GST Suvidha Provider Meaning (GSP) was first introduced and established by the Goods and Service Tax Network (GSTN) to help the taxpayer to comply with the GST provisions. GSTN is a private company where the stake of the State governments is 24.5% and the Central government is 24.5% which makes 49% stakes collectively. The motive behind the formation of GSTN was to provide and develop the IT infrastructure for GST implementation in India. The formation of GSTN has even boosted paperless tax compliances thereby promoting the Digital India initiative.

GSTN Shareholding

The percentage of shareholding in GSTN is mentioned below

- 24.5% stake by the State government along with the empowered group of states

- 24.5% stake by the Union/Central government.

- 11% LIC housing finance

- 10% ICICI Bank

- 10% HDFC BANK

- 10% HDFC

- 10% NSE Strategic Investment Co.

What is GST Suvidha Provider (GSP)?

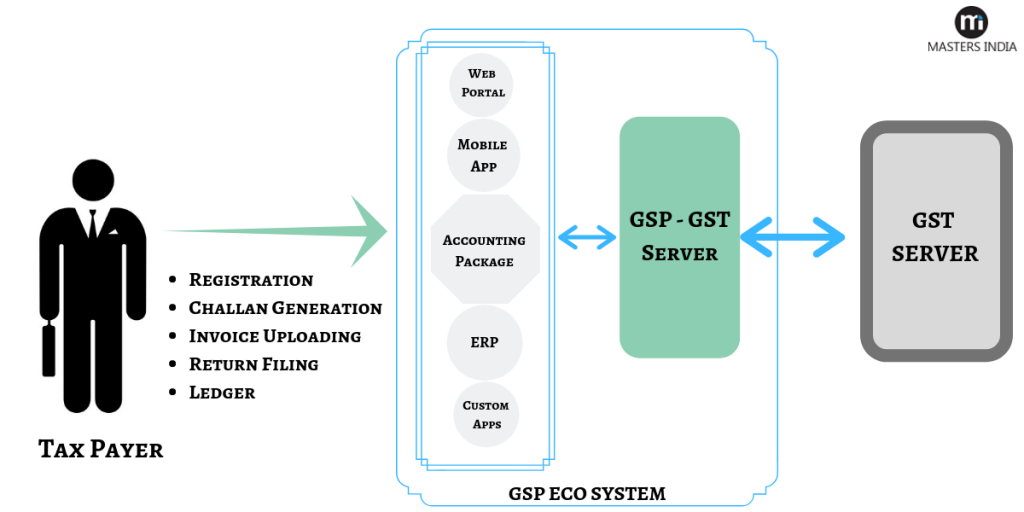

Meaning of GST Suvidha Provider (what is GSP in GST) is paramount for GSTN as GSPs are special entities who are recognized and authorized to create and develop a platform (especially a web-based platform approach) to enable the taxpayer to carry out Goods and Services Tax (GST) compliances. GSP full form in GST is GST Suvidha portal.

Why GSP Services Are Needed?

Under GST, process such as filing GST Returns or synchronizing invoice details is very time-consuming for the taxpayer as the taxpayer has to fill approximately 37 Returns every year. This is where the GSP caters for the need of taxpayers as it simplifies and saves time that is needed for GST compliance whether it is GST Return filing or synchronization of invoices. GST Suvidha Provider (GSP) will provide APIs to carry out the procedure such as GST Registration, GST Return filing, tax payment or invoice uploading and will also be in direct contact with the GSTN.

What Are the Functions/Services of Software Provided by GSP?

The software provided by the GST Suvidha Provider and the functions of GSP is as follows.

- Reconciliation of sales and purchases for errorless bookkeeping and uploading the same on the GST portal

- Consolidated view of all the businesses

- ERP Integration

- Multi GSTIN and Multi-warehouse support

- Action-based MIS reports for the taxpayer

- The taxpayer can create GST invoices, purchase orders, delivery challan etc

- Supports e-commerce invoices

- The taxpayer can upload multiple invoices

- Simplified GST Return through auto-population

- Notification for e-way bill expiry

- Unlimited access to the taxpayer

Masters India is a licensed GST Suvidha Provider by GSTN which offers GST and E-way bill automation to the taxpayers. The list of software that Masters India provides for easing GST compliance is GST Suvidha provider API, and Masters India - GST Suvidha Provider software.

GST Return Filing and Reconciliation Solution

This solution helps the taxpayer to automate their GST filings and helps them to file their GST Returns within a few seconds. The key feature of this software is that it provides the reconciliation of inward and outward supplies which in turn helps the taxpayer to maintain error-free books of accounts and also reduces the scope of the duplicity of invoices.

E-Way Bill Solution

This solution automates the e-way bill generation process and helps the user to generate an e-way bill with just a single click. Moreover, this software gives alert notification to the user regarding the expiry of the e-way bill so as to save the taxpayer from non-compliance of the e-way bill provisions.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement