e-Invoice Reporting - A step towards improving Ease of Doing Business and Reporting for GST

Agenda

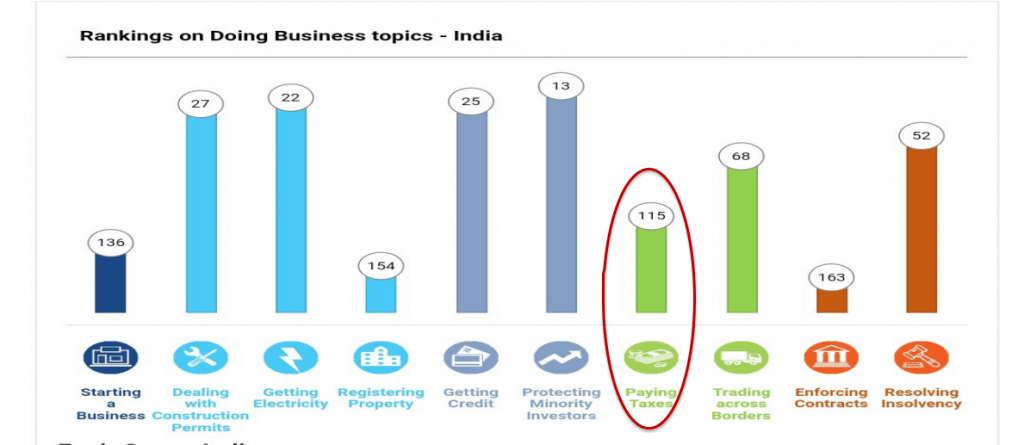

- India’s position in ease of doing business

- What is meant by e-invoice?

- Why are we getting into this?

- Implications for the Taxpayers

- Implications for the accounting/billing/ERP providers

- Timelines

- Technical Specs by NIC team

Ease of Doing Business

| India was at 77th position in 2018. On Paying Taxes, India at 121. | India is at 63rd position in 2019. On Paying Taxes, India is at 115. |

Paying Taxes in India - Summary

| India | 2018 | Score |

| Number of tax payments: | 11 | 86.67 |

| Time to comply with the tax system (hours per year): | 252 | 68.64 |

| Total Tax Rate (cost of all taxes borne by the company as a % of commercial profits): | 49.7% | 65.80 |

| Overall Paying Taxes ranking: | 115 | 67.63 |

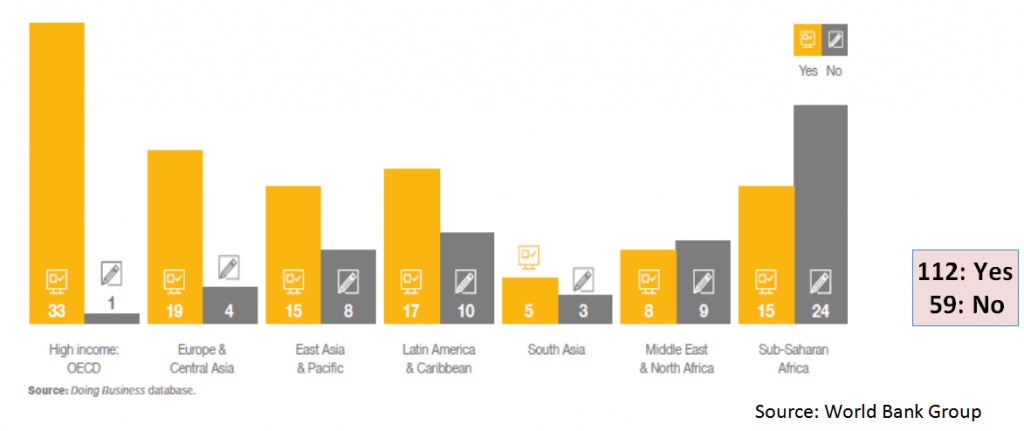

Electronic invoice is being looked at to reduce compliance burden apart from increasing business efficiency. Important lessons from other countries:

- Standards

- Enabling taxpayers to generate electronic invoice (IT infra as well as cultural issues)

Paying Taxes: Current Status

Paying taxes includes Return preparation, which contributes largest share of the index. Current Status

- Separate reporting of invoice data for GST Return and e-wayBill

- Both have different formats and hence the taxpayer has to prepare them every time.

- The format of reporting in GSTR-1 and that for e-way bill are different from original invoice

- Lots of errors creep in in manual processing by

- It involves lot of paper use, use of courier

- Unscrupulous elements generate fake invoices, push them in the GST system and

Absence of Standard

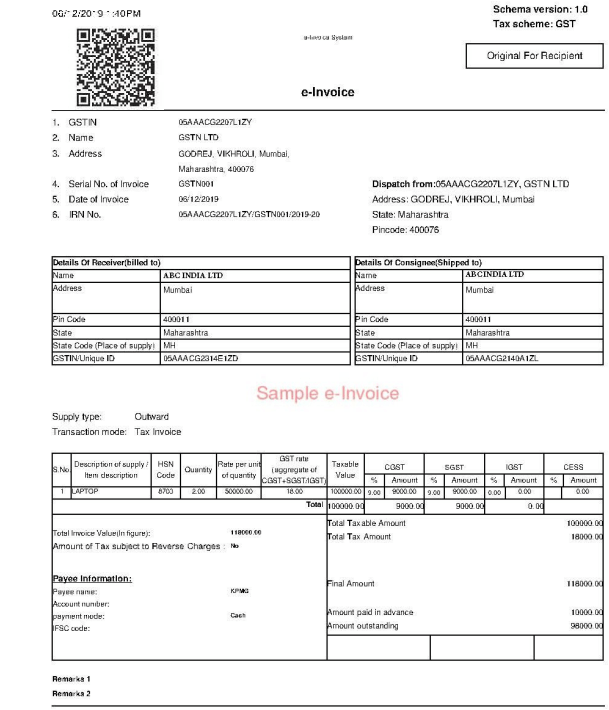

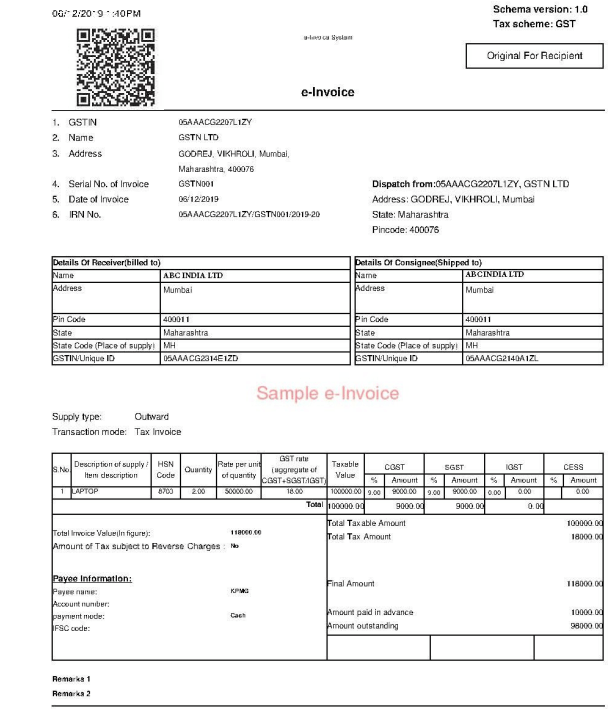

This is how our e-invoice format looks like

Why e-Invoice?

- Is your e-invoice taken into buyer’s billing/accounting system directly?

- If not, how is the data entered?

- Transcription errors

- Wrong entries

- Need for standards to ensure complete inter-operability

- Elimination of need of manual data entry and transcription errors

Advantages of e-Invoice

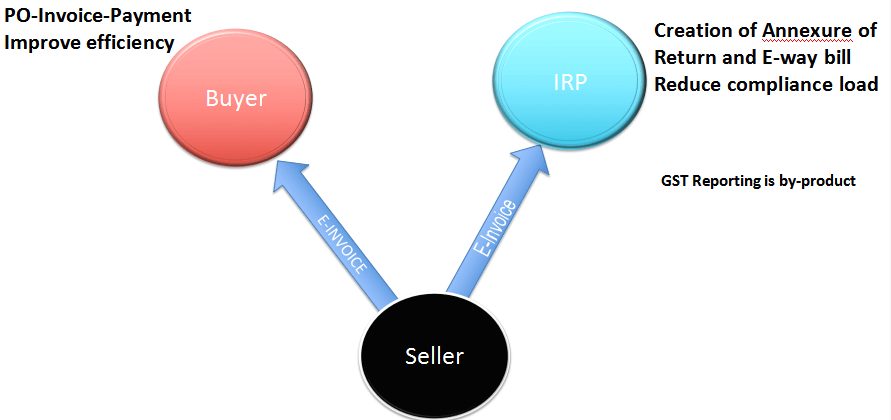

Generation of invoice and its reporting will become part of business process. Also, no further reporting to GST portal or e-way bill portal.  Reporting to GST is a by-product. Auto of Return by GSTN Benefits of e-invoice system

Reporting to GST is a by-product. Auto of Return by GSTN Benefits of e-invoice system

Case Study from France

| Items | Paper invoice (pre e-invoice period) | After introduction of e-invoice | Change | |||

| Cost of handling of one invoice | 7 Euros | 0.3 Euros | 96% saving | |||

| Number of invoices handled by an employee in a year | 6,000 invoices | paper | 90,000 e-invoices | 15 times efficiency improvement | ||

| Time saving | 15 days for paper invoice | 3 days invoice | for | e- | 80% saving of time | |

| 52% businesses view the cost reduction as the principal advantage of digital transformation | ||||||

Source: EY Study 2016

E-invoice: Generation and Reporting

- e-invoice does not mean generation of electronic invoice on GST Portal but reporting of electronic- Invoice?

- What will change for users/taxpayers? Nothing

- The taxpayer will NOT be required to make any change in his ERP?

- Change?: Reporting of invoice data generated in a particular format which can be understood by government portal as well as by

- The aim is to make it part of business process of taxpayer and eliminate all reporting

- Reporting in near real time. ->Return generation by GST System.

Way Forward

- Reporting on B2B invoice data in the form it is generated (no further processing as being done today). Reporting should become part of his business process, as generation of e-way bill is

- GST System will then generate Return as well as e-way bill from this data

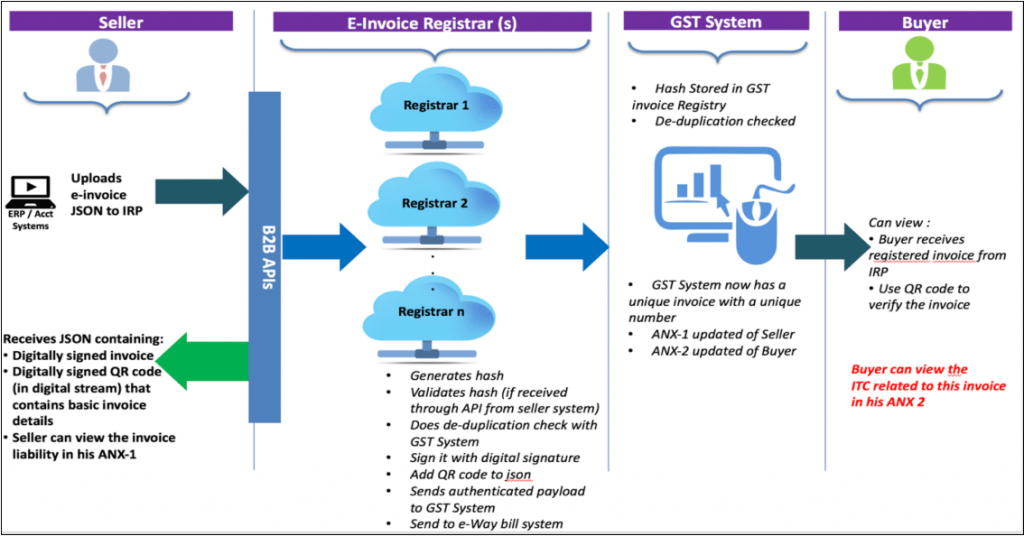

- The uploaded invoice data will be digitally signed by GST System and shared with seller, buyer

- Once fully rolled out, GST System will prepare the Return where only few details like B2C sales, imports will have to be filled by taxpayer and taxes paid.

Features of E-Invoice System approved by Government

- E-invoice will be created by Taxpayers on their own accounting/billing/ERP system

- The e-invoice, as prepared, will be reported on Invoice Reference Portals(IRP)

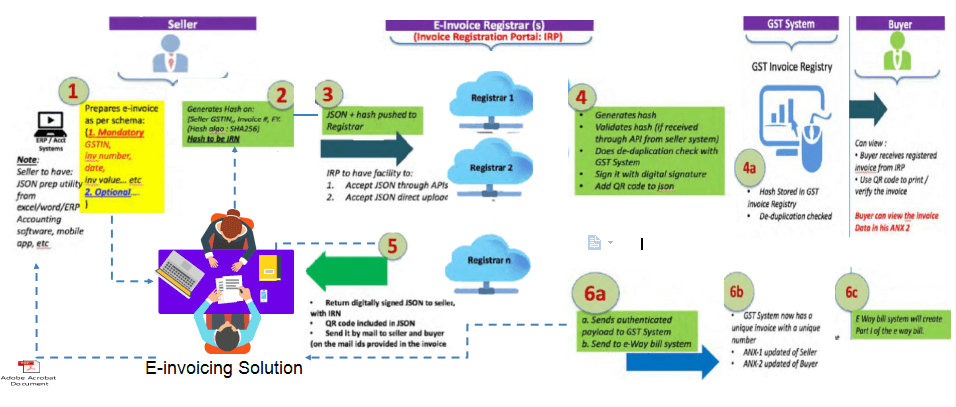

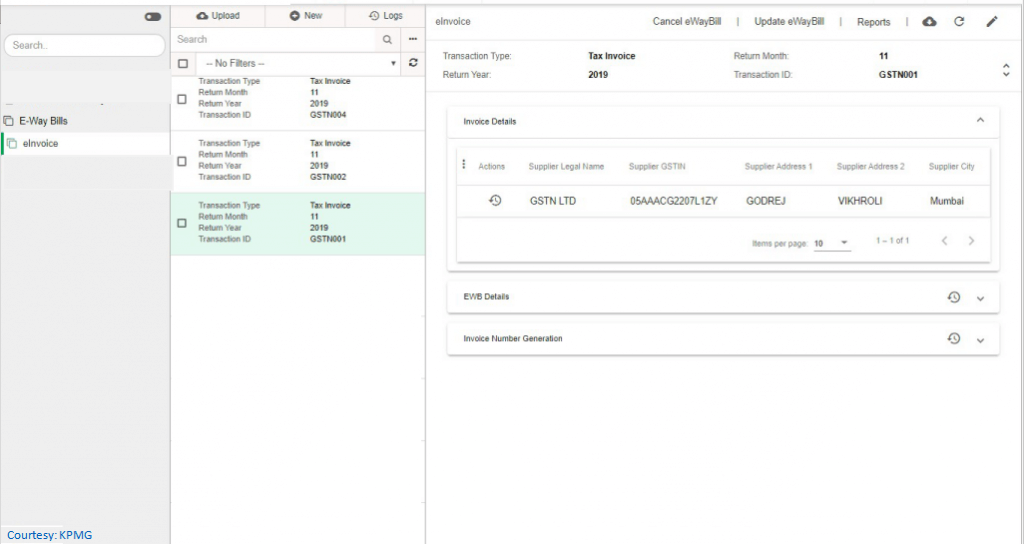

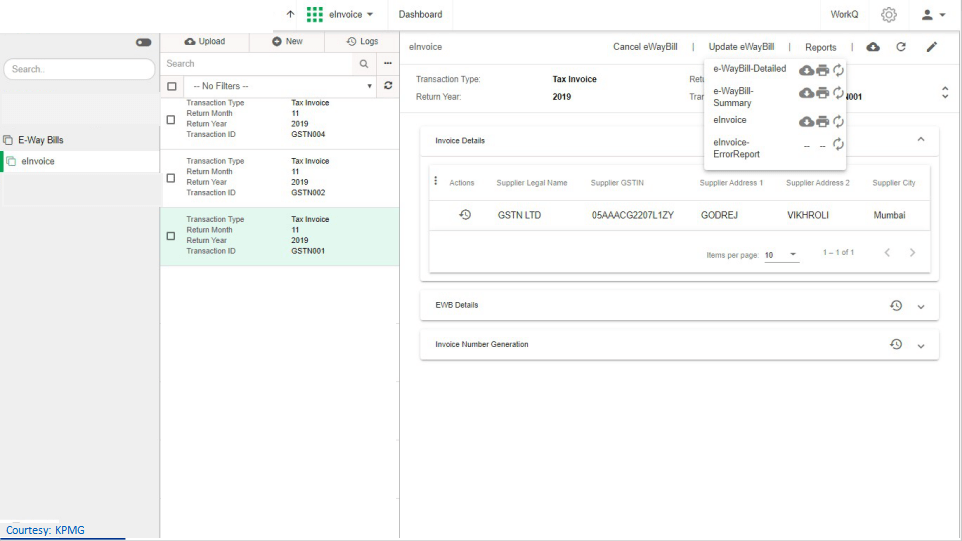

- IRP will generate unique Invoice Reference Number (IRN) which will be attached on the e-invoice and system will digitally sign the same and return to taxpayer (supplier) as well as

- The IRP will also generate a QR code containing the unique IRN along with some important parameters of invoice like GSTIN of supplier and buyer, invoice number, date, invoice value, total tax amount and HSN code of major

- QR code will enable Offline verification using Mobile

- Multiple Invoice Reference Number Portals (IRP) to ensure uninterrupted To start with, NIC will be the first Registrar. Based on experience of the trial more registrars will beadded.

- The standards of e-invoice schema, template and FAQ are available at https://www.gstn.org/e-invoice/

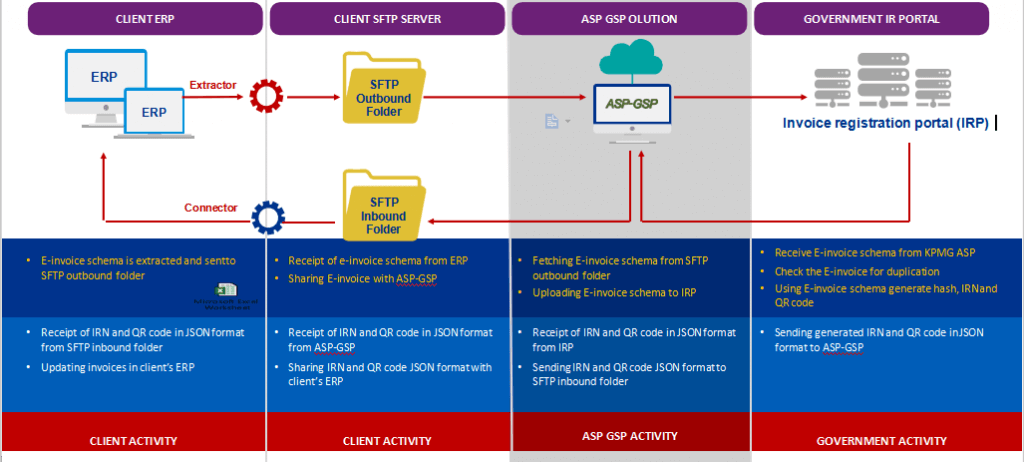

Flow of the E-Invoice Registration System

E-invoice workflow* (Seller - Buyer)

*Source: last FAQ doc released by GSTN

*Source: last FAQ doc released by GSTN

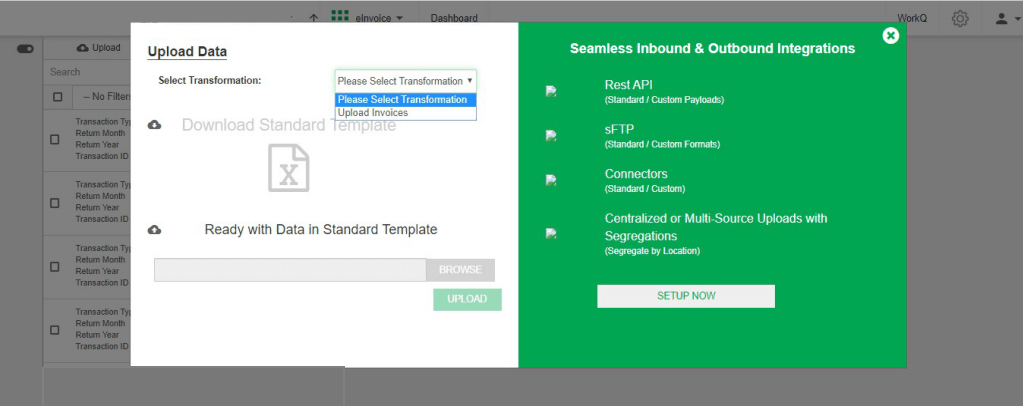

Features of Solution

- Modes for getting invoice registered: Multiple modes should be made available so that taxpayer can use one based on his/her

- API based,

- mobile app based,

- Offline tool based and

- GSP

All the modes mentioned above should be used under e-invoice system as well. QR Code: The Portal will generate a QR code containing the IRN (hash) along with some important parameters of invoice and digitally sign it so that it can be verified online or offline.

Signed QR Code

- The IRP will also generate a QR code containing the unique IRN (hash) along with some important parameters of invoice and digital signature so that it can be verified on the central portal as well as by an Offline

- This will be helpful for tax officers checking the invoice on the roadside where Internet may not be available all the time. The web user will get a printable form with all details including QR

- The QR code will consist of the following e-invoice parameters:

- GSTIN of supplier

- GSTIN of recipient

- Invoice number as given by supplier

- Date of generation of invoice

- Invoice value (taxable value and gross tax)

- Number of line

- HSN Code of main item (the line item having highest taxable value)

- Unique Invoice Reference Number(hash)

Mobile based App for e-invoice

- We would recommend software companies providing accounting and billing software to offer Mobile based app for creation of e-invoice.

- We have seen demo of four such products so they are quite good for micro and small companies.

Implications for the User (Taxpayer)

- No Change in the way user interfaces with ERP/Accounting Software

- No need to avail services of Consultants

- All changes are to be made by software provider in software to enable reporting at Invoice Reporting

e-Invoice as Business Efficiency Enabler

E-invoice Solution : IRN Generation process Option

Snapshots of a Invoicing Tool Prototype by a ASP GSP Partner

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement