The income tax department has segregated assessees into different groups based on the source and estimation of income. This helps the taxpayers to select the relevant Income Tax Return form. In this article, you will find the details about the ITR-1 SAHAJ form.

Learn about the other ITR forms here:

ITR-1 ITR-2 ITR-3 ITR-4 ITR-5

Note: The due date to file ITR-1 for the AY 2020-21 (FY 2019-20) is extended to 30 November 2020 for all taxpayers.

Who is Eligible to File ITR-1 SAHAJ Form?

ITR-1 SAHAJ is for those assessees who have income up to INR 50 lakhs. Here, the assessee needs to be an:

- Individual receiving income from salary or pension or/and

- Individual earning rental income only from one House Property or/and

Note: If there is a loss brought forward from the previous years or is to be carried forward to the next years, this ITR cannot be filed.

- Individual earning income from other sources (except lottery income and winnings from racehorses)

Note: If the assessee chooses to add his/her spouse’s/child’s income to his/her income while filing the ITR 1, the same should be within the purview of the points mentioned above.

Who is not eligible to file ITR-1 SAHAJ FORM?

The below-mentioned individuals cannot file ITR-1 SAHAJ FORM:

- Any individual whose income exceeds INR 50 lakhs

- An individual who owned unlisted equity shares at any time during the relevant financial year or was a director in any company

- Not Ordinarily Resident (NOR) and Non-Residents

- Any assessee having income from the below-listed sources:

-

- More than one house property

- Agricultural income exceeding INR 5,000

- Short and long term taxable capital gains

- Foreign assets

- Business and Profession

- Legal gambling, winnings from racehorses, lottery and related

- Assessee taking double taxation relief U/S 90/90A/91 of the Income Tax Act

Documents required for filing ITR-1 SAHAJ Form

The list of documents that are helpful while filing ITR-1 SAHAJ Form are:

- Form 16: This is a TDS certificate issued by employers to their employees for the relevant FY.

- Form 16A: This is also a TDS certificate showing the tax deducted on income (other than salary) earned.

- Form 26AS: This is a tax credit statement issued by the Income Tax Department. It helps in verifying the TDS mentioned in FORM 16 and 16A.

- Details of other income earned and investments made: Income from Other Sources if earned, should be included in the ITR 1. Income receipts or bank transfer details can provide the information needed for this. Further, receipts of premium paid, donations given, and tax-saving investments can help taxpayers claim genuine deductions under chapter VI A.

- PAN

- AADHAAR

Format of ITR 1 SAHAJ Form (Offline)

The notified format of ITR 1 Sahaj Form download for AY 2020-21 can be downloaded here. This has seven parts that need to be filled (as applicable). PART A: General Information PART B: Gross Total Income PART C: Deductions and Taxable Total Income PART D: Computation of Tax Payable PART E: Other Information Schedule IT: Detail of Advance Tax and Self-Assessment Tax payments Schedule TDS: Detail of TDS/TCS Verification

Penalty for not filing Income Tax returns in time

If an assessee misses the ITR due-date to file the returns, he/she needs to pay up to INR 10,000 as a penalty as per the revised rules u/s 234F of Income Tax act (effective since 1 April 2017). However, in case if the income is less than INR 5 lakhs then he/she has to pay a penalty of INR 1,000.

| Late Fee Details | ||

| Filing Date in the relevant AY | Total Taxable Income Below INR 5,00,000 | Total Taxable Income Above INR 5,00,000 |

| 31st July | INR 0 | INR 0 |

| Between 1st August to 31st December | INR 1,000 | INR 5,000 |

| Between 1st January to 31st March | INR 1,000 | INR 10,000 |

Significant Changes in ITR 1 (AY 2020-21)

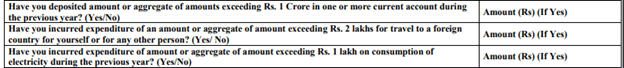

- An assessee who is:

a. Making cash deposits above INR 1 crores or

b. Incurring expenses above INR 2 lakhs on foreign travel or

c. Incurring expenditure above INR 1 lakhs on electricity should enter the relevant details in the ITR-1.

- Considering the current pandemic across the country, for this AY only, assessees have an option to claim and disclose tax-saving investments made between 1 April 2020 to 30th June 2020.

- Resident individuals who have a house property in joint ownership can also file ITR-1 when the individual share of the total rental income does not exceed INR 50 lakhs.

Ways of Filing ITR-1 SAHAJ Form

There are two ways of filing ITR-1 SAHAJ Form

1. Offline filing of ITR 1 SAHAJ Form (See format above)

Only the following assesses can file the ITR 1 offline.

- Super Senior Citizens: A person who is above 80 years of age at any time during the previous financial year is considered as Super Senior Citizen.

- Assessees with income less than INR 5 lakhs: An individual/HUF whose income is below INR 5 lakhs and does not claim any refund in the Income Tax Return can also file the ITR 1 offline.

Note: Income Tax Department issues an acknowledgement slip when the ITR is submitted at the designated office.

2. Online filing if ITR-1 SAHAJ Form

All eligible assessees (except the ones’ mentioned above), should mandatorily file their ITR 1 electronically. Note: When the ITR-1 SAHAJ Form is filed ITR 1 online form (how to file ITR 1 online ), the acknowledgement is received via email to the registered email ID. The password to open the Acknowledgement will be the combination of PAN (in lowercase) and the date of birth of the assessee in DDMMYYYY format.

Need of GST Notes | GST Invoice Number Length | Power of Officer Under GST | GST On Dry Fruits | GST On Society Maintenance

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement