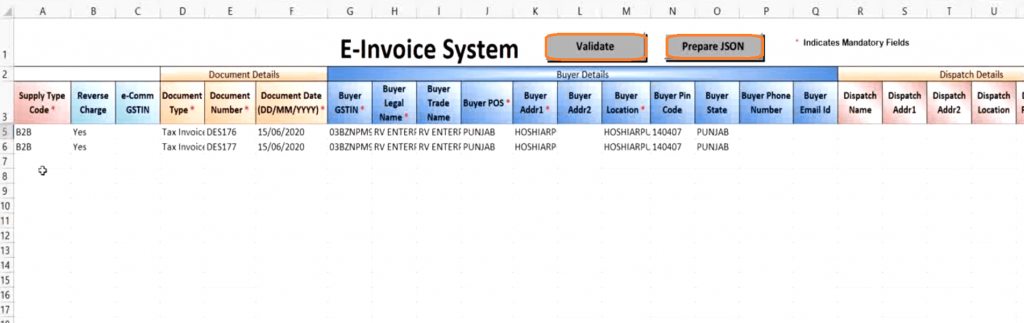

- Step 3: In the ‘Invoice’ tab, enter the required details in the respective fields and ‘Validate’ the same.

- Step 4: For e-invoice JSON preparation - format a, use the ‘Prepare JSON’ button JSON preparation tools after the details are successfully validated. An E Invoice JSON file will be generated containing details of all the invoices entered.

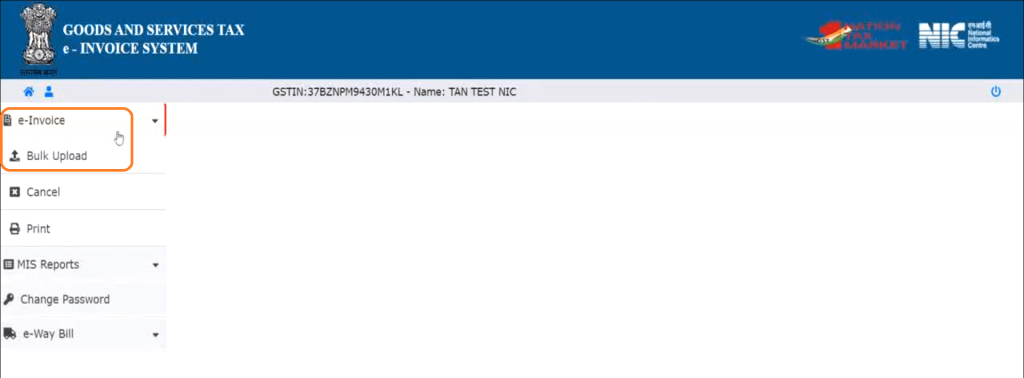

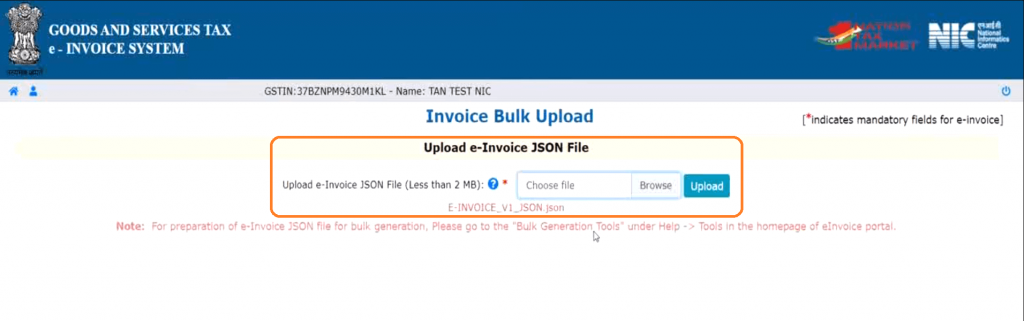

- Step 5: Log in to the e-invoice portal and go to E-invoice -> E Invoice Bulk Upload and select the JSON file to be uploaded. It is to be ensured that the JSON file is not more than 2MB.

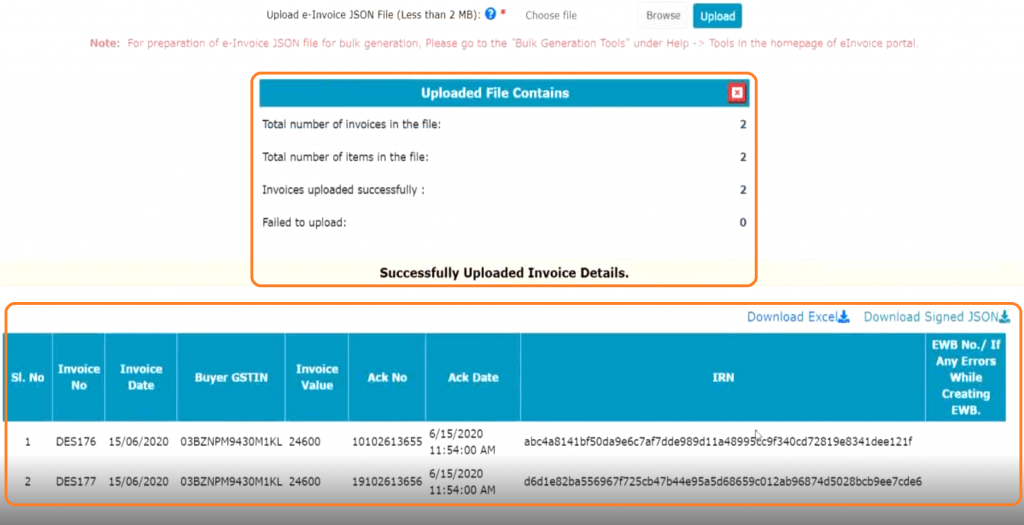

- Step 6: A summary of the invoices uploaded will be displayed on the screen. Each invoice is assigned a 64-character length IRN, and the same can e invoice excel utility download or in e-invoice JSON file download. In case any errors are noted, it has to be corrected and reuploaded.

For information on bulk invoicing through various options under API, please refer to the e-invoice portal.

How to Cancel an IRN?

A taxpayer may need to cancel an IRN generated. Common reasons for cancellation are:

- Cancellation of invoice

- Wrong invoice details uploaded, etc.

Note: An IRN can be cancelled only within 24 hours of being generated and, it cannot be cancelled if a valid e-Way bill is already obtained. The following steps may be followed for bulk IRN cancellation:

- Step 1: E invoice offline utility download for Bulk IRN Cancellation by visiting the e-invoice portal. Help -> Tools -> Bulk Generation Tools.

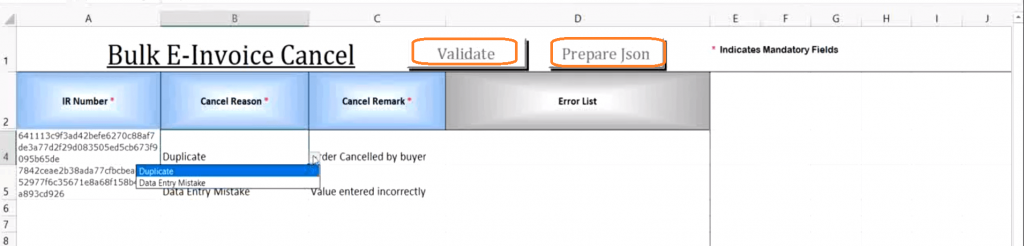

- Step 2: After downloading the offline utility, enter the details of IRN’s to be cancelled, including the IRN, the reason for cancellation, and remarks (if any). Post this, ‘Validate’ the entered details.

- Step 3: Use the “Prepare JSON” button after the tab is successfully validated. A JSON file will be generated containing details of all the IRN’s to be cancelled

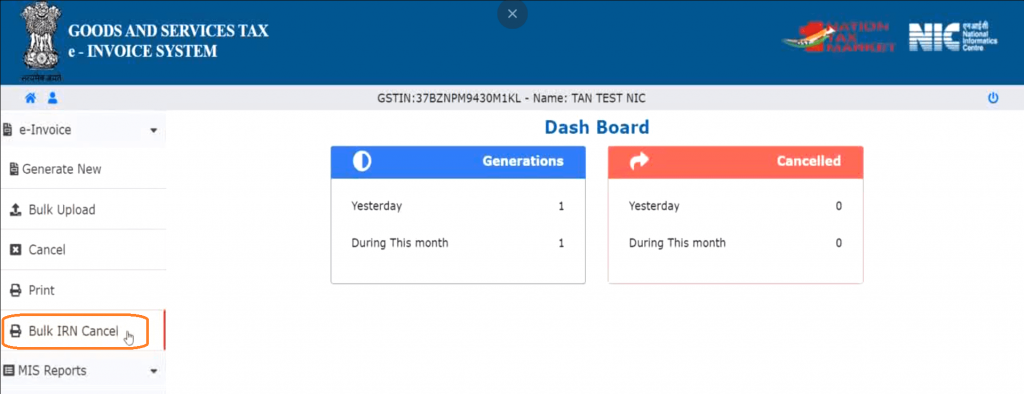

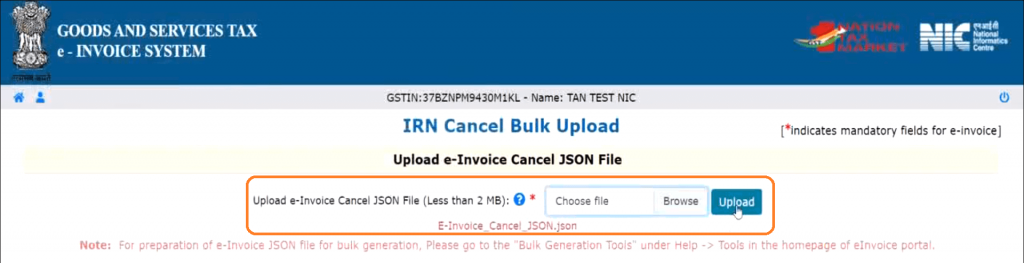

- Step 4: Log in to the e-invoice portal and go to E-invoice ? Bulk IRN Cancel and select the JSON file to be uploaded

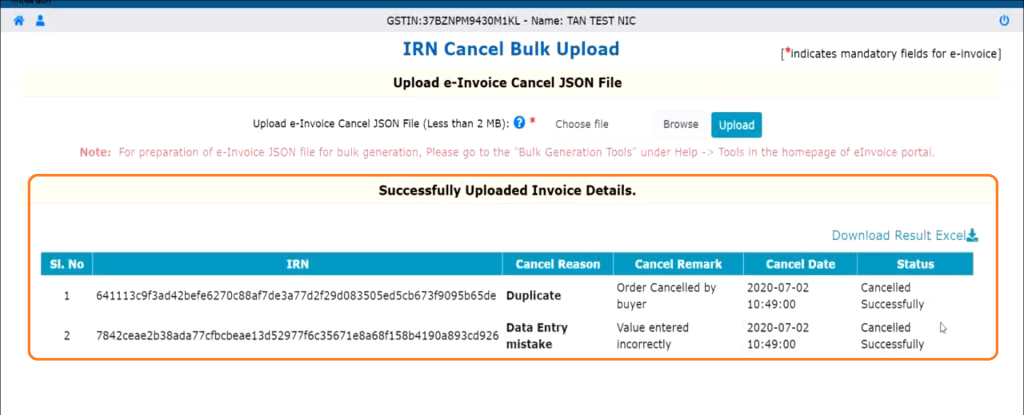

- Step 5: The list of the IRNs cancelled is displayed on the screen. The same can be downloaded e invoice in excel format. In cases any errors are noted, the same is to be corrected and re-uploaded.

What are the Benefits of Bulk Invoicing?

The benefits of the bulk generation facility are:

- Generates multiple IRN in one go

- Avoids duplication errors when duplicate invoices are uploaded

- Reduces time taken to generate IRN for multiple invoices

Image Source: https://einvoice1-trial.nic.in/Others/BulkGenerationTools https://einvoice1-trial.nic.in/

Need of GST In Points | GST Invoice Series Rules | Powers of Revisional Authority Under GST | Kaju GST Rate | Maintenance GST Rate

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement