As a sector that holds together a countless number of manufacturing and trading activities in the country on a daily basis, and is forever attempting to bridge the shaky gap between increasing consumption and timely supply, it would hardly be an understatement to consider logistics as the backbone of the rapidly shape-shifting Indian economy. The congruence of infrastructure, technology and multiple service providers is what makes up the playing field of the logistics industry, which effectively helps facilitate timely, safe and proper delivery of goods and services to the end consumer via a robust supply chain. Therefore, it is important to understand the Impact of GST on Logistics.

Admittedly, the sudden explosion of the e-commerce boom in an erstwhile sluggish economy meant that the stakeholders in this space have had to deal with far more complicated processes and multi-layered factors involved in figuring out the logistics of bulky items, something that has drastically changed the rules of the game in this industry and begs for fast adaptability. Making hundreds of decisions based on size, weight, capacity parameters to ensuring proper storage of goods and even navigating unpredictable climate conditions, in addition to keeping the costs down, are daily challenges players in this field grapple with, making the logistics sector a domain where the stakes are high for everybody – both the traders/suppliers and the consumer.

It comes as no surprise then that the Indian logistics industry is expected to surpass $200 billion by 2020, as per a JLL study.

And augmenting this projected growth is the much-debated Goods and Services (GST) tax which finally rolled out this 1st of July 2017 – underlined by the “One Nation – One Tax” philosophy and promising a streamlined tax and credit system. Wide-ranging provisions such as State Goods and Service Tax (SGST), Central Goods and Service Tax (CGST) and Integrated Goods and Service Tax (IGST) are the centre of the GST structure, doing away with a chaotic tax structure that till some time ago routinely imposed miscellaneous taxes such as value-added tax (VAT), OCTROI, Excise tax and others. In short, GST seeks to simplify the tax regime of the country, via imposition of one indirect tax in India, thereby reducing a sizeable portion of the burdens borne by commercial participants in the field.

However, before we delve into the possible impact of GST on the logistics industry, it would be prudent to first take a brief look at the current scenario shaping the present-day context of this sector.

Existing challenges in Present-day Logistics Industry in India

The Indian logistics sector is neatly divided into two key segments: freight and passenger transportation, and warehousing and cold-storage. A blend of the inbound and outbound services sourced by manufacturing and supply chains, it is a vast playing field that has to date, mostly failed to deliver as per its potential, primarily due to infrastructural mismanagement.

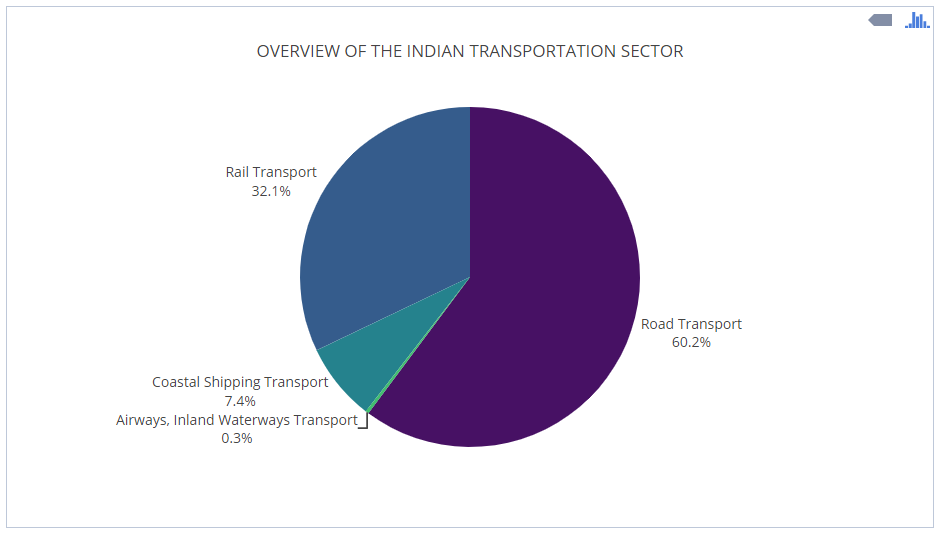

Unevenly distributed infrastructure leads to under-utilization of key resources while unnecessarily burdening the other components. The graph below, based on statistics reported by the India Brand Equity Foundation (IBEF), is indicative of the road and rail transport bearing the weight of the industry’s burden, while air and waterways remain grossly underutilized.

A glaring disconnect between transport networks, software and equipment and warehouse facilities further fuels more disorganization in this industry, leading to volumes of largely preventable waste.

However, these are not the only challenges that plague the Indian logistics industry. Some of the other obstacles in this respect are:

- Vague and unregulated pricing policies and unrestrained costs (over twice or thrice as high as the global standards)

- Differential regulations brought about by multifarious local, regional and national authorities leading to a state of no consensus, which ultimately weakens the spine of the logistics network running through the nation as a whole

- Lack of trained personnel and adequate software/tools at various levels that ultimately results in poor management and decision-making

- Flaky assessment of transportation costs that lead to corruption on the part of the agents in control, and a total lack of awareness on the part of the recipients involved

- Stock damage and bad debts ensuing from delayed/improper delivery of goods

- Lack of research and development conducted in this space that renders most information out of the reach of a large number of players, thereby, making the market very uncertain and indeterminable.

How and where is GST expected to fill the gaps?

While it is too early to consider GST as an absolute saviour in the face of the numerous challenges cited above, this radical shift in the country’s taxation policy admittedly has some indisputable benefits to offer. Some of these have been described below:

-

- Increased efficiency in inter-state transportation of good at reduced costs – Impact of GST on logistics sector in India is most likely to be felt in this area, by reducing lengthy clearance processes and complex paperwork at numerous inter-state points to a thing of the past. This automatically means a drastic cut in travel time as well as sizeable cost-cutting in logistics by almost 30-40%, as estimated by a World Bank report. Amping up on the speed and reduction of expenses of goods’ movement, in turn, means a great boost to the GDP by approximately 100-200 bps and opening up of numerous commercial opportunities, as per industry experts. On this front, expansion and improvement of road connectivity seem paramount, and so does the timely and hassle-free movement of trucks. Fortunately, the government has already taken assertive measures in furtherance of the same. The changes have come about in the way of an increase in budget allocation by almost 6924 crores in FY2017-18 and promise of the seamless connectivity with ports and railways, thus, making even the interiors of the country accessible. Post GST, numerous check posts at more than 20 state borders have already been dismantled, thus enabling trucks to cover more ground. Additionally, the E-way bill (backed by the National Informatics Centre and to be generated from GST-Network portal) mandating online registration of goods exceeding Rs. 50,000/- prior to their movement across borders, was due to be incorporated in October 2017.

Even without all of these changes having been implemented, the shift in taxation policy seems to have already borne fruits in a time shorter than the same was anticipated in – that is, in July, a document prepared by the road transport ministry cited an increase in distance covered by trucks by almost 30% post-GST. And though it might be too soon to assess GST’s efficacy in its entirety, it cannot be denied that it has done wonders by removing compliance, infrastructure and time laches from the way.

- Increased efficiency in inter-state transportation of good at reduced costs – Impact of GST on logistics sector in India is most likely to be felt in this area, by reducing lengthy clearance processes and complex paperwork at numerous inter-state points to a thing of the past. This automatically means a drastic cut in travel time as well as sizeable cost-cutting in logistics by almost 30-40%, as estimated by a World Bank report. Amping up on the speed and reduction of expenses of goods’ movement, in turn, means a great boost to the GDP by approximately 100-200 bps and opening up of numerous commercial opportunities, as per industry experts. On this front, expansion and improvement of road connectivity seem paramount, and so does the timely and hassle-free movement of trucks. Fortunately, the government has already taken assertive measures in furtherance of the same. The changes have come about in the way of an increase in budget allocation by almost 6924 crores in FY2017-18 and promise of the seamless connectivity with ports and railways, thus, making even the interiors of the country accessible. Post GST, numerous check posts at more than 20 state borders have already been dismantled, thus enabling trucks to cover more ground. Additionally, the E-way bill (backed by the National Informatics Centre and to be generated from GST-Network portal) mandating online registration of goods exceeding Rs. 50,000/- prior to their movement across borders, was due to be incorporated in October 2017.

-

-

Overhaul of the Supply Chain Management via consolidation of warehouses – A lesser-discussed effect of the GST in logistics, and yet, the logistics industry would stand nowhere without organized, robust warehouses. With the implementation of the reformed tax structure, sweeping changes are expected to seep through this segment, with companies vying for overall operational efficiency than mere tax efficiency. With GST for logistics having rolled out, companies will now find the global hub-and-spoke model for freight movement much more feasible. This means fewer warehouse centres in strategic locations instead of smaller ones scattered in each and every state; in turn, leading to less time wasted at multiple points, less paperwork and faster movement of goods, not to mention, a central regulation percolating down to the many distributors via the secondary despatch model.

With freight times coming down by 30-40%, a leaner supply chain management with proper utilisation of vehicles and overall efficiency is promised. And with tax considerations out of the way, what remains is a lot of decision-making to be handled, albeit, only on the operational level of logistics management. This ultimately translates to better services for the end consumer. Encouraged by the many possibilities and relaxations offered by GST, some warehouse operators and e-commerce players have already begun considering Nagpur as a warehousing hub (owing to its status as the zero mile city in India), in a bid to ramp up their logistics efficiency. The collective reaction at the implementation of GST has not remained confined to companies overhauling their warehouse management alone; it has gone on to rightly getting identified as a lucrative business prospect by players in this niche – who do not just see warehouses as storage counters anymore, but as centres that can be milked for a bunch of other services (packaging, barcoding, etc.) in a bid to provide more sophisticated services to the consumers. If Canada Pension Plan Investment Board’s recent $500 million joint venture with India’s Indo Space or Singapore’s Ascendas-Singbridge’s $600 million deal with Bengaluru’s Firstspace Realty is anything to go by, then we ought to acknowledge the potential of this segment booming into a veritable business model on its own, as domestic and foreign investments flow in.

-

-

- The entry of new stakeholders while boosting the presence of existing participants in the logistics market – Who would have thought online truck booking would ever be a thing? This interestingly has shaped up as a shining reality though, given the country’s massive daily domestic consumption and its formidably huge road network (approximately 4.7 million km) pitted against the countless transportation challenges faced by logistics firms and their carrying agents (such as truckers, shippers) alike. However, with the internet and modern technology making inroads into this sector as well, online truck booking has developed into enviable convenience businesses truly cannot afford to overlook. The likes of Bengaluru-based Lobb and Telangana-based Freight Bazaar have already made a mark on this front. Chunky perks on offer such as – timely delivery of goods marked by live tracking of goods based on the real-time GPS tracking system, easy access to transportation records, competitive freight pricing, truck pooling, etc. are what make the booking experience user-friendly and speedy, lending these services a coveted position in the larger picture of the logistics industry. As such, the contribution of the road infrastructure cannot be overlooked, with this segment reportedly contributing about 5% to the country’s GDP. And with GST positively impacting other commercial industries and businesses in the country, the resulting changes are expected to benefit the road transport industry significantly, typically owing to a rise in demand. With the growth in this sector projected at 6.1% in real terms in 2017 and a Compounded Annual Growth Rate (CAGR) of 5.9% through 2021, it would be fair to assume that the online trucking industry would stand to gain immensely from this trickle-down effect. While on a discussion on the impact of GST in this regard, it would be unwise to miss out on the edgy benefits the Third-Party Logistics Providers (3PLs) stand to gain from the reformed tax-rollout. As a viable alternative to handling complex logistics by companies in a standalone manner, 3PLs spell massive potential in that they can provide streamlined warehousing services to slotted clients from key distribution points; the only criteria they need to step up on to fully take advantage of this lush commercial space are the integration of logistics-friendly warehouse points and reshuffling of assets.

- Bringing in transparency in logistics activities, thereby reducing overall corruption – By eliminating the roots of the parallel economy (and resultantly, black money), the GST move is expected to act as a formidable deterrent to across-the-border corruption and monopoly of local booking agents, by allowing broader scope for fair play which benefits all parties involved – businesses, consumers, states and the Centre.

A Summary of the advantages accrued from the enactment of GST by and large points to three key expected results – optimal utilization of all equipment and components involved in running the logistics industry, a seamless tax-credit system that does away with the duality and cascading effect of multiple taxes and significant cost reduction in logistics by almost 20%.

Negatives of the policy cannot be discounted as such – for example, fuel, which is a prime element factoring into present-day inflated costs of transportation, still lies outside the ambit of GST, and it may continue to be so for some time before the egregious taxes on the same are lifted off. Similarly, the concept of E-way bill, while promising better regulation and monitoring of the logistics sector, may still come under the scanner for inviting needless bureaucratic intervention, the very thing plaguing the segment at this point in time.

However, if one were to weigh the pros and cons of the reformed tax policy, it would come to light that the benefits far outweigh the negatives. In any event, the impact of GST cannot really be pigeonholed as it will most likely have far-reaching effects on business and consumerism as a whole – from pushing commercial players to adopt technology and advanced tools (such as automation) bringing in more precision in the logistics chain, to neatly organizing warehousing and freight machinery and optimizing their geographic strengths, from providing the much-needed thrust to existing participants looking to scale up, to making the industry accessible to new entrants; mergers, acquisitions, domestic and foreign investments galore; GST is a disruptive force on the surface of the current ecosystem that spells much hope, efficiency and prosperity for the entire logistics sector in general.

Know Your GST, GST Verification, GST Calculator, HSN Code Search, GST Return Status

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement