Get the Complete PAN Card Details

The (PAN) Permanent Account Number and DNA share the same traits as they both are exclusive. However, there is a one in a million chance of DNA being common but details of pan card are unique. The PAN number is a blend of 10 digit number and alphabets that helps the Income tax to gather information about the PAN holder. The Income Tax Department is using Phonetic Soundex Code algorithm to generate PAN number these days.

Now, searching PAN card is an easy task, you can check PAN card details, PAN number search by name and dob. The PAN card finder helps to get PAN master India.

However, the PAN Card details can be found using the following things:

Verifying PAN Card Details by Name, PAN No. and Date of Birth

By just furnishing your Name, PAN No. and D.O.B you can easily find PAN card details. So to find PAN Card details you have to follow the below-mentioned steps:

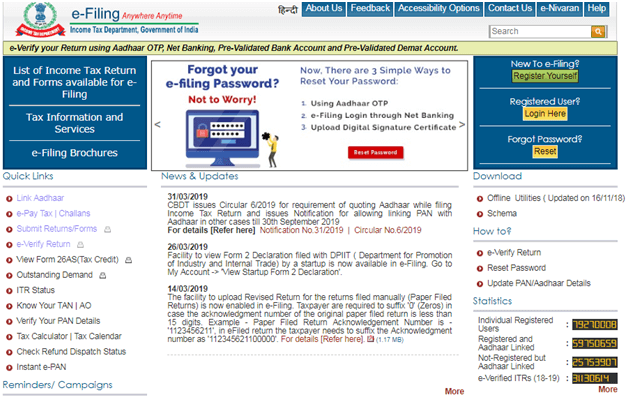

- Step 1: Open the Income Tax E-Filing website using https://www.incometaxindiaefiling.gov.in/home

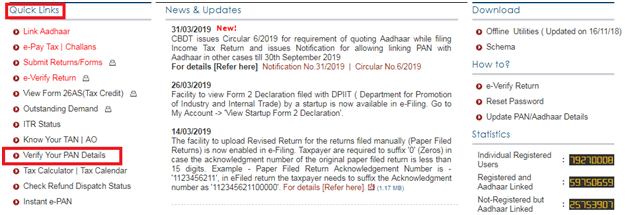

- Step 2: Under Quick Links, you can find Verify your PAN details.

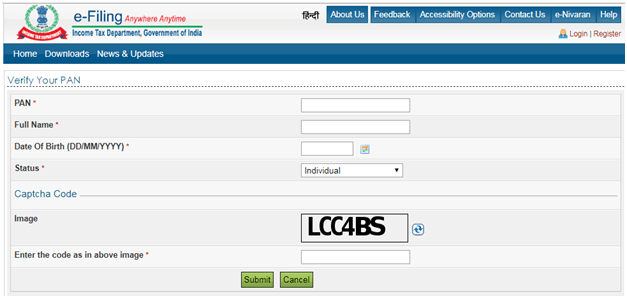

- Step 3: You need to enter your PAN number, full name, Date of Birth, Status and Captcha code.

- Step 4: After furnishing the entire above details click on the submit button.

All the above steps help you to do PAN card details check and verify. In this way, you can find PAN card details by PAN number, name, and DOB. You can also get the help of Masters India by MastersIndia PAN search by name and get the master PAN card.

Change/Correction in PAN Card Details

Details in the PAN card can be changed by following the below-mentioned steps:

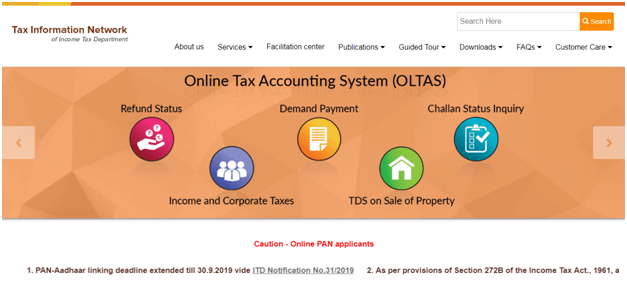

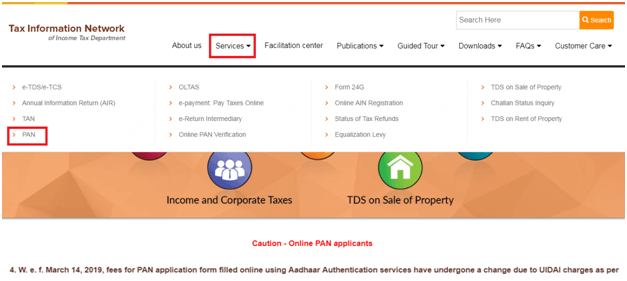

- Step 1: Open NSDL e-Governance portal using www.tin-nsdl.com

- Step 2: Under the Service section you can find PAN

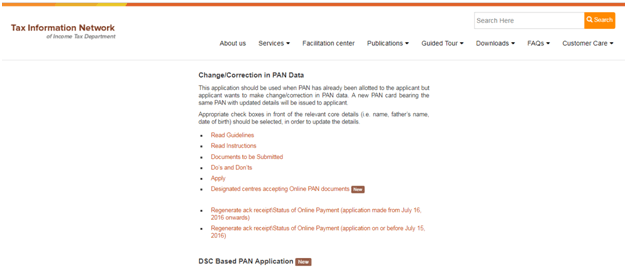

- Step 3: Afterwards find Change/Correction in PAN Data downwards and click on the Apply button.

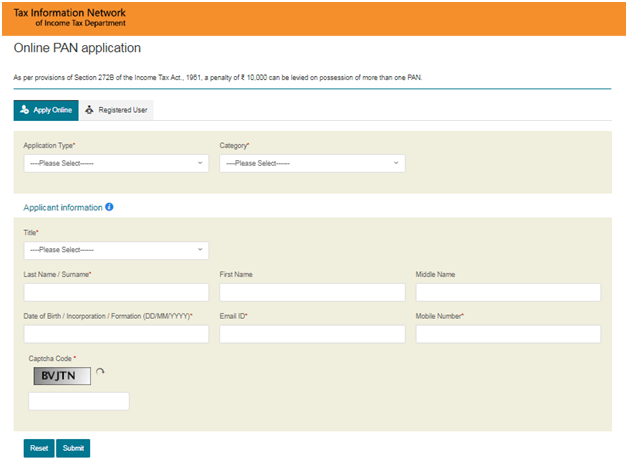

- Step 4: After clicking on the Apply link you will be redirected to a new page where you need to furnish all the details.

- Step 5: Once you furnish all the details you have click on the Submit button.

- Step 6: You will be directed to a payment page wherein you have to pay the change/correction in PAN details fees.

- Step 7: After the successful payment of the fees, you need to download the acknowledgement slip.

The entire process of changing the PAN Card details will take 15-20 days after making the request for the Change/Correction in PAN Data. Moreover, you will get your PAN Card with all the changes or correction after this period of time of only.

Checklist for Requesting Change/Correction in PAN Card Details (Offline)

Here is the checklist for requesting change/correction in PAN Card details:

| Check List | Particulars |

|---|---|

| ✓ | Fill the entire application form in block letter to fill the application |

| ✓ | Paste 2 recent color photographs in the 3.5 cm X 2.5 cm size |

| ✓ | Signature the form in the provided box |

| ✓ | Mention your correct PAN |

| ✓ | In case if you are using thumb impression on the form, get it attested either by Gazetted Officer or Magistrate |

| ✓ | Provide Proof of Identity, Proof of Address and Proof of D.O.B |

| ✓ | Tick mark the correct column where you need to change |

| ✓ | In the application provide the complete postal address together with landmark and correct PIN code. |

| ✓ | Attach PAN along with the PAN Card letter with the application form |

| ☓ | Overwrite in the application |

| ☓ | Staple the photograph |

| ☓ | Sign outside the prescribed box |

| ☓ | Proof of address or identity which are not of the applicant |

| ☓ | Give additional details such as Rank or designation |

| ☓ | Spouse’s name in the Father's Name column. |

| ☓ | Abbreviate or initials of your name |

| ☓ | Apply for a new PAN if you have one |

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement