GST ANX-1 Form

Know the Facts About GST ANX-1 Form

In this article, we will cover all the points related to GST ANX-1 Form and SEZ supplies with payment . The topics that we will cover in this article will be:

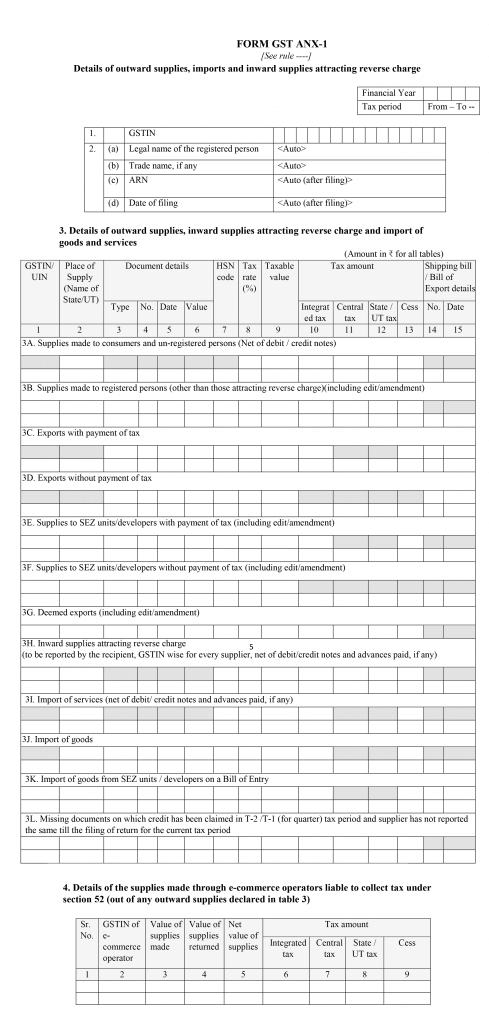

What is GST ANX-1 Form?

GST ANX-1 Form is an annexure form to the main return GST RET-1. In ANX-1 form the taxpayer has to mention all the details regarding outward supplies, imports and inward supplies attracting reverse charger. In this GST ANX-1 form the above details has to be reported by the taxpayer invoice wise except for B2C supplies. The reporting of the details can be carried out on real time basis which will help the recipient to take necessary action in their GST ANX-2 Form.

Format of GST ANX-1 Form

Contents of GST ANX-1 Form

- GSTIN: This will contain the GSTIN of the taxpayer which will be auto-populated

- Other Details: This will contain all the basic details about the taxpayer such as legal name of the registered person, trade name if any, ARN and date of filing. All the fields in this column will get auto-populated on the basis of GSTIN.

- Details of sale, import and purchase attracting reverse charge. This column in the GST ANX-1 Form has different section and they are:

| Table No. | Instructions | Notes |

|---|---|---|

| 3A | In this section, the taxpayer has to mention all the B2C supplies. | In table 3A the taxpayer need to report the tax rate wise summary of the supplies and net of debit and credit note. |

| He/she need not report the HSN Codes. | ||

| 3B | In this table, the taxpayer needs to mention all the B2B supplies except all those supplies attracting a reverse charge. Moreover, he/she needs to report all the TDS and TCS registration including amendments if any. | The taxpayer shall report the supply of services made by an SEZ to a person located in DTA. |

| In column 6 the taxpayer is required to mention the invoice value and taxable value in column 9. | ||

| Let us understand this with an example if the invoice value is 100 and the GST rate is 18%. Then in this case 100 has to be mentioned in column 6 and 118 has to be reported in column 9. | ||

| 3C & 3D | All exports with IGST shall be reported in table 3C and all exports without IGST shall be reported in table 3D. | In table 3C and 3D, the taxpayer needs to mention the shipping bill number or bill of export whichever is available at the time of filing the return. |

| The GST portal will introduce new functionality to amend these tables. | ||

| 3E & 3F | In table 3E the taxpayer needs to mention the supplies made to SEZ units who have paid the IGST and in table 3F he/she need to mention the supplies made without IGST. This includes amendments if any. | The taxpayer can claim a refund in the case where IGST is paid by the taxpayer.If in case the supplier is not claiming the refund, the SEZ unit can avail ITC (Input Tax Credit). |

| 3G | Deemed export supplies need to be mentioned in table-3G | The supplier can take the GST refund of the tax paid by him. In case if the supplier does not claim the refund, the recipient can avail ITC (Input Tax Credit). |

| 3H | In this table the taxpayer is required to report all the inward supplies attracting reverse charge GSTIN wise. | In case if there are any advances during a month than those advances shall be reported in that particular month. |

| The value of supply shall be net of Debit/credit notes, and -advances (if any) where the tax has already been paid. | ||

| In case if the advance is paid without any invoice or supply then on reporting the same it shall reflect in the FORM GST RET-1 which has to be reversed in table 4 of the said return. | ||

| ITC can only be claimed by the taxpayer on the issue of invoice or receipt of the supply. | ||

| 3I | In table 3I the taxpayer need to mention the imported services | In case if there are any advances during a month than those advances shall be reported in that particular month. |

| The value of supply shall be net of Debit/credit notes, and -advances (if any) where the tax has already been paid. | ||

| In case if the advance is paid without any invoice or supply then on reporting the same it shall reflect in the FORM GST RET-1 which has to be reversed in table 4 of the said return. | ||

| Any services received from SEZ unit shall not be mentioned in this table. | ||

| 3J | In table 3J the taxpayer needs to report the details regarding the taxes paid on the import. | In case if there is any reversal of ITC because of ineligibility or due to any other reason shall be carried out in table 4B of the GST RET-1. |

| To avail ITC, the taxpayer needs to mention the amount of IGST paid and CESS in this table. | ||

| 3K | In Table-3K the taxpayer has to report the BOE (Bill of Entry) of the goods received from the SEZ units or developers. | These outward supplies shall not be included in Table-3B of GST ANX-1 form by the SEZ unit carrying out such supply. |

| This entry is not subject to the tax at the time of filing this return as the IGST was already paid at the time of clearance into the DTA. | Until or unless the data from ICEGATE and SEZ to GSTN starts flowing online it shall be reported in Table 3K and 3J. | |

| 3L | In this table of GST ANX-1 Form, the recipient has to mention the document wise details against which ITC has been availed where such supply details are not yet uploaded by the supplier(s). There can be two cases under this: | In case if the supplier reports the details through invoice after the recipient reports the same in table-3L of GST ANX-1 Form, then the ITC has to be reversed through table 4B(3) of the FORM GST RET-1 as it ITC cannot be claimed twice. |

| i) In the case of monthly GST filers, the supplier has not mentioned the details of supplies in their consecutive 2 tax period | ||

| ii) In case of quarterly GST return filers after the expiry of 1 tax period |

- In table 4 of the Form GST ANX-1, the taxpayer needs to mention all the consolidated details of supplies made by the e-com operators those who are liable to collect TCS level irrespective of the details mentioned in the table-3

What should taxpayers know as they file their FORM GST ANX-1?

- The documents in the GST ANX-1 form can be uploaded continuously on a real-time basis.

- The details uploaded by the supplier will be available for the recipient in the GST ANX-2 Form to accept and reject the same.

- The recipient will get ITC depending upon the documents uploaded by the supplier. The due date for which is 10th of every subsequent month for monthly filers and quarterly filers 10th of every subsequent quarter.

- The recipient has to report all the supplies attracting a reverse charge and not by the supplier in the GST ANX-1 form.

- The taxpayer must mention the place of supply (POS). However, in the case of intra-state supplies, the place of supply will be the place in which the supplier is registered.

- The negative values can also be reported as it is in GST ANX-1 form in the case when the supplies are computed based on the net of debit and credit notes.

- In case if the annual aggregate turnover of the supplier is more than 5 Crores INR has to mention HSN level data. However, in the case where the aggregate turnover is up to 5 Crore INR then the supplier can either report the HSN code or leave it blank (Optional).

- If the recipient rejected any document then such rejection shall only be conveyed to the supplier after filing the return.

- The New GST Return system has an option to amend the details exclusively for the supplier. However, the recipient can only reject or accept the documents uploaded by the supplier.

- In case if the documents are uploaded in the wrong table where the particulars are correct then in such case the documents can be transferred to the appropriate table.

About the Author

I am a content and marketing manager at Masters India. I am also a tax and finance content writer. I also write academic books on accounts and tax. I have an experience of 7+ years in Income Tax Read more...