Know CBIC Facts

Central Board of Indirect Taxes and Customs (formerly known as Central Board of Excise & Customs) is the national nodal agency responsible for administering Customs, GST, Central Excise, Service Tax laws & prevention of smuggling and Narcotics in India.

Did You Know?

The Customs & Central Excise department is one of the oldest government departments of India. In 1855, the British Governor-General of India established a council to administer customs laws in India and to facilitate collection of land revenue and import duties.

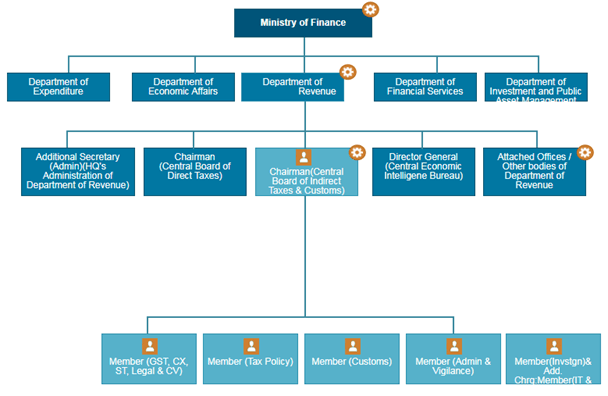

Organisational Chart of the Central Board of Indirect Taxes and Customs (CBIC)

Currently, the Central Board of Indirect Taxes and Customs (CBIC) is a part of the Department of Revenue that comes under the Ministry of Finance, Government of India.

Image source: https://www.cbic.gov.in/htdocs-cbec/whoweare/whoweare

Chairman & Members of the Central Board of Indirect Taxes and Customs (CBIC)

| Names | Designation |

| Mr M. Ajit Kumar | Chairman |

| Mr Sandeep Mohan Bhatnagar | Member (Customs) |

| Mr Ajay Jain | Member (Legal, CX & ST) |

| Mr Vivek Johiri | Member (GST, IT, Tax Policy) |

| Mrs Sungita Sharma | Member (Admin & Vigilance) |

Functions of CBIC

As mentioned above, CBIC administers all the Indirect Tax related matters in India. GST in totality comes under the purview of this board. Under customs, matters relating to the collection of customs duty at:

- International Airports

- Seaports

- Custom Houses

- International Air Cargo Stations

- International Inland Container Depots (ICD's)

- Land Customs Station

- Special Economic Zones (SEZ's)

- Container Freight Stations (CFS's) are administered by the CBIC.

Furthermore, matters relating to de-rail smuggling through International airports, seaports, land customs stations & border checkpoints are also under the ambit of CBIC.

Did You Know?

CBIC played a vital role in the implementation of GST as it was closely associated in the drafting of the model GST law, rules and procedures.

CBIC Campaigns and Projects

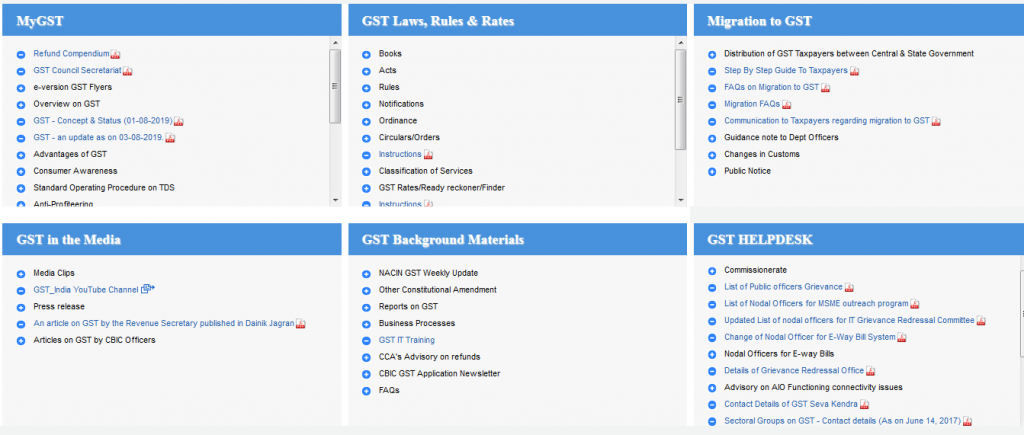

1. GST GST being the front-runner in the indirect tax regime has its own set of governing acts and laws. The CBIC website provides a platform for accumulation of all GST related laws, rules and regulations. Thus, this becomes the one-stop solution for all GST related material as well.

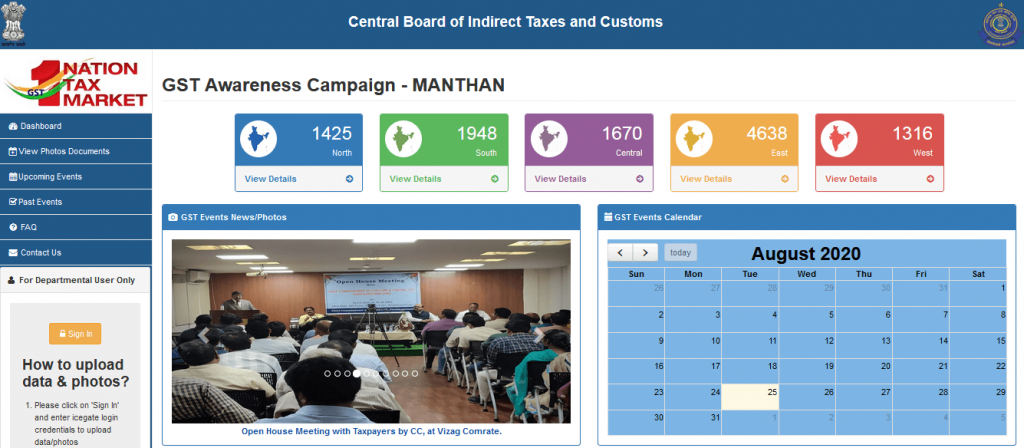

2. Manthan Manthan was the GST awareness campaign introduced to reach out to all business stakeholders regardless of whether they are from the smallest of towns or cities. The main objective of this program was to ensure complete preparedness for GST implementation. Up-to-date details regarding the GST outreach programmes (past or proposed) of CBIC in various parts of the nation are visible on this page.

3. SVLDRS Sabka Vishwas - (Legacy Dispute Resolution) Scheme, 2019 (SVLDRS) is a bold attempt to solve the baggage of past disputes relating to Central Excise and Service Tax (now subsumed under GST). Dispute resolution and voluntary disclosure by non-compliant taxpayers are the two main pillars of this scheme.

4. Customs Customs Authority is responsible for collecting tariffs and controlling the movement of goods, including animals and transportation of personal, and hazardous items, into and out of India. Customs related acts, rules, regulations, tariffs, manuals, forms, notifications, case laws, circulars/ instructions, duty drawback schedules, FAQs etc. can be all found on the CBIC website.

5. Central Excise Central excise duty was levied by the Central Government for the manufacturing of goods. However, GST has now subsumed many indirect taxes, including excise duty.

6. Service Tax The Government levied service tax on services rendered or agreed to be provided. However, after the implementation of the GST service tax is no longer applicable.

7. Tenders and Auctions The CBIC evaluates the need for amendments and modifications from time to time. When need be, they also invite applications from the public to help them manage and fulfil their responsibilities. The latest tenders/auctions issued by CBIC are visible on the website.

What’s New on CBIC?

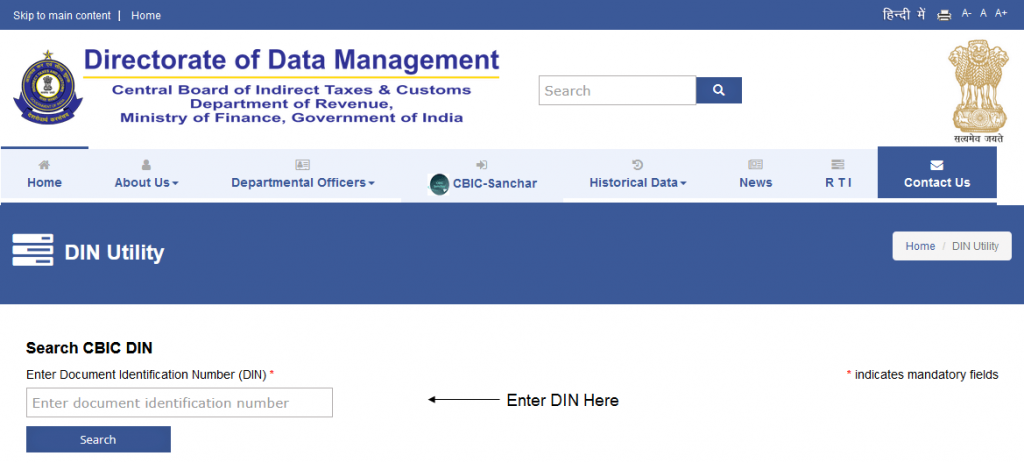

1. Verify CBIC- DIN This utility tool on CBIC allows you to verify the Document Identification Number (DIN). For this, you need to enter the DIN and click on the search button. Here is how the DIN Utility looks like:

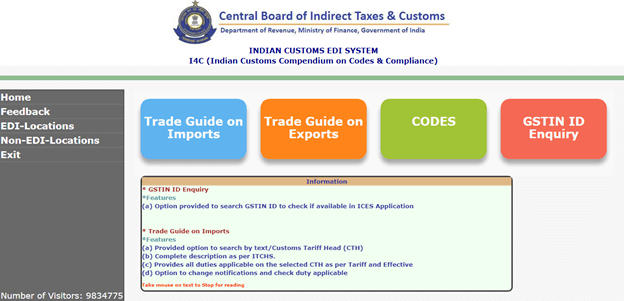

2. Custom Duty Calculator This utility on CBIC is developed by the NIC under the strict supervision of Directorate General of Systems and Data Management (CBIC), New Delhi. On this portal, you will find:

- Trade Guide on Imports and Exports

- Customs Online Directory Enquiry System (CODES)

- GSTIN ID enquiry - Here, you can search the GSTIN ID to check if it is available in the ICES Application.

3. Compliance Information Portal (CIP) This utility on CBIC provides Customs related information - The laws, step by step procedures and details regarding all Partner Government Agencies (PGAs) regulating Import and export of commodities.

Need of GST Notes | GST Invoice Number Length | Power of Officer Under GST | GST On Dry Fruits | GST On Society Maintenance

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement