What is GSTR 9?

GSTR 9 meaning is a GST annual return form that shall be filed by every registered taxpayer in every financial year after the introduction of the GST regime. Here, you will learn all about GSTR 9. The GSTR 9 forms include all the consolidated summaries carried out by any taxpayer monthly or quarterly. The summary includes basically all the information of the ITC declared, outward and inward supplies particularly.

Who Shall or Who Shall Not File GSTR 9?

As discussed earlier GSTR 9 must be filed by all the regular taxpayers as per the GST Act. But there are some exemptions who may not have to file GSTR 9. The list includes:

- The person who is a casual taxpayer falls under the "Casual Taxable Person" category.

- A person who is not a resident of India or a "Non-Resident Taxable Person."

- The person who is responsible for tax deduction at source.

- Any person who is providing an input tax credit.

- Any e-commerce website or portal collecting TCS.

Types of GST Return Forms (Excluding GSTR 9)

Apart from GSTR 9 forms, there are also other forms available which has different eligibility criteria. Let us toss some light over these types of GST Return forms:

- GSTR 9A - This form has to be filed by the taxpayers who come under the composition scheme

- GSTR 9B - Any e-commerce company that has filed GSTR 8 in the financial year needs to file GSTR 9B as their annual return under GSTR9.

- GSTR 9C - Any taxpayers whose turnover exceeds the threshold limit of 2 crore INR needs to file GSTR 9C along with their annual return GST. These company accounts shall also be audited by authorized personnel and copies of all the audited accounts with the GSTR 9C form.

Note: The due date to file GSTR-9/GSTR-9A and GSTR-9C for FY 2018-19 is extended to 31 December 2020.

Ḍue Date of GSTR 9 Form

The last date of submission of the GSTR 9 form is 31st December from the subsequent financial year. For instance, if the financial year is 2017-18 then, the due date for filing the GSTR 9 form will be 31st December 2018.

Penalties for Late Filing GSTR 9 Form

Every taxpayer shall submit the GSTR 9 form within the prescribed time limit. In case he fails to comply with that then there is a considerable GSTR 9 penalty amount that will amount to 200 INR per day. This late fee includes CGST 100 INR per day and SGST 100 INR per day, there is no late fee payment on IGST. The amount of penalty will not exceed the amount of quarter turnover of the taxpayer.

The Format of GSTR 9 Form

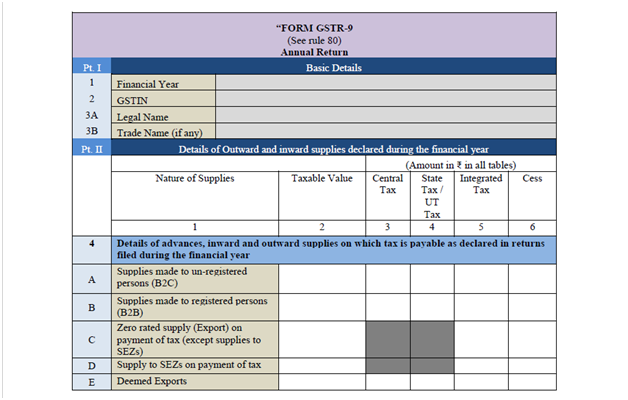

See below the GSTR 9 Format:

GSTR 9 Form can be divided into six major parts. Let us discuss them

1. Basic Details

The very first part of the GSTR 9 form includes the basic details about the taxpayer which will already be filled.

2. Inward and Outward Supply Details

This part of the form includes the details regarding the inward and outward supply in that particular financial year of the taxpayer. These details will be in the summarized form containing all the information of FY.

3. Details of ITC

In this column, the taxpayer needs to furnish the details ITC that was declared in the financial year by him along with the details of ineligible and reversed ITC if any. The details must be consolidated for the whole FY.

4. Details of Tax Paid

This section consists of the details of the tax paid by the taxpayer under the GST Act during his applicable financial year. Further, to mention the details in this section GSTR3B form can also be used by the taxpayer.

5. Particulars of Transaction

Every taxpayer needs to furnish the details about each and every transaction but there is a condition and that is

- Transaction declared in the returns of April to September of the current financial year or

Up to the date of filing the GSTR 9 annual return of the previous financial year; whichever is earlier.

6. Other Details

In this section of the GSTR 9 form, the taxpayer needs to furnish details about different things. The details compromise of the following details

- GST Refund and demand details as asked by the government.

- Late fees paid or payable

- Particulars of Inward supplies from the composition scheme taxpayer

- Consolidated details of inward and outward supplies which shall be HSN wise.

- ★★

- ★★

- ★★

- ★★

- ★★

Check out other Similar Posts

😄Hello. Welcome to Masters India! I'm here to answer any questions you might have about Masters India Products & APIs.

Looking for

GST Software

E-Way Bill Software

E-Invoice Software

BOE TO Excel Conversion

Invoice OCR Software/APIs

GST API

GST Verification API

E-Way Bill API

E-Invoicing API

KSA E-Invoice APIs

Vehicle tracking

Vendor Verification API

Other Requirement