Know All About GSTR 2A

GSTR 2A is an auto-populated GST return that is generated for a taxpayer from GSTR 1 of his sellers. In this article, we are going to discuss topics like GSTR 2A, 2A in GST, GST 2A, what is 2A in GST, what is 2a GSTR2A, GSTR 2A return, when GSTR 2A generated in depth.

Table Content

What is GSTR 2A?

GSTR 2A is an auto-populated GST Return that takes the information from the filed GSTR 1 of the seller.

GSTR 2A shows the information regarding the purchased good and/or services from the supplier.

Moreover, the data in GSTR 2A will be available on the GST Portal as soon as your supplier files his GSTR 1. In addition to this, you are required to verify it before filing your GSTR 3B.

GSTR 2A will be auto-generated from the following Returns:

| GST Returns | Furnished by |

|---|---|

| GSTR 1 | Normal Registered Vendor/Seller |

| GSTR 5 | Non-Residents |

| GSTR 6 | ISD |

| GSTR 7 | TDS Deductors |

| GSTR 8 | E-commerce Operators |

GSTR 2A and GSTR 3B Comparison

Form GSTR 3B is a summary return that is filed by the taxpayer every month. Moreover, GSTR3B shall be filled by 20th of the next month.

On the contrary, GSTR 2A is an auto-filled GST Return that is for informational purpose and is not editable.

GSTR 3B and GSTR 2A Reconciling:

GSTR 3B is a GST Return that contains the whole summary of a month. Hence, Input Tax Credit amount available in Table 4(a) must reconcile with that of GSTR 2A Form.

GSTR 2A and GSTR 3B Discrepancies:

If any discrepancies between GSTR 2A and GSTR 3B leads to the any excess ITC availed then the same shall be paid by such taxpayer together with interest.

To know more about GSTR 2A and GSTR 3B you can read our article on it.

GSTR 2A Details

In GSTR 2A, there are seven different heads as per the government prescribed format.

Now let us discuss these different heads

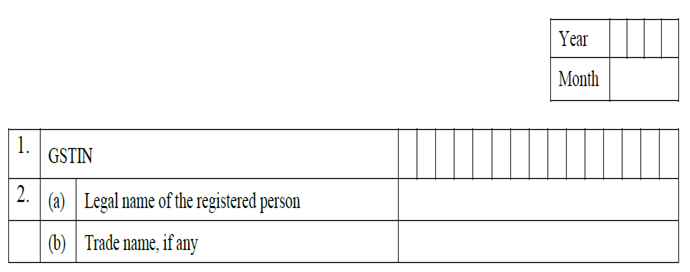

1. GSTIN

In this column, you will get GST Number of the taxpayer.

2. Taxpayer’s Name

- Legal Name of the taxpayer

- Trade name

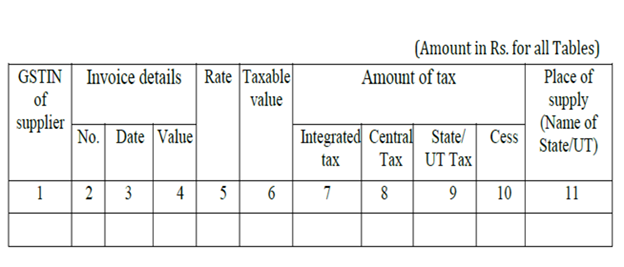

3. Inward supplies received from a registered person other than the supplies attracting the reverse charge

In this head, the details will get auto-populate when the taxpayer files his GSTR 1.

The details under this column include:

- GSTIN of supplier

- Invoice Details

- Rate

- Taxable Value

- Amount of Tax

- Place of supply

However, this head will not contain any supplies on which reverse charge is applicable.

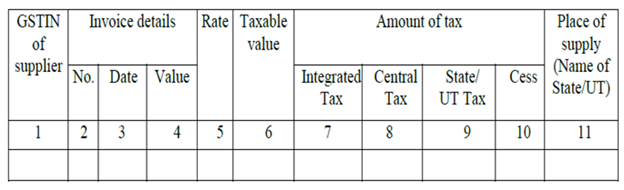

4. Inward supplies received from a registered person on which tax is to be paid on reverse charge

This will contain all the details regarding the inward supplies on which reverse charge is applicable.

Reverse Charge is a situation where the recipient of such supply is liable to pay the tax instead of the supplier.

This head will contain the following details:

- GSTIN of supplier

- Invoice Details

- Rate

- Taxable Value

- Amount of Tax

- Place of supply

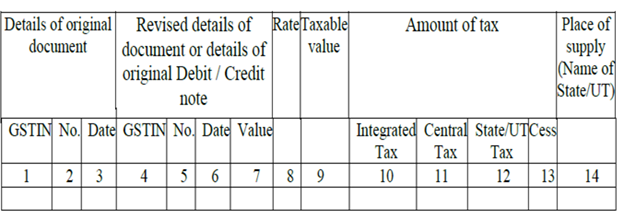

5. Debit / Credit notes (including amendments thereof) received during the current tax period

This head will contain all the Debit and Credit notes details that are issued by or to a taxpayer during a tax period.

In addition to this, it will also contain all the amended details of original debit and credit note.

It contains the following Details:

- Details of the original document

- Revised details of original debit and credit note

- Rate

- Taxable value

- Amount of Tax

- Place of supply

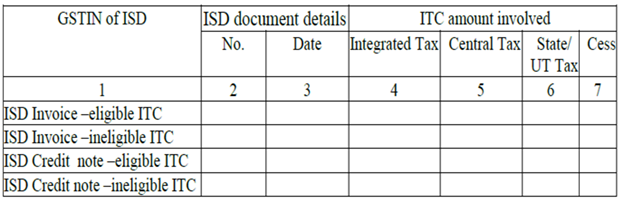

6. ISD credit (including amendments thereof) received

Once the Input Service Distributor files his GSTR 6 for a month all the branches will receive the data in their GSTR 2A.

This head includes the below-mentioned details

- GSTIN

- ISD document details

- ITC amount involved

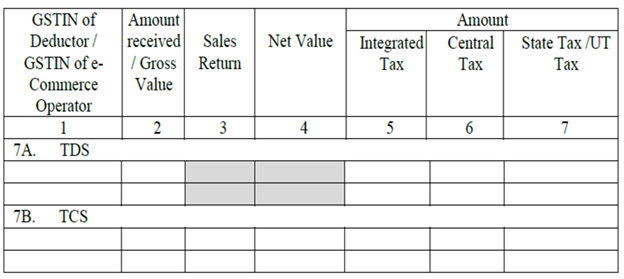

7. TDS and TCS Credit (including amendments thereof) received

a. TDS Credit Received

This section of the head shows the cred received for the tax deducted at source.

Generally, the government deducts the tax at source.

Moreover, it will get auto-populate once the taxpayer files his GSTR 7

b. TCS Credit Received

This section of the head represents the credit received for tax collection at source.

Normally, the e-com operator collects the tax at source.

Furthermore, it will get auto-populate when the e-com operator files his GSTR 8

In addition to this, the taxpayer shall keep this in mind that there is no declaration at the end of GSTR 2A. As GSTR 2A is an auto-populated GST Return which is used to cross-verify the details.

The Conclusion

GSTR 2A is nothing but an auto-filled GST Return that helps in claiming accurate Input Tax Credit (ITC). A taxpayer can claim ITC once he reconciles his purchase register with his GSTR 2A.

In order to reconcile, he can either do manually by downloading GSTR 2A or else can use specialized GST software.

Considering such requirement Masters India established autoTax GST Software that ensures you avail correct ITC within a few clicks.

FAQs

1. How and when to file GSTR 2A?

A taxpayer needs not to file GSTR 2A as it is an auto-generated GST Return.

2. How to amend or rectify seller’s mistakes in GSTR 2A?

GSTR 2A cannot be edited as it is for cross verification and is for a ready only purpose. You can rectify all the mismatches in GSTR 2A by communicating it with your supplier.

3. Is it possible to download GSTR 2A for future reference?

Any taxpayer can view and download GSTR 2A for a given period to refer it in future. He can either visit GST Portal to view or download GSTR 2A or by using Masters India autoTax GST Software.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement