How to File GSTR 1 in GST Portal

GSTR 1 is a monthly GST return, which captures all the outward supplies, i.e. sales of the reporting month. The return cycle of a GST payer starts with GSTR 1 and is to be filed by 10th of the following month to ensure a smooth input tax credit availability. Though, the due date of filing of GSTR-1 is 10th of every month, however, since, these are the initial months of GST, the due date for filing the GSTR-1 for July’17 was 5th September’2017, which has been now revised to 10th Sep’17. The due date for filing the GSTR-1 for August’17 is 5th October ’17.

In this article, we will discuss the process to file GSTR 1 in GST portal and relevant details.

Who needs to File GSTR 1?

All taxable GST registered persons are required to file GSTR-1, barring a few, who are required to file other GST returns but GSTR-1. E-commerce operators, composite dealers, input service distributors, non- resident dealers and tax payers liable to deduct TCS are not supposed to file GSTR-1 but other specific returns, as the case may be. Even if, there is no business in any month, then too the GSTR-1 is to be filed.

Importance of GSTR-1

GSTR-1 is the first step in the ladder and helps to auto-populate GSTR-3 and GSTR-2A for the dealer itself and for the dealer to whom the supply have been made respectively.

Checklist before Filing of GSTR 1

- User ID and password

- A valid GSTIN

- A valid digital signature certificate [DSC]. DSC is obligatory for companies, limited liability partnerships and foreign limited liability partnerships. It is optional for proprietors, partnership concerns, HUF etc. who have an option to e-sign the form (Mandatory require Mobile No and linked Aadhaar Card for e-sign).

The above points help taxpayers, when they wanted to know how to fill GSTR 1.

GSTR 1 Filing Process

Once the checklist is handy, the taxpayer needs to start GSTR1 filing process, log in to the GSTN portal with the user ID and the password. After logging in the following steps to file GSTR 1 need to be performed:

- Look for services ----> Click on Returns ----> Click on Returns Dashboard

- Fill in the financial year and the month in the dashboard, for which return has to be filed Click Search.

- All the applicable returns for the subsequent period will be displayed on the screen in a tiled fashion.

- Click on GSTR-1

- Select an option to prepare the return online or simply upload it.

- Either the invoices are to be added or uploaded directly now.

- After filling the GSTR 1 form, click on Submit and validate the filled data.

- Post validation, click on File GSTR-1 and proceed to e-sign or digitally sign the form.

- A final confirmation message pops up asking you to confirm the submission with a Yes / No.

- Click on Yes and an Acknowledgement Reference Number [ARN] is generated.

- GSTR-1 is now filed.

From the above GSTR 1 filing steps, you understand that how to file GSTR1 in GST portal.

What Details are Required to Fill GSTR 1?

The GSTR-1 form has 13 different sections, however, some of the sections will be auto-filled and does not require manual filling:

Part 1 to part 3 – Outward supplies table details:

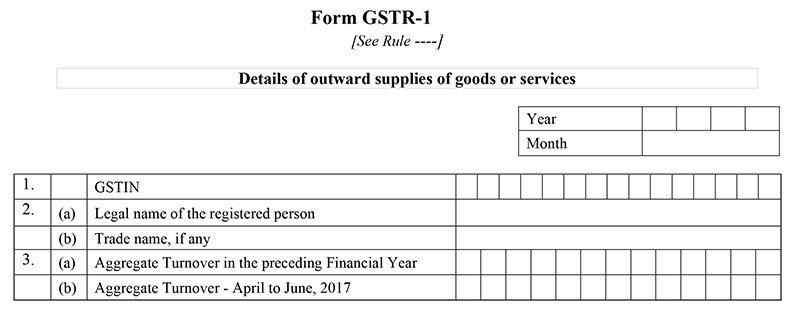

GSTIN is the first field of GSTR-1, which auto-populates. The legal name of the taxpayer: It is an auto populating field Aggregate turnover in the last financial year [1st April’16 to 31 March 17] : Aggregate Turnover is the total value of all taxable supplies made (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both.

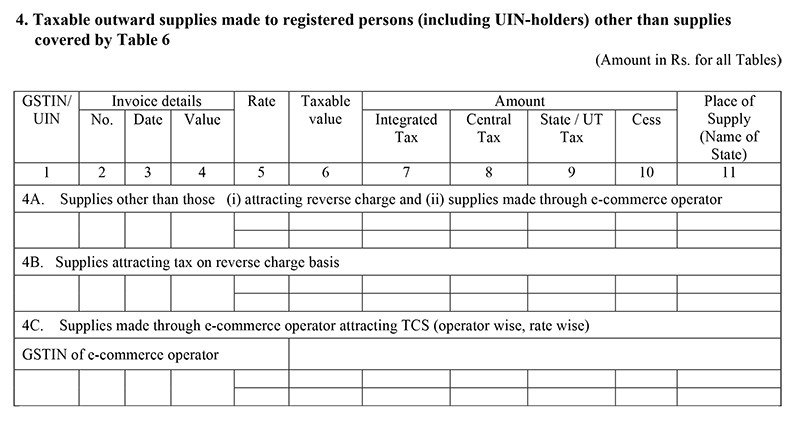

Part 4 - Taxable outward supplies made to registered persons [including UIN holders] other than supplies

It covers all the taxable supplies made to the registered taxable person including normal taxable supplies, all supplies made under reverse charge and supplies done by e-commerce operators. Taxable outward supplies made to registered persons [including UIN holders] other than supplies mentioned in Table 6.

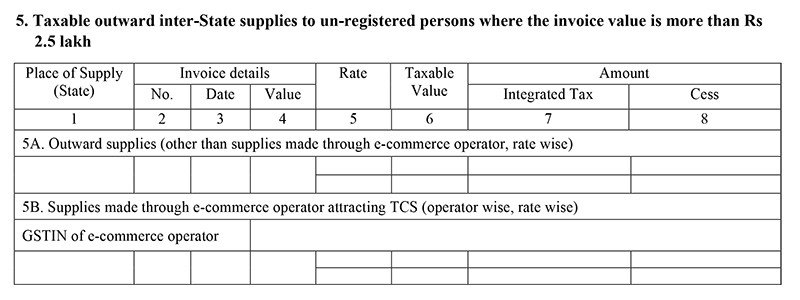

Part 5 - Taxable outward inter-state supplies, where the invoice value is more than Rs. 2.5 lakhs made to unregistered persons

5A – Details of B2B invoices - sale made to unregistered dealer 5B – Details of B2C supplies though an electronic commerce operator

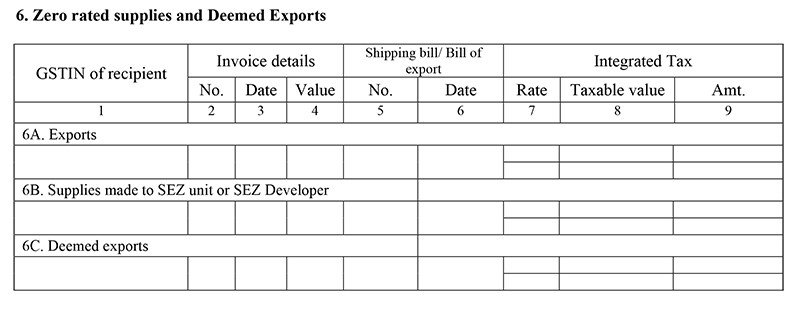

Part 6 –All the zero rated supplies and all deemed exports

All zero-rated supplies, exports, deemed exports (supply to SEZ, EOUs) will come in this head. A registered dealer has to give details of invoice, bill of export or shipping bill.

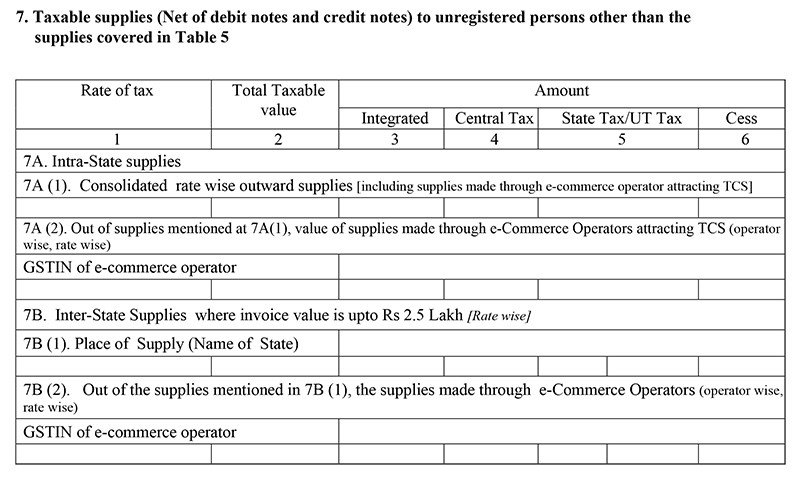

Part 7 –All taxable supplies made to unregistered persons [Sum of all Debit and Credit Notes]

7A: All sales including the sales through e-commerce operators will come here. Additionally, the supplies through e-commerce operators has to be separately mentioned here. 7B: All B2C inter-state supplies, where the invoice value is more than Rs. 2.5 lakhs should come here with the state of supply also to be mentioned.

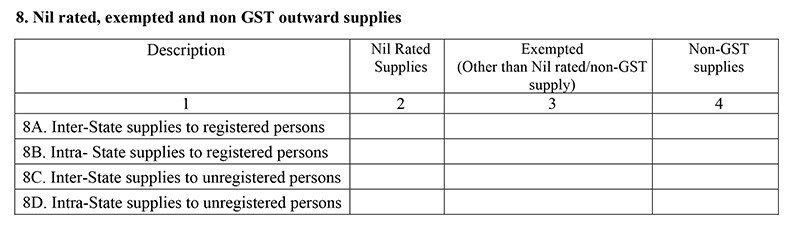

Part 8 –It covers all the NIL rated, exempted and non GST outward supplies

All the nil rated, exempted and non GST outward supplies, which are not covered above, will get captured here.

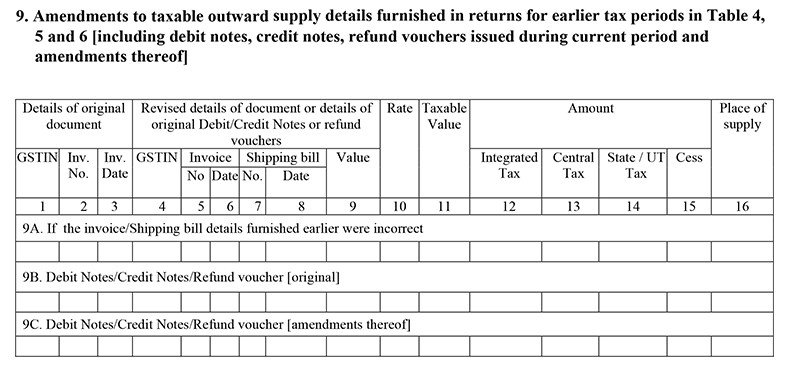

Part 9 –All amendments to the taxable outward supplies to an unregistered individual

It captures all the amendments to outward tax supplies details and the returns made for the Previous tax intervals. The section covers details of every other amendment in outward supply from earlier tax period. The section also captures any amendment in debit or credit note.

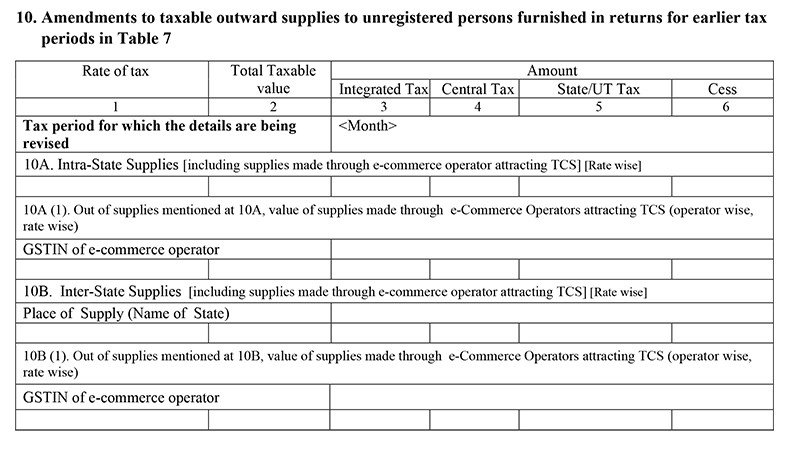

Part 10 – Amendments to the taxable outward supplies made to an unregistered person for which return has filed for earlier tax periods:

The details of amendment of any taxable outward supplies done to an unregistered individual from earlier tax period need to be included in this section.

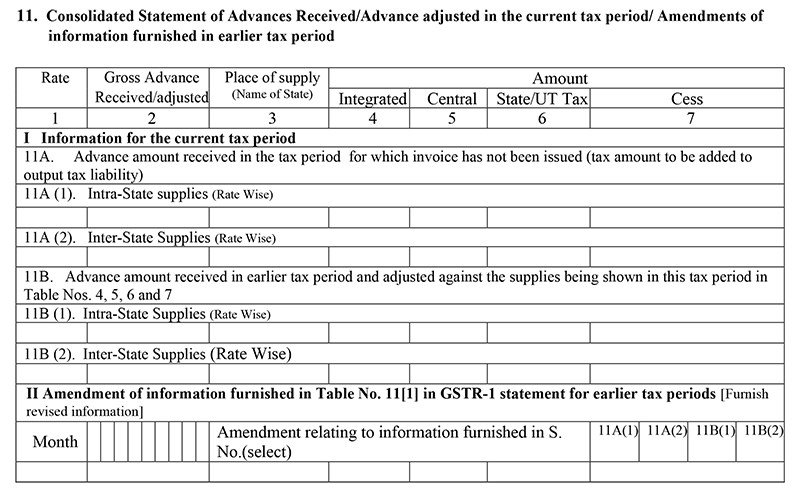

Part 11 – Combined statement of advances received / adjusted [current tax period] + any changes from previous tax periods

This section covers all the details of the advances received and adjusted in the current time period. It will lead to a fluctuation [+ / - ] in the GST liability and any sort of amendment in the advance payments from the earlier tax periods is recorded here.

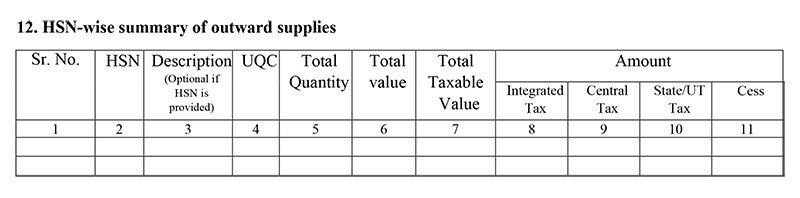

Part 12 –HSN-wise summary of outward supplies

All the taxable supplies have to be consolidated through HSN codes by the tax payer. This section captures quite a significant amount of information about the supplies of IGST, SGST and CGST.

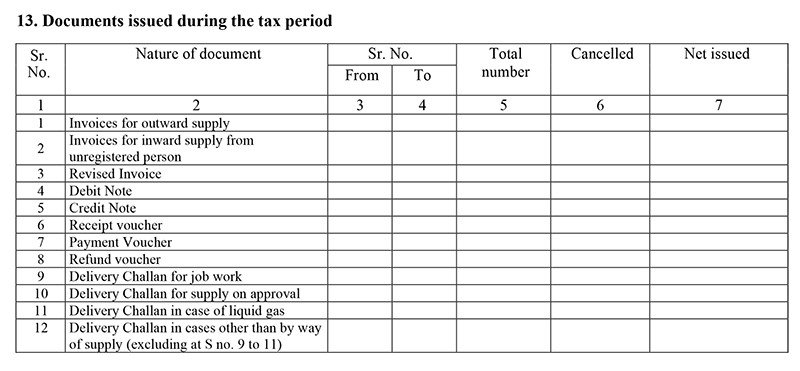

Part 13 –Documents issued during the tax period

The section captures all the details of the invoice and its relevant issues in the tax period, revised invoices, credit notes and debit notes.

General Slip-ups While Filing GSTR 1

The mistakes can vary from mentioning an incorrect HSN code / service accounting codes to citing the incorrect GSTIN, picking up of an incorrect rate of tax, treating an intra-state sale as an inter-state or vice-versa. Please be cautious about not mentioning a tax invoice twice. Should there be any change in the ship to address of the customer, it can be witnessed while filing the GSTR-1. Should you still be confused about filing GSTR-1 and want to consult an expert, the proficient team at Masters India, a GST Suvidha Provider, authorized by the GSTN, is here to help. autoTax from Masters India, is a fully automated GST Software, which along with other functionalities also ensures that you always remain in the good books of the government by maintaining a high GST compliance rating. To know more about, on how can you put your taxation life cycle on an auto-pilot, please connect with Masters India Team at info@mastersindia.co | 9773706840.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement