Know All About GSTR-7

Under the GST regime, every registered taxable person has to furnish a GST Return either monthly or quarterly in addition to an Annual GST Return. GSTR7 is one such GST Return, let us discuss what is GSTR 7 and how to file GSTR-7 in brief:

1. What is GSTR-7?

GSTR-7 means, it is a type of GST Return that shall be furnished by those who deduct tax at source (TDS Deductor). In GSTR-7 the taxpayer has to disclose all the TDS-related information such as

- Amount of TDS deducted

- TDS liability payable and paid

- TDS refund claimed and so forth.

2. Who needs to deduct tax at source (TDS) under GST?

Here is the list of entities that shall deduct tax at source under GST:

- Central or State Government department or establishment, or

- Agencies of government, or

- Any Local authority,

- PSU (Public Sector Undertaking)

- Society registered under Societies Registration Act, 1860

- Or any other person as may be notified by the Government on the recommendations of the GST Council.

The above-mentioned deductor will be liable to deduct tax at source when the total supply value exceeds 2.5 Lakhs INR.

However, the tax would not be deducted if the location of the supplier and the place of supply differ from the recipient's place of registration.

3. Why is GSTR-7 important?

As the GSTR-7 provides each and every detail about TDS, this helps the deductee to claim ITC on TDS that can be further used by him/her to set-off the output tax liability. The deductee gets all such details regarding the tax deducted at source in Part-C of GSTR-2A. In addition to this, the deductee also gets certificate against the TDS in Form GSTR-7A furnished on the basis of GSTR-7.

4. What is the due date of GSTR-7?

The due date for filing GSTR 7 is the 10th day of the subsequent month. Let us understand this with an example:

GSTR-7 for the month of June 2019 will be due on 10th July 2019.

5. What is the rate of TDS?

The TDS rate is 2%, however, there are two cases for the same:

If there is a supply within a state (intra-state) then this 2% will be bifurcated into two parts CGST/UTGST 1% and SGST 1%.

In case if the supply is inter-state i.e., between two states then 2% TDS will be deducted under the IGST heading.

6. What are the consequences of late filing of GSTR-7?

If a TDS deductor late files the GSTR-7, in that case, he has to pay the total penalty of 200 INR which will be further divided into two parts 100 INR CGST/UTGST and 100 INR SGST. However, there are no late fees on IGST in the case of late filing of GSTR-7. Moreover, the late filing fees cannot exceed the 5,000 INR mark.

In addition to this, the TDS deductor is liable to pay interest at the rate of 18% per annum that will start from the very next day of the last due date of GSTR-7.

7. Is it possible to revise GSTR-7?

The GSTR-7 cannot be revised once it is furnished. However, the TDS deductor can revise such a mistake at the time of filing the subsequent month GSTR-7 or any other month in which it is notified. Let us understand this with an example:

If there is a mistake in the GSTR-7 of June then such mistake can be amended in the July month GSTR-7 or any other month in which such mistake is ascertained.

8. Details in the Form GSTR-7

There are 8 headings under the GSTR-7 form and they are:

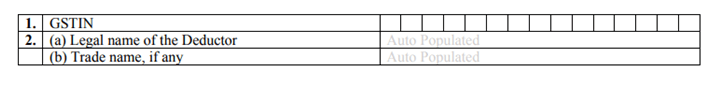

- GSTIN

This section of the GSTR-7 form will auto-populate at the time of furnishing the GST Return with Goods and Services Taxpayer Identification Number (GSTIN).

- The legal name of the Deductor

The legal name or the deductor will get auto-populated once the taxpayer logs into the GST Portal. In addition to this in case if there is any trade name it will also get auto-filled.

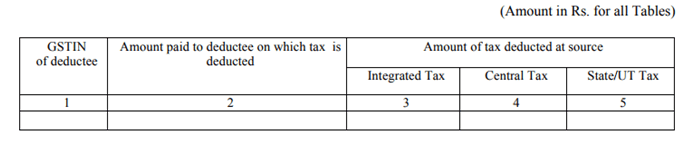

- Details of the tax deducted at the source

Under this heading, the TDS deductor has to mention the details regarding the deducted tax at source. This heading includes the following details:

- GSTIN of the deductee

- Amount paid to the deductee on which tax is deducted

- The amount of tax deducted at the source is further bifurcated into three parts IGST, CGST and SGST.

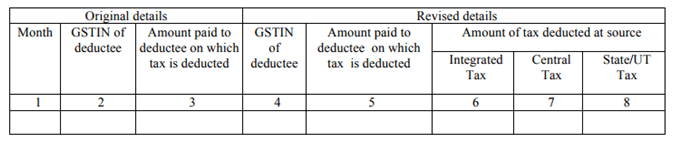

- Amendments to details of tax deducted at source in respect of any earlier tax period

In this section of the GSTR-7, the TDS deductor can amend the previously filed GSTR-7 in case if he finds any error or mistake. For amending the wrong details, the taxpayer needs to write both the original details and revised details under this heading. Moreover, GSTR-7A (TDS Certificate) will be amended too.

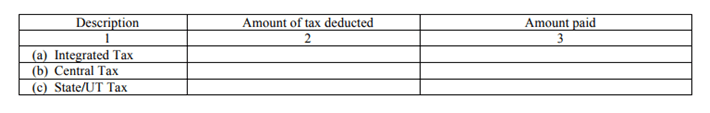

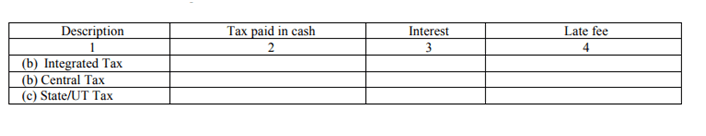

- Tax deduction at source and paid

Here the TDS deductor has to provide the details regarding the amount of tax deducted and the amount paid to the government. Furthermore, these amounts will be divided into three categories, namely:

- Integrated Tax

- Central Tax

- State/UT Tax

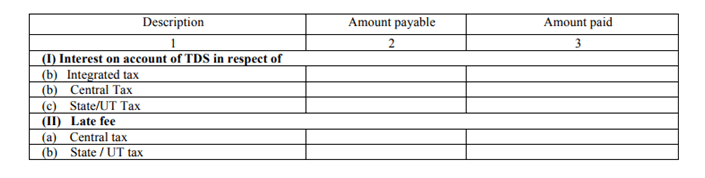

- Interest, late Fee payable and paid

In this section of the GSTR-7 Form, the taxpayer shall mention the amount of the interest and late fee paid and payable by him. However, it should be noted that late fees it shall only be divided into two parts, which are Central Tax and State/UT Tax.

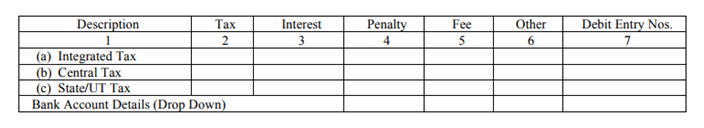

- Refund claimed from electronic cash ledger

In a case, if a taxpayer wants to claim a refund on TDS paid from their e-cash ledger, he shall provide such details in this section. In addition to this, he has to give bank account details in which he wants TDS refunds to be credited.

- Debit entries in electronic cash ledger for TDS/interest payment [to be populated after payment of tax and submissions of return]

This section of the GSTR-7 Form is auto-filled once you fill all the details in the GST Return form and once you submit the same.

After furnishing all the details in the GSTR-7 Form the TDS Deductor has to validate the authenticity of the details filled under various heads either through the AADHAAR-based signature verification or Digital Signature Certificate (DSC).

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement