GST ITC 04 Form is used by GST registered taxpayers to file quarterly ITC04 return to claim Input Tax Credit (ITC). With the help of this form, the details of the inputs or the goods sent to the job worker and received from the job worker are recorded. Here, the quantity and description of goods which are sent by one job worker to another or are returned to the Principal (manufacturer) are also shown.

GST ITC 04 Form has to be filed every quarter by the manufacturer (Principal). If we talk about the penalty for late filing of ITC 4 in GST, there is no late filing penalty on the filing of ITC 04 form under GST after the due date. A job worker is a person who executes an assigned job on the goods that are manufactured by someone else.

The ownership of the goods remains with the Principal manufacturer, and hence he/she is called the Principal. E.g., A belt manufacturer may send the goods to another worker to do the job of pinning holes in the belt. Here the manufacturer is the Principal and the person pinning holes is the job worker who will return the goods (belts) received back to the manufacturer once his part of the job is completed.

Due Date To File ITC 04 in GST

ITC 04 is a quarterly return and must be furnished on or before the 25th day of the month succeeding the quarter. For example, ITC 04 due date for the quarter ended on 30 September 2020, is 25 October 2020.

Components Of ITC 04 Form

- Basic details of the manufacturer

- Goods and Service Tax Identification Number (GSTIN) of the Principal or the registered manufacturer.

- The legal name of the manufacturer, i.e. the name as on the PAN card with which the GSTIN was registered.

Note: Legal name can be different from the trade name.

-

- Trade name (if any), i.e. the name with which the manufacturer trades or raises an invoice.

- Period, i.e. the quarter for which the manufacturer is furnishing the Form GST ITC 04

- Details of the inputs or capital goods sent to the job worker

- GSTIN of the registered job worker or State of the non-registered job worker

- Challan number

- Challan date

- Description of goods sent

- Unique Quantity Code (UQC)

- Quantity

- Taxable value

- Type of goods (Inputs or capital goods)

- Rate of tax (CGST, IGST, SGST/UGST and cess)

- Details of the inputs or capital goods received from the job worker

- Section A: Details of the inputs or goods received back from the job worker to whom the goods were sent for job work.

- GSTIN of the registered job worker or State of the non-registered job worker

- Challan number (issued by the job worker) under which the manufacturer has received goods. In case there is no fresh challan issued by the job worker then, it is an optional column in the table.

- Date of Challan issued by the job worker which was generated while sending back the goods

- Description of goods

- UQC

- Quantity

- Original challan number under which goods are sent for job work. This column is not required to be filled in cases where there is no correlation between the goods sent for job work and goods received back.

- Nature of job done by the job worker

- Losses and wastage (including UQC and quantity of goods).

- Section B: Details of the inputs or goods received back from the job worker other than the job worker to whom the goods were sent for job work originally

- GSTIN of the registered job worker or State of the non-registered job worker

- Challan number (issued by the job worker) under which the manufacturer has received goods. In case there is no fresh challan issued by the job worker then, it is an optional column in the table.

- Date of Challan issued by the job worker, which was generated while sending back the goods.

- Description of goods

- UQC

- Quantity

- Original challan number under which goods are sent for job work. This column is not required to be filled in cases where there is no correlation between the goods sent for job work and goods received back.

- Nature of job done by the job worker

- Losses and wastage (including UQC and quantity of goods).

- Section C: Details of the inputs or goods sent to the job worker which were subsequently supplied from the premises of the job worker.

- GSTIN of the registered job worker or State of the non-registered job workers

- Invoice Number (issued by the Principal) in case the goods are supplied from the premises of the job worker.

- Invoice Date (issued by the Principal) in case the goods are supplied from the premises of the job worker.

- Description of goods

- UQC

- Quantity

- Original challan number under which goods are sent for job work. This column is not required to be filled in cases where there is no correlation between the goods sent for job work and goods received back.

- Nature of job done by the job worker

- Losses and wastage (including UQC and quantity of goods).

- Section A: Details of the inputs or goods received back from the job worker to whom the goods were sent for job work.

How To File ITC 04 in GST Online?

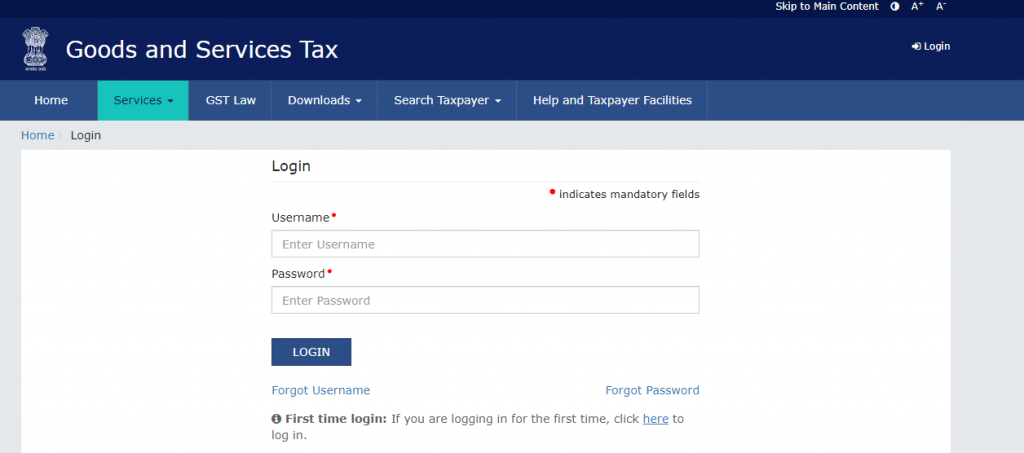

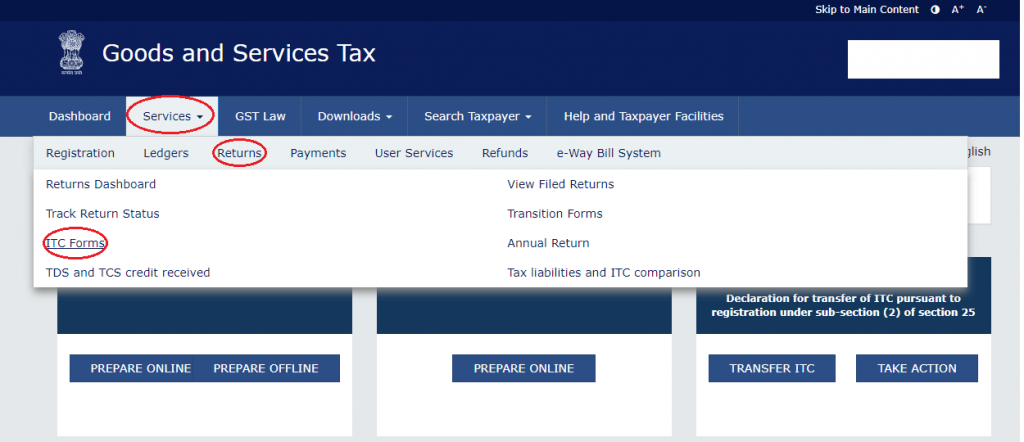

Step 1: Log in to GST Portal.  Step 2: Under ‘Services’ select, ‘Returns’ and then, select ‘ITC Forms’.

Step 2: Under ‘Services’ select, ‘Returns’ and then, select ‘ITC Forms’.  Step 3: Select ‘GST ITC 04’ and choose to ‘Prepare Online’.

Step 3: Select ‘GST ITC 04’ and choose to ‘Prepare Online’.

Step 4: Select the relevant Financial Year from the drop-down menu and also select the return filing period and click on ‘Search’.

Step 5: Fill the details in the tables and click ‘Save’.

Step 6: Click ‘File Return’.

Step 7: Generate OTP and verify the return. Taxpayers can use the Digital Signature Certificate (DSC) to validate the form as well.

How To File ITC 04 in GST Offline?

Step 1: Log in to GST Portal.

Step 2: Under ‘Services’ select, ‘Returns’ and then, select ‘ITC Forms’.

Step 3: Select ‘GST ITC4’ and choose to ‘Prepare Offline’.

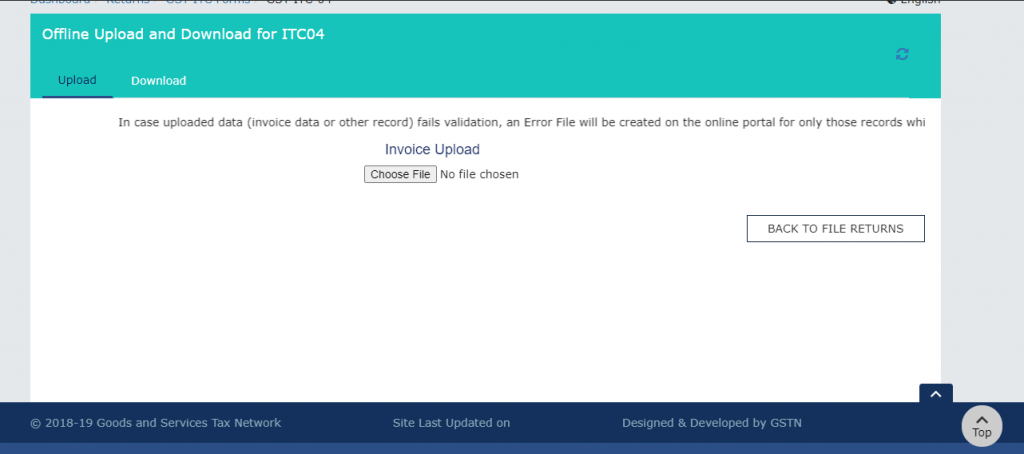

Step 4: Choose and upload the invoice.  Step 5: Click 'Initiate Filing button'

Step 5: Click 'Initiate Filing button'

Step 6: Select the tax period

Step 7: Check details and the taxable amount

Step 8: Generate OTP and verify the return or validate using DSC

Need of GST In Points | GST Invoice Series Rules | Powers of Revisional Authority Under GST | Kaju GST Rate | Maintenance GST Rate

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement