ITR 3 Form

The Income Tax Department has bifurcated assesses into a different group depending upon the income and its source. This was done to simplify the income tax return filing procedure. So, it is important for an assessee to know in which group they fall in.

In this article, we will discuss the criteria’s to file the ITR 3 Form.

2. Structure of the ITR-3 Form

ITR-3 is divided into 4 Parts and they are

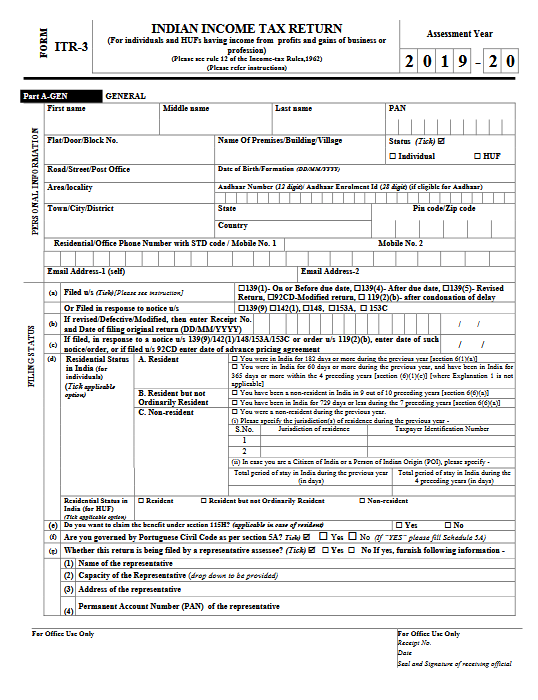

PART-A

- Part A-GEN: Nature of business and other General information

- Part A-BS: Balance Sheet of the Proprietary Business or Profession

- Part A- Manufacturing Account: Manufacturing Account for the financial year 2018-19

- Part A- Trading Account: Trading Account for the financial year 2018-19

- Part A-P&L: Profit and Loss for the Financial Year 2018-19

- Part A-OI: Other Information (optional in a case not liable for audit under Section 44AB)

- Part A-QD: Quantitative Details (optional in a case not liable for audit under Section 44AB)

Schedules

- Income from Salaries

- Income from House Property format

- Income from business or profession

- Depreciation on plant and machinery

- Depreciation on other assets

- Depreciation Summary on all the assets

- Deemed capital gains on depreciable asset sale

- Expenditure on scientific research (Section 35 Deduction)

- Capital gain Income

- Other sources Income

- Income statement after setting off of current year’s losses

- Income Statement after setting off unabsorbed loss brought/carried forward from earlier years.

- Loss statement carried forward to future years.

- Unabsorbed depreciation statement.

- Income computation Disclosure Standards on Profit

- Computation of deduction under section 10AA.

- Donations entitled for deduction under section 80G.

- Donations to research associations etc. entitled for deduction

- Section 80IA Deduction

- Section 80IB Deduction

- 80IC / 80-IE Deduction

- Deductions (from total income) under Chapter VIA

- Alternate Minimum Tax Payable under Section 115JC

- Section 115JD Tax credit

- Income statement arising to the spouse or minor child or wife or Son's wife or any other person or AOP to be included in the income of the assessee in Schedules-HP, BP, CG and OS.

- Income statement that is chargeable to tax at special rates

- Partnership firms where the assessee is a partner

- Exempted Incomes

- Pass-through income details from a business trust or investment fund as per section 115UA, 115UB

- Income details from outside India and tax relief

- Tax relief statement claimed under section 90 or section 90A or section 91.

- Foreign Assets and income from outside India.

- Information related to the distribution of income between spouses as per the Portuguese Civil Code

- Asset and Liability at the end of the year if the total income exceeds 50 Lakhs INR

- Gross receipt reported for GST

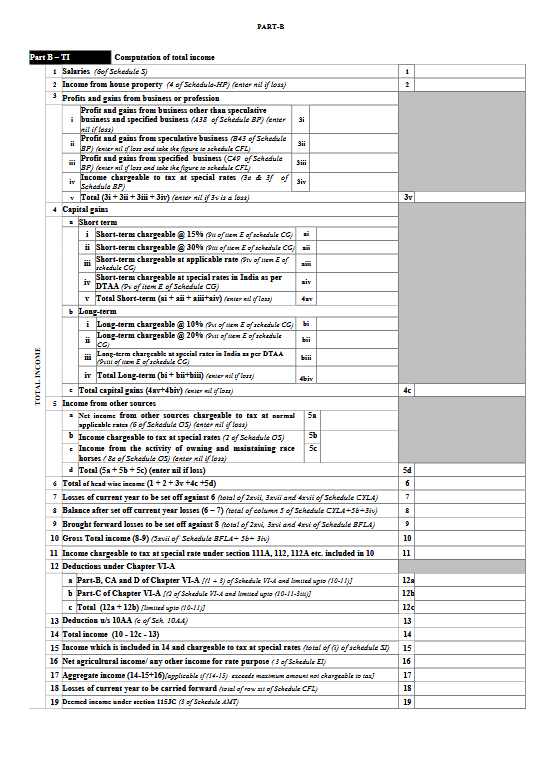

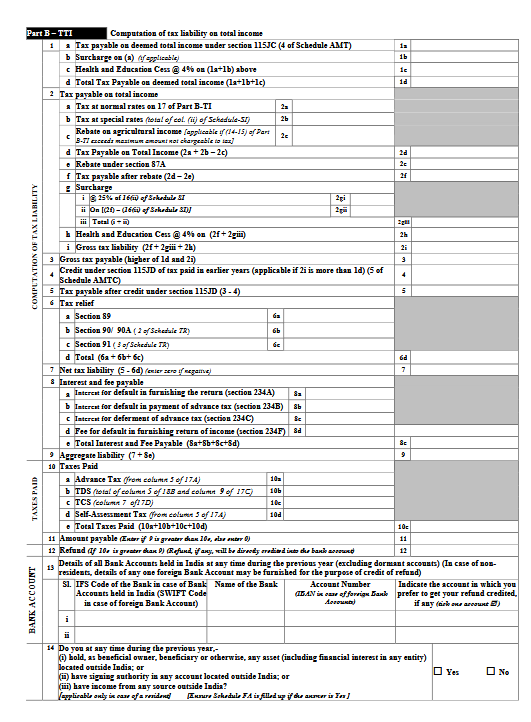

PART-B

Part TI: Computation of Total income

Part TTI: Computation ITR on total income

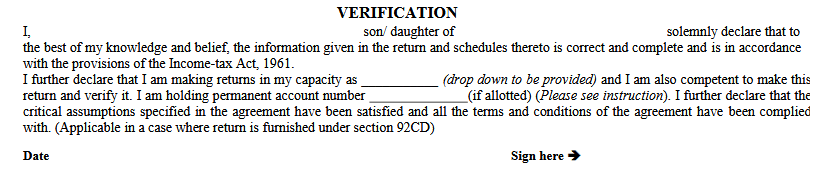

Verification

3. Ways file ITR 3

There are two ways to file ITR Form 3 ; either you can file it online or offline

- Offline Filing of ITR-3 Form

ITR-3 Form can be filed offline by every Super Senior Citizen

After filing the ITR-3 Form offline, the person gets an acknowledgement slip issued by the Income Tax Department.

- Online Filing of ITR-3 Form

ITR-3 Form can be filed electronically or online using a digital signature (DSC) by every assessee falling into this group.

When you file 3 number form or ITR-3 Form online you will get an acknowledgement mail on your registered e-mail ID.

Note: ITR-3 form does not consist of any annexure that means you need not to attach any document at the time of filing the ITR-3 Form.

You can get help of site:www.mastersindia.co. Here, you will get complete solutions of your ITR 3 form issues and other relevant too.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement