Amendment and Cancellation of E-Invoice - Procedure and Implications

Introduction

There is a 24-hour window for e-invoice amendment and cancellation. The E-invoice cancellation process is quite simple and proves convenient in case of cancellation of order by the buyer, or incorrect or double entry of the e-invoice. This blog helps you to understand how to amend e invoice after 24 hours.

Points to remember (E Invoice Amendment Update)

E invoice amendment time limit, or e invoice modification time limit, or e invoice cancellation time needs to be reported to the IRN within 24 hours only, as after 24 hours the IRN portal will not be able to cancel invoice or amend the same as it is e invoice cancellation time limit. However, after this 24 hour window, one can manually do the cancellation on the GST portal before filing the returns. Next we’ll also come to know about how to cancel e invoice after 24 hours or can we cancel e invoice or can be amended in GST portal.

E-Invoicing in GST was introduced to simplify the communication between businesses. It is a process where the taxpayer uploads the invoice details on the Invoice Registration Portal (IRP) and obtains the Invoice Reference Number (IRN) from the IRP. To know more about how to cancel e invoice, read here.

In this article, you will find we’ll discuss the procedure for cancellation of invoice under GST.

Amendment And Cancellation Of E Invoice

Can e Invoice be cancelled on the IRP within 24 hours of generation of the IRN. This is mainly because the IRP servers do not store e-Invoices for more than 24 hours. However, if an e-Way Bill is already generated for the IRN, it cannot be cancelled. But do you know about how to cancel e invoice in tally prime or how to cancel e invoice in GST portal?

Partial cancellation of e-Invoice is not possible; hence, the whole of the invoice would have to be cancelled. Moreover, any amendments of any sort cannot be done on the IRP as there is einvoice cancellation time limit. In case any changes are necessary for the invoice details reported on the IRP, then, it can be through the GST portal while filing GSTR-1. However, these changes will be flagged to the concerned officer, who may request further information from the taxpayer. Now lets know how to cancel e way bill in e invoice portal and about GST invoice cancellation rules.

Procedure To Cancel An E-Invoice On IRP

An e-Invoice may be cancelled for reasons like:

- Order cancellation by a buyer

- Incorrect entry

- Duplicate entry, etc.

To cancel an e-Invoice on the IRP, a taxpayer has to follow these steps:

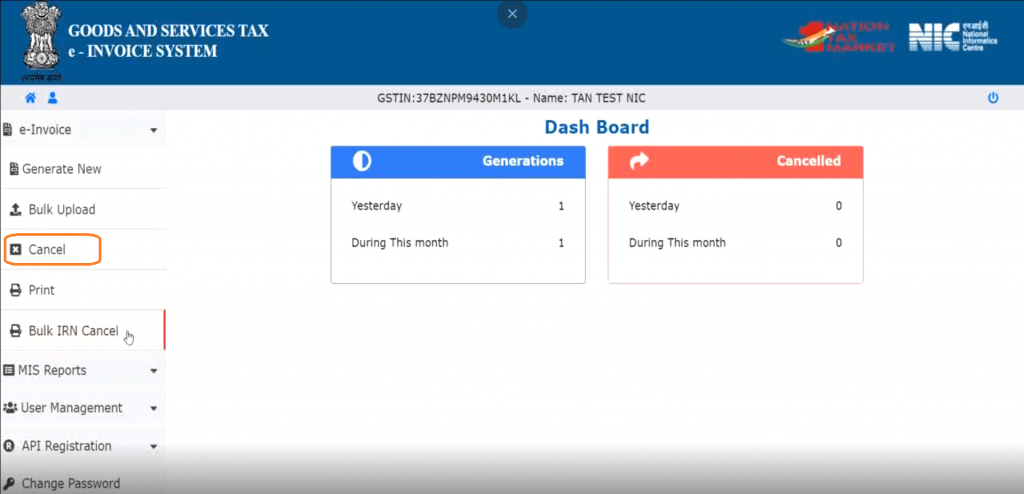

- Step 1: Log in to the e-Invoice portal and select ‘e-Invoice’ ‘Cancel’.

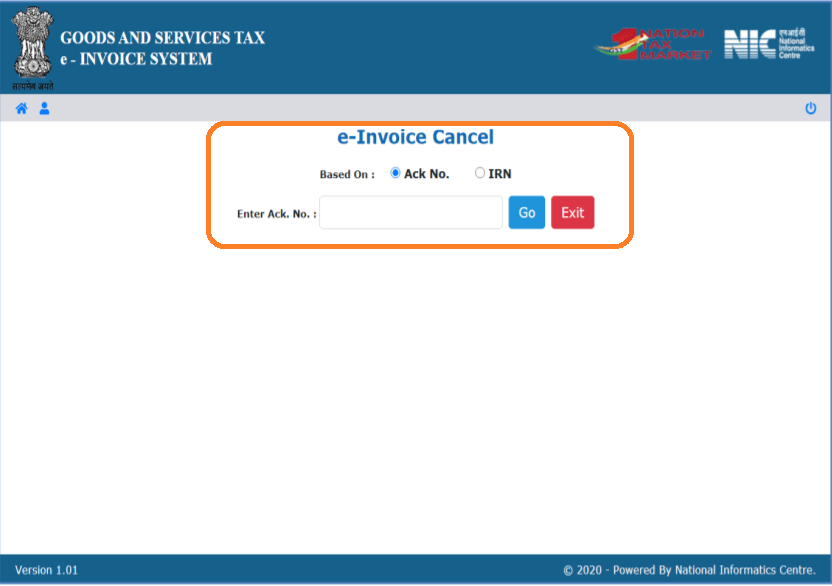

- Step 2: The below screen will be displayed. Select ‘Ack No.’ or ‘IRN’ as applicable and enter the number. Click ‘Go’ to proceed.

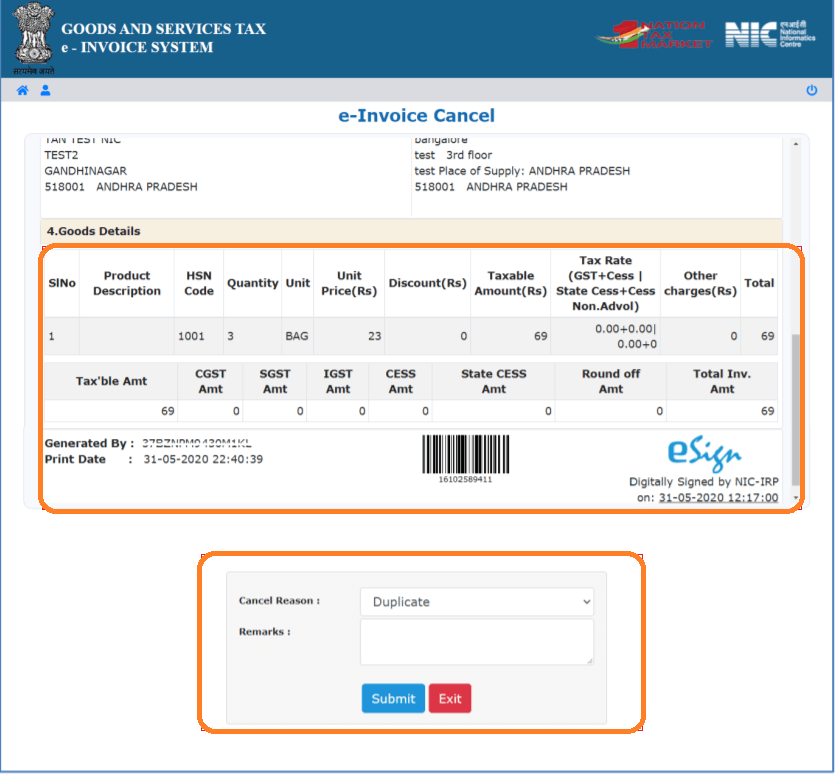

- Step 3: The system will display the e-Invoice and ask the user to select the reason for cancellation. To cancel the e-Invoice click ‘Submit’.

The portal will display that the invoice has been successfully cancelled. The cancelled e-Invoice will be displayed with a ‘Cancelled’ watermark.

Points To Remember

- If an IRN is cancelled, then, the same invoice number cannot be used again to generate another IRN. If it is used again, the invoice will be rejected by the IRP, when reported. This is because, IRN is a unique reference number for individual invoices generated based on the supplier’s GSTIN, document/invoice number, type of document & financial year it is issued in.

- If an e-way bill for an IRN is active, cancellation of IRN will not be permitted by the IRP.

- In case an IRN is cancelled, then GSTR-1 will also be automatically updated with such ‘cancelled’ status.

- If an invoice has to be cancelled after 24 hours, the taxpayers can manually cancel the same on the GST portal before filing the GST returns.

- If you are thinking can we amend e invoice, so amendments to an e-Invoice are allowed only through the GST portal as per the provisions of GST law.

Need for GST In India | GST Invoice Serial Number Rules | Powers of GST Officers | Dry Fruits GST Rate | Maintenance Charges GST

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement